Has demonetisation in India been a game-changer or a costly misstep? On 8 November 2016, India embarked on an unprecedented experiment by demonetising high-value currency notes of INR 500 and 1,000. The aim was to combat black money, corruption, and counterfeit currency. It was a move that captured the world’s attention and sparked both hope and scepticism.

Here, we will look at the effects of demonetisation in India. From its impact on the economy to its repercussions on society, we will explore the far-reaching consequences that unfolded in the wake of this monumental decision.

Understanding Demonetisation

Demonetisation is a significant economic policy implemented by governments to combat various issues such as black money, corruption, and counterfeit currency and to promote financial inclusion. The process involves the sudden withdrawal of the legal tender status of a specific currency unit. It is generally done with the intention of replacing it with a new currency.

Demonetisation aims to disrupt illicit financial activities, promote financial inclusion, and also create a more transparent and accountable economy. By invalidating certain denominations of currency, governments hope to force individuals and businesses to disclose their unaccounted wealth and further promote a shift towards formal financial channels. This can significantly impact the flow of funds, leading to positive and negative consequences.

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.

Econometrics Tutorials

Economic Impact of Demonetisation in India

Demonetisation in India had significant economic consequences, affecting various sectors such as agriculture, manufacturing, and services. The effects of demonetisation were experienced in both the short-term and long-term. It impacted key economic indicators such as GDP, employment, inflation, and investment.

Agriculture

The agricultural sector, which heavily relies on cash transactions, was hit hard by demonetisation. Farmers faced challenges in accessing cash for purchasing inputs and paying labourers, leading to disruptions in farming activities. This negatively affected farm production in the period following demonetisation.

However, the long-term effects of demonetisation on agriculture were more nuanced. The increase in digital payments and digitization also brought benefits to farmers later. It enabled them to receive subsidies and payments directly into their bank accounts. This digitization of transactions streamlined processes and also reduced leakages.

Manufacturing and Services

The manufacturing and services sectors were also significantly impacted by demonetisation. Small and medium-sized enterprises (SMEs) experienced a decline in production and sales, as consumers also had limited access to cash. The reduction in consumer spending had a cascading effect on industries such as textiles, construction, and retail.

Similarly, the services sector, including tourism, hospitality, and transportation, saw a temporary slowdown due to the cash crunch. The ban on high-denomination currency notes resulted in lower tourism spending, affecting businesses dependent on tourist inflows.

Short-term and Long-term Effects of Demonetisation in India

In the short term, demonetisation led to a contraction in economic activity, as people were unable to carry out transactions smoothly. This further resulted in a decline in GDP growth and increased unemployment as businesses struggled to adapt to the sudden shock.

In the long term, it encouraged a shift towards digital transactions, reducing the dependence on cash and also bringing transparency to financial dealings. The increased use of digital payments further improved access to banking and financial services across India.

Social Effects of Demonetisation in India

Effects on Digitization

Demonetisation in India has had far-reaching social implications, affecting various aspects of society. The increase in digital transactions due to demonetisation has led to increased access to formal banking channels for many individuals who were previously excluded from the financial system. This has further opened up opportunities for financial services and products, promoting greater economic participation and empowerment.

Furthermore, demonetisation has accelerated the shift towards digital transactions in India. The emphasis on cashless payments has led to a surge in the adoption of mobile wallets, digital payment platforms, and online banking. This transformation has not only made transactions more convenient but has also contributed to the growth of the digital economy, fostering innovation and entrepreneurship.

Effects on Marginalized Sections

By curbing the circulation of unaccounted cash, demonetisation aimed to eliminate illicit activities and promote transparency. While this measure may have had good intent, its effectiveness in rooting out parallel economies and illicit wealth has been a subject of debate.

The sudden withdrawal of high-value currency notes caused significant disruptions, particularly for marginalized sections of society that heavily rely on cash transactions. Daily wage earners, small traders, and rural communities faced difficulties in conducting basic transactions and meeting their immediate needs.

The impact of demonetisation on different segments of society, including the rural and urban population, has been uneven. While urban areas with better access to digital infrastructure witnessed a quicker transition to digital transactions, rural areas faced greater challenges due to limited connectivity and technological literacy.

Despite these challenges, demonetisation has accelerated a shift towards a more digitized and transparent economy. It has triggered conversations around financial literacy, digital empowerment, and the need for inclusive growth.

Criticism of Demonetisation in Inida

While demonetisation in India was intended to tackle issues such as black money, corruption, and counterfeit currency, it has faced a fair share of criticisms and controversies.

Lack of Implementation Preparedness

One of the primary criticisms of demonetisation was the lack of adequate preparation and planning. The sudden withdrawal of high-value currency notes led to chaos and inconvenience for the general public. It led to long queues at banks and ATMs, with people struggling to exchange old notes for new ones. Furthermore, Banks struggled to meet the increased demand for currency exchange and faced challenges in printing and distributing new currency notes in a timely manner. These implementation issues caused significant disruption to the economy, affecting businesses and daily wage earners.

Economic Disruption

The abrupt withdrawal of nearly 87% of the currency in circulation harmed various sectors of the economy (Source: Reserve Bank of India). Small and medium-sized businesses, which rely heavily on cash transactions, were hit hard. The informal economy, comprising a significant portion of the workforce, also faced the brunt of the economic disruption. Many individuals lost their jobs or experienced reduced income due to the decline in economic activity. India’s Growth Rate fell from 8.3% in 2016 to 6.8% in 2017 (Source: World Bank).

Black Money and Counterfeit Currency

One of the primary objectives of demonetisation was to eradicate black money and counterfeit currency. However, data from the RBI indicated that 99.3% of the demonetised currency was returned to the banking system. That is, ₹15.3 trillion was deposited back into the banking system out of the ₹15.41 trillion that had been demonetised. This suggested a failure in uncovering unaccounted wealth. The likely reason behind this is the fact that a very small proportion of black money is held in the form of cash. Instead, the majority of the black money is in the form of Benami properties, jewellery and bullion.

Adverse Effects on the Informal Economy

Demonetisation disproportionately affected the informal sectors where cash transactions are prevalent. The reliance on cash and lack of access to digital payment methods posed further challenges for individuals and businesses operating in these sectors. The disruption caused by demonetisation highlighted the vulnerability of these sectors, underscoring the need for comprehensive measures to address their specific needs.

Hardships Faced by Marginalized Sections of Society

Another key criticism of demonetisation revolves around the hardships faced by marginalized sections of society. The unbanked population, particularly in rural areas, faced difficulties in accessing banking services and conducting digital transactions. It exacerbated the existing economic divide, widening the gap between those with access to formal financial systems and those without.

Despite the criticisms, demonetization did have some positive outcomes, such as increased digital transactions and a push towards a more cashless economy. However, it is essential to consider the costs and consequences to ensure that future policy decisions account for the challenges faced by all sections of society and are implemented with proper planning and preparation.

Conclusion

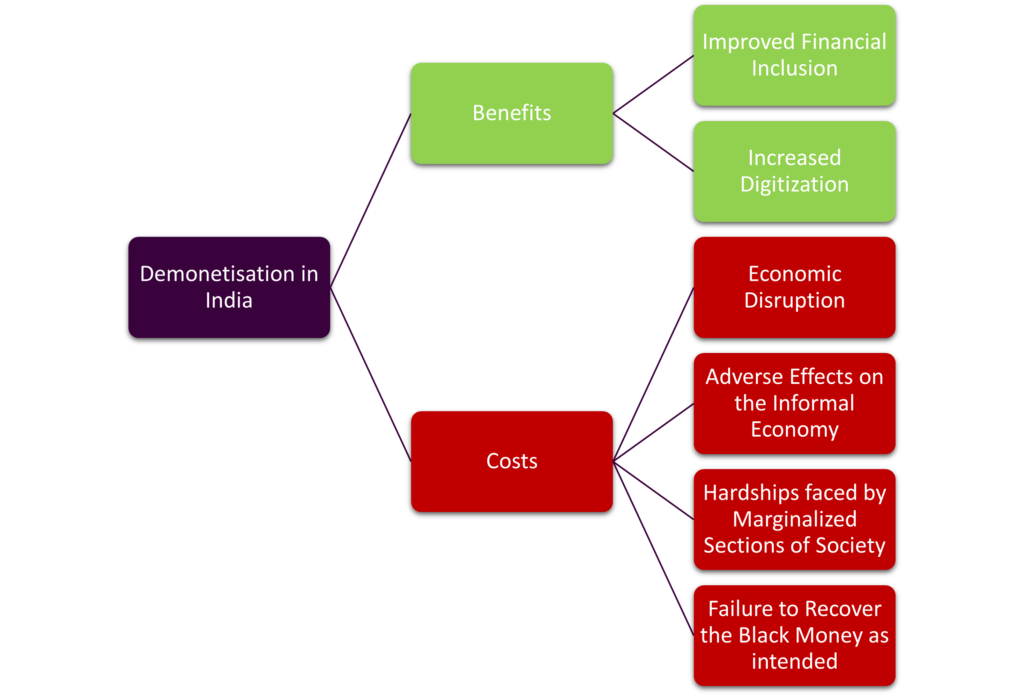

In conclusion, demonetisation in India had significant consequences on the economy and society. The policy aimed to combat black money, corruption, and counterfeit currency, while promoting digital transactions and financial inclusion. However, its implementation resulted in short-term economic disruptions and hardships for marginalized sections of society.

On the positive side, demonetization helped deepen financial inclusion by promoting the use of digital payment platforms. However, the costs of demonetization, such as the decline in economic activity, GDP growth and employment, cannot be ignored. Policymakers must ensure that the benefits of a policy move outweigh the costs.

Indian Economy

- New Economic Policy of 1991

- Nationalisation of Banks in India

- Foreign Direct Investment in India

- Green Revolution in India

Econometrics Tutorials