It is vital to recognize that the Central Banks often target a consistent 2% inflation rate. This is to bolster ideal job conditions and stable prices within the economies. At its core, this figure highlights the essential role inflation assumes within our economic framework. Demand-pull inflation is a unique situation where excessive consumer demand propels prices upwards, encompassing various industry sectors.

The surge in demand and the economy’s consequent growth underpin demand-pull inflation. Therefore, this starkly contrasts cost-push inflation, which emanates from escalating production costs. The primary features of demand-pull inflation underscore the strong consumer demand, coupled with fiscal and monetary expansion policies, along with an upsurge in inflation expectations. For policymakers, a deep understanding of demand-pull inflation’s causes is indispensable. It equips them to deploy effective strategies to maintain a stable price level.

Econometrics Tutorials with Certificates

What is Demand Pull Inflation?

Demand-pull inflation emerges when consumer demand surges beyond available goods and services, elevating the general price level in an economy. Such scenarios manifest due to a substantial upswing in aggregate demand, fueled by factors like burgeoning consumer confidence and expansionary fiscal and monetary actions, coupled with burgeoning inflationary foresight.

Definition and Explanation

This inflation type occurs as the demand for products and services outstrips their supply, thus escalating their prices. In sharp contrast to cost-push inflation, demand-pull inflation pinpoints demand-side excesses.

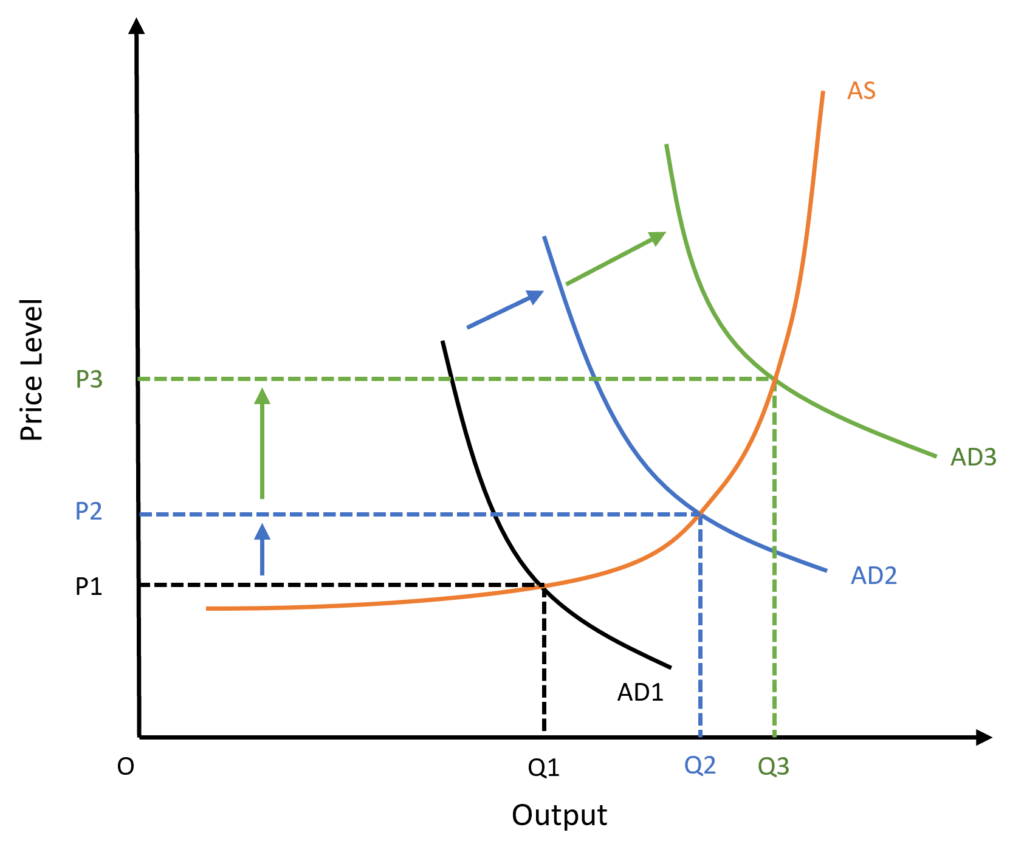

In the diagram, the aggregate supply curve (AS) becomes steeper as more output is produced because of the supply constraints. The supply cannot go on increasing indefinitely due to several factors such as the availability of raw materials or finite resources. As Aggregate Demand increases from AD1 to AD2, the output increases from Q1 to Q2. At the same time, the Price level also rises from P1 to P2 causing inflation.

However, as demand keeps growing to AD3, the increase in the Price level from P2 to P3 or inflation is much higher because of the steep Aggregate Supply curve (AS). The goods become expensive because the constrained supply is accompanied by increasing consumer demand. This leads to higher inflationary pressures and is known as Demand-pull inflation.

Key Characteristics

Essential attributes of demand-pull inflation encompass heightened consumer demand matched with a scarcity of correspondingly available products and services. This disparity results in broad-based economic escalations in prices. Moreover, it engenders a scenario where workers aspire for augmented wages to counterbalance their affordability erosion vis-à-vis the rising prices.

Amidst the Covid-19 pandemic, instances of demand-pull inflation were also notably evident. Products like hand sanitisers, and surgical masks faced a spike in demand, causing further supply constraints.

Causes of Demand-Pull Inflation

The sources of demand pull inflation are diverse, and rooted in several economic variables. These factors fuel consumer demand, thereby precipitating economy-wide price escalations.

Increase in Consumer Demand

Enhanced consumer spending emanates from augmented disposable incomes and heightened economic optimism. This phenomenon further leads to burgeoning demands across various sectors. Such trends are bolstered by favourable employment figures, escalating remunerations, and the availability of easy credit.

Expansionary Fiscal Policy

Policies that bolster government expenditure, including tax reductions or augmenting state spending, also invigorate consumer demand. Consequently, they contribute to the dynamic of demand-pull inflation.

Expansionary Monetary Policy

The enactment of policies by central banks, like injecting more currency into circulation or diminishing interest rates, intensifies consumer demand. These manoeuvres also exhibit a potential to foster demand-pull inflation.

Mechanism of Demand-pull inflation

When consumer demand surges, businesses gain the ability to elevate their prices. This happens because they possess greater control over their pricing strategy. Consequently, this price escalation diffuses throughout the economy. In reaction to the rising prices, consumers may insist on higher wages. Such demands initiate a cycle commonly known as the wage-price spiral, propelling inflation further.

Various factors can contribute to the surge in consumer demand. These also include an upsurge in employment rates, escalating incomes, the ready availability of credit, buoyant consumer sentiment, and macroeconomic policies designed for expansion. These elements fuel consumer desire. When this enthusiasm for purchasing surpasses the goods and services available, it triggers demand-pull inflation. In this scenario, enterprises react by adjusting their prices upwards to align with the surpassing demand.

Factors Driving Consumer Demand

Characterized by strong consumer demand, proactive monetary and fiscal policies, and growing expectations of inflation, demand-pull inflation gains momentum. A diminutive unemployment rate poses another factor that propels this form of inflation. Here, a larger percentage of the population enjoys more disposable income, augmenting their purchasing capacity. Indeed, these are pivotal dynamics in the phenomenon of demand-pull inflation.

The genesis of demand-pull inflation may spring from several sources. These include a thriving economy, escalating demands for exports, heightened government expenditures, anticipations of inflation, and a surge in the money supply. These influencers also set demand-pull inflation against the backdrop of cost-push inflation, where augmented production expenses are transferred to the consumer.

Inflation can wield a significant influence on an economy’s various facets. It touches upon the values of currencies, trade balances, the behaviour of consumers, and their saving and investment patterns. Therefore, the phenomenon of demand-pull inflation commonly leads to a universal increase in the prices of commodities within an economy. This manifests when the cumulative demand exceeds the supply volumes.

Consequences of Demand-Pull Inflation

Demand-pull inflation fundamentally alters the ability of consumers to purchase. With prices increasing due to overpowering consumer demand, the value of money depreciates. Consequently, individuals find it progressively daunting to maintain their usual standard of living. This predicament poses acute challenges for those reliant on fixed incomes or experiencing meagre wage escalation.

Effects on Purchasing Power

The notability of demand-pull inflation is its profound impact on consumers’ purchasing power. With their money encompassing the acquisition of fewer goods and services, a gradual decline in their standard of living emerges. Essential items become more difficult to obtain, hence, necessitating severe financial prioritization.

Impact on Savings and Investments

The detrimental effects also extend to savings and investments. As inflation rises, the real gains from investments wane, deterring further saving and investment. This, consequently stifles capital accumulation and impedes the economy’s sustained growth over time.

Impact on Economic Growth

If unaddressed, ongoing demand-pull inflation can gravely thwart national economic growth. The associated instability and high levels of uncertainty disincentivize corporate investments. Companies, reluctant to incur extra financial commitments, forego expansions. Such abnegation not only curtails workforce increment but also undermines productivity, vitally affecting the nation’s economic health.

Demand-pull vs Cost-push Inflation

Demand-pull inflation differs from cost-push inflation by its root causes. Cost-push inflation emanates from supply-side influences like amplified production expenses, supply interruptions, or a wage-price surge. In contrast, demand-pull inflation arises when consumer hunger exceeds market supplies. Factors including escalating wages and raw material expenses contribute to inflationary pressures. Hence, policymakers must strategize distinct plans to effectively manage each type of inflation.

The year 2021 bore witness to a global price surge in essential commodities, primarily due to the disruptive effects of the COVID-19 pandemic and its consequent supply chain interruptions. Transitioning into 2022, the workforce clamoured for wage hikes to offset mounting living costs, culminating in elevated price points. This scenario mirrors a quintessential instance of cost-push inflation. Importantly, cost-push inflation materializes when the supply of economic goods shrinks, compelled by mounting production costs.

Conversely, demand-pull inflation surges when consumer demands surpass the economic capability to supply. Examples include low unemployment fostering larger disposable incomes.

Both demand-pull and cost-push inflation exert their unique strains on economic fabrics. They can alter the currency market, favouring exporters or importers variably. Furthermore, they can stimulate or suppress spending, while also depreciating the value of accumulated savings.

Role of Inflationary Expectations

Inflationary expectations stand as pivotal players in the dynamics of demand-pull inflation. They serve as the catalyst, propelling consumers and businesses to anticipate future inflation. This anticipation often leads them to upscale their present spending, thus elevating the demand for goods and services. This, therefore, engenders a reinforcing cycle of inflation.

Adaptive Expectations

The theory of adaptive expectations indicates that individuals, whether as households or businesses, formulate their estimates of future inflation based on previous trends. Hence, a foresight of escalating inflation influences their present economic decisions, promoting increased spending and demands for higher wages. These actions further exacerbate the demand-pull inflation phenomenon.

Rational Expectations

Conversely, the premise of rational expectations asserts that economic entities possess forward-looking, cognitively sound abilities. Under this assumption, enhanced by the availability of all relevant information, their expectations of future inflation also lead to strategic adjustments. This might include negotiation for higher wages or revisions in investment and spending strategies. Therefore, such actions can accentuate demand-pull inflation.

Fully grasping the various dimensions of inflationary expectations, be it through adaptive or rational lenses, is imperative in the realm of policymaking. It provides the groundwork for a coherent strategy to tackle demand-pull inflation effectively and to sustain price stability.

Policies to Control Demand-Pull Inflation

In the realm of economic regulation, policymakers wield an arsenal of methodologies to combat the emerging threats posed by demand-pull inflation. This efficacy further spans across two pivotal themes: monetary policy, and fiscal directives. These delineations further allocate strategies between central banking manoeuvres and government-driven fiscal adjustments.

Monetary Policy Tools

Central banking entities, as the keystone of economic stewardship, orchestrate a suite of mechanisms aimed at controlling demand-pull inflation. Further, these strategies encompass the elevation of interest rates, augmentation of banking reserve prerequisites, and the vendition of government-backed securities. This trifecta of interventions is orchestrated to diminish the circulating money supply, concurrently thwarting superfluous consumer spending.

Therefore, by stifling the accessibility of credit and dissuading extravagant expenditures, central banks endeavour to pacify the economic tempo. Through this concerted strategy, inflationary increments are effectively contained.

Fiscal Policy Measures

Alternatively, governmental bodies can also engage in contractionary fiscal protocols to manage the perils of demand-pull inflation. These actions might encompass tax hikes, budgetary reductions, or a synthesis of both strategies. Positioned to reduce demand aggregation within the economy, these endeavours restrict the consumer’s power to elevate product valuations.

Hence, the synergy between fiscal and monetary influencers forms a complete governance paradigm, ensuring a nuanced and comprehensive approach to the inflationary challenge.

However, the triumph of these strategies is contingent upon the idiosyncrasies of the economic trajectory and the instigators of the inflation burden. Elected officials are bound to weigh the repercussions and latent detriments of their statutory ventures, thereby fostering a response that is not only effective but also sustainable.

Historical Examples of Demand-Pull Inflation

In the aftermath of World War II, the United States underwent a substantial transformation. This was also marked by an economic boom, attributed to pent-up consumer demand and expansionary policies. Consequently, widespread price increases ensued. This scenario typifies demand-pull inflation post-crisis. A parallel event unfolded in China during the early 2000s. The rapid industrialization and the subsequent rise in consumer demand also fostered significant economic growth and inflation.

The oil price shocks during the 1970s and expansionary monetary policies significantly impacted several advanced economies. This further led to a period of stagflation, characterized by high inflation and sluggish growth. More recently, the COVID-19 pandemic served as a modern example of demand-pull inflation. The pandemic saw dramatic price increases for essential goods like hand sanitisers and masks. These behaviours were heavily influenced by supply shortages due to panic buying.

As the constraints of the COVID-19 pandemic loosened, a surge in travel commenced. The ensuing post-pandemic era witnessed an increase in airline ticket and hotel room prices. This phenomenon was a direct consequence of growing tourism and supply shortages, such as staffing issues in the travel sector. The spectrum of demand-pull inflation, from post-war rebounds to the impacts of global health crises, illustrates the complexity of these economic dynamics. It underscores the vital role policymakers play in mitigating the effects of inflationary pressures.

Demand-Pull Inflation and the Phillips Curve

The association between demand-pull inflation and the Phillips curve transcends simplicity. In the interim, an apparent trade-off between inflation and joblessness emerges, aligning with the curve’s graph. This dynamic allows for a fleeting increase in employment by policy intervention, at the expense of potential inflationary pressures.

Short-Run and Long-Run Phillips Curve

Nonetheless, the Phillips curve becomes vertical in the long-run outlook. This implies the absence of a protracted trade-off between inflation and unemployment levels. Policy directives, under such a scenario, should concentrate on fostering price stability and ensuring growth sustainability. They ought not to hinge on initiatives producing ephemeral spikes in employment that might catalyze inflation.

From a historical perspective, demand-pull inflation phenomena, evident in events like the late 1980s inflation escalation in the UK and the late 1960s in the US, have been witnessed. These occurrences were fueled by factors including brisk economic expansion, bolstering consumer morale, and the adoption of expansionary measures.

Conclusion

Demand-pull inflation, an economically consequential event, arises when consumer demand surpasses available supply, resulting in economy-wide price escalations. A profound grasp of its inception, function, and repercussions remains imperative. This ensures policymakers can deploy pivotal strategies. These aim to sustain price equilibrium and foster enduring economic vitality.

Monetary and fiscal strategies, integrated with proactive inflation expectation management, constitute cornerstone initiatives. Such efforts are essential for attenuating demand pull inflation’s adversities. They strive to cultivate a harmonious economic landscape.

Inflation signifies the surge in goods and services’ pricing levels, with demand-pull and cost-push inflations as their distinctive variants. In India, CPI inflation was 5.55% in November 2023 (Source: Forbes Advisor). The nation witnessed demand-pull inflation significantly amidst the adversity of the COVID-19 pandemic. Thus, it is incumbent upon policymakers to judiciously balance inflation hazards. Such equilibrium is vital for price constancy and sustainable economic advancement.

Policymakers are encouraged to tackle demand-pull inflation’s root causes, encompassing economic expansion, heightened export requisites, government disbursements, and anticipations of inflation. Through the application of monetary and fiscal protocols, alongside adept management of inflation forecasts, the deleterious effects of this inflation type can be alleviated. Consequently, it paves the way for robust and protracted economic progress.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.