The Adjusted R square addresses the drawback of the R square by penalising the inclusion of additional independent variables. As a result, this ensures that additional unnecessary variables are not included simply to increase the value of R square. In this sense, it also attempts to overcome the shortcomings of the R square. Furthermore, it helps to identify unnecessary variables in the model.

Econometrics Tutorials with Certificates

Computing the adjusted R square

The formula for computing the Adjusted R Square is as follows:

The Adjusted R square is, therefore, a modified version of the R square.

Firstly, it penalises the inclusion of additional independent variables. The higher the number of parameters (coefficients), the lower will be the value of (n-k) because of more parameters (k). As a result, the value of the numerator will be higher as more parameters and independent variables are included. Hence, the value of the Adjusted R square will be lower as more variables are included. This is the result of the higher fraction being subtracted from 1. Additionally, the value of Adjusted R square is less than R square. The difference between them will further increase as more unnecessary coefficients or parameters are included in the model.

Secondly, comparing the values of Adjusted R square and R square makes it easier to choose between models with different independent variables. If the value of Adjusted R square falls dramatically and the difference between Adjusted R square and R square is huge, then the additional independent variables may be unnecessary and we can consider dropping them from the model. Hence, it is desirable to have the values of R square and Adjusted R square to be closer to each other.

R square and Adjusted R square in practice

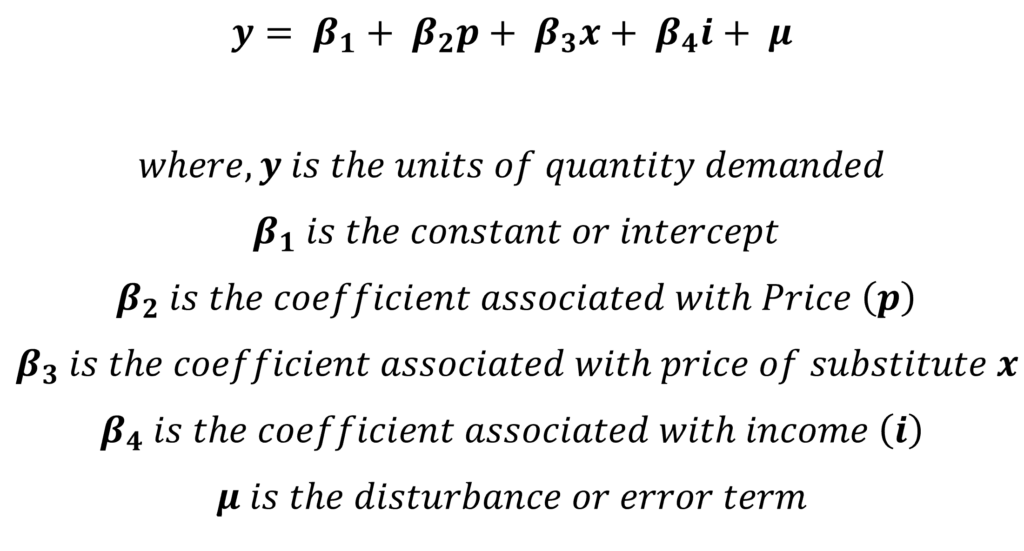

When implementing the Ordinary Least Squares model, the R square and Adjusted R square are automatically estimated by the econometric software packages. We usually do not need to estimate them manually. Let us consider the same hypothetical data and model used in Ordinary Least Squares Estimation:

| Quantity demanded (y) | R square = 0.9720 | Adj. R square = 0.9581 | ||

| Coefficient | Standard error | t | P-value | |

| Price (p) | -2.004936 | 0.2764868 | -7.25 | 0.000 |

| Price of substitute (x) | 0.7060227 | 0.1753896 | 4.03 | 0.007 |

| Income per capita (i) | 0.3263422 | 0.0272013 | 12.00 | 0.000 |

| Constant | 27.03021 | 26.28797 | 1.03 | 0.343 |

In this model, the quantity demanded of a commodity is a function of its price, the price of a substitute good and the per capita income of consumers. Based on economic theory, all the variables in the model are necessary. This is because the quantity demanded is influenced by price, price of related goods and income.

The results of the model are consistent with economic theory because all the independent variables are significantly affecting the dependent variable. This is further strengthened by the values of R square and Adjusted R square because both values are high and close to 1. Moreover, there is little difference between the values of R square and Adjusted R square. This also indicates that all the independent variables are necessary to the model. Finally, you can go to the post on Interpretation of Coefficients: OLS to understand the interpretation of OLS results.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.