The accelerator theory explains the relationship between change in output or income and the rate of investment. In this theory, a change in income or output causes a change in the rate of investment. This relationship is opposite to that of the multiplier, which depicts changes in income due to changes in investment.

With an increase in income and output, the existing capital stock is unable to meet the increased demand for goods. As a result, firms need to increase their production capacity to meet the increasing demand. Firms increase their productive capacity with the expansion of their capital stock which requires a higher rate of investment. Hence, a rise in income or output brings about an increase in investment and capital stock.

Econometrics Tutorials

capita-Output ratio

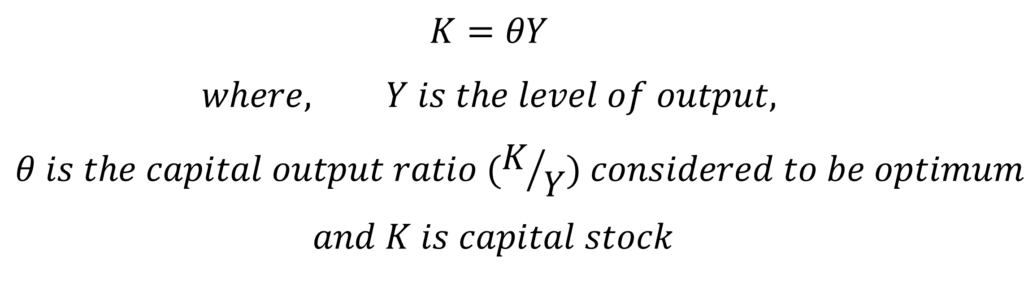

Investment is needed to increase the capital stock because firms need to produce more output. It is possible to increase output without increasing capital stock by more intensive utilisation of capital. However, this increase is limited and the firms prefer to maintain an optimum level of capital-to-output ratio. This ratio can vary considerably from industry to industry because some industries require more capital and others require less capital per unit of output or income.

For instance, the mining industry, manufacturing firms and automobile industry generally have high capital requirements and tend to have a high capital-output ratio. In our analysis, however, we assume that there is an optimum capital-output ratio for the economy as a whole and it does not change over time.

The capital required to produce the desired output given the capital-output ratio can be expressed as follows:

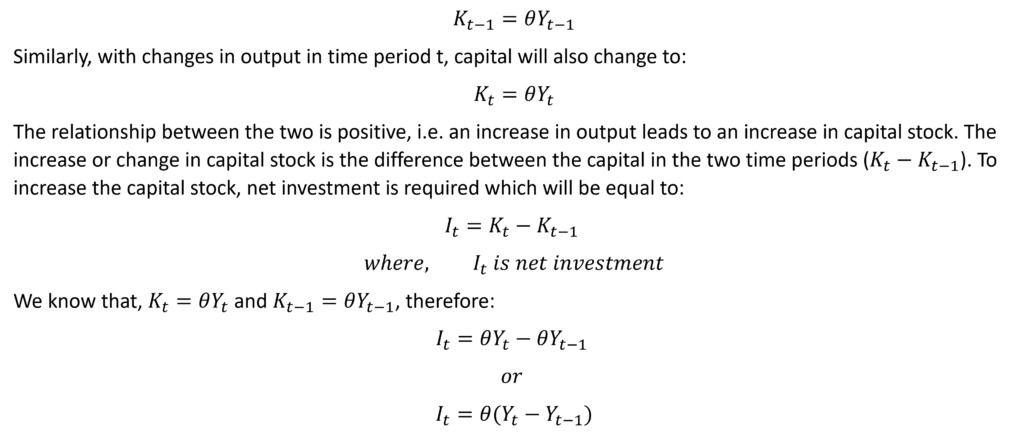

Because the desired capital-output ratio (theta) remains constant, the level of capital stock (K) will change with changes in output (Y). Therefore, the capital stock will change with output in any given time period. In time period “t-1”, the capital stock will be given by:

This shows that the net investment is equal to the change in output in the given time periods multiplied by the desired capital-output ratio. If output or income increases in the time period “t” as compared to “t-1”, then the change in output is positive and net investment will be positive. On the other hand, a negative net investment will be observed when output falls in the time period “t”.

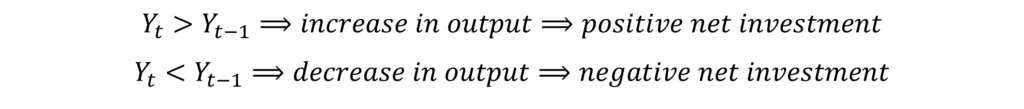

Depreciation and Excess capacity

Over time, depreciation in the capital also occurs. Therefore, gross investment can be shown by including depreciation in the above equation. To offset this depreciation in the capital, replacement investment is undertaken by firms. As a result, gross investment can be expressed as:

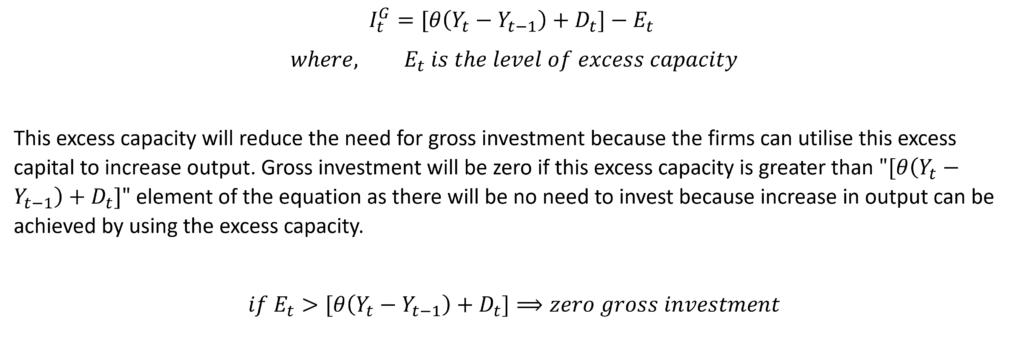

Moreover, the firms may not be operating at full productive capacity. This means that firms do not need to invest in capital if they have some excess capacity. It allows them to increase output without investing in new capital stock. We can include this variable in the above equation as follows:

process of accelerator

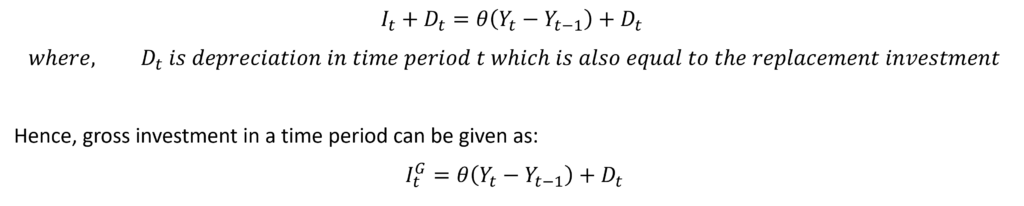

| Desired capital-output ratio (Theta) = 2 and depreciation is 10 per cent | |||||||

| Period | Output | Desired capital | Actual Capital | Replacement investment | Net investment | Excess capacity | Gross investment |

| 1 | 250 | 500 | 500 | 50 | 0 | 0 | 50 |

| 2 | 250 | 500 | 500 | 50 | 0 | 0 | 50 |

| 3 | 400 | 800 | 800 | 50 | 300 | 0 | 350 |

| 4 | 500 | 1000 | 1000 | 50 | 200 | 0 | 250 |

| 5 | 490 | 980 | 980 | 50 | -20 | 0 | 30 |

| 6 | 400 | 800 | 930 | 0 | 0 | 130 | 0 |

| 7 | 350 | 700 | 880 | 0 | 0 | 180 | 0 |

| 8 | 300 | 600 | 830 | 0 | 0 | 230 | 0 |

In this example, we assume that the optimum capital-output ratio (theta) is 2 and depreciation is 10 per cent from the initial capital of 500. That is 50 depreciation in every time period. The output remains the same from period 1 to period 2 which means that only a replacement investment of 50 is needed. There will be no net investment because desired capital remains the same with no increase in output.

Net investment is positive in time periods 3 and 4 with an increase in output from 250 to 400 to 500. To make the actual capital equal to desired capital, there will be a replacement investment of 50 and a net investment of 300 and 200 in time periods 3 and 4 respectively.

In time period 5, however, output falls by 10 and desired capital falls by 20 to 980. Net investment in this period will be negative because of a fall in output and actual capital. After the replacement investment of 50, the net investment will have to be -20 to get the desired capital stock. The gross investment will still be positive due to the replacement investment being greater than the negative net investment.

Excess capacity

In time periods 6, 7 and 8, excess capacity starts to develop. This is because the fall in output and subsequent fall in desired capital is greater than replacement investment. Hence, producers will stop replacing the depreciated capital and there will be no net investment. Moreover, production will occur at less than full capacity because only the desired capital will be used for production. Excess capacity is equal to the difference between desired and actual capital. It goes on increasing as output goes on reducing in time periods 6, 7 and 8.

criticism

- In many cases, an increase in output may be temporary. Producers will try to increase output by using existing capital instead of investing in new capital stock because the output increase is temporary. Therefore, every increase in output may not lead to additional investments.

- If producers know that the increase in output is permanent, they might increase investment not just to meet the current increase. But they will also try to anticipate a future increase in output and invest accordingly. Therefore, an increase in investment may be more than what is needed in the current time period.

- The assumption of a constant capital-output ratio is unrealistic. Even in the absence of technological changes, the capital-output ratio keeps changing due to various reasons. Such as the distribution of increased output among different industries with different capital-output ratios may lead to changes in the overall optimum ratio.

- Producers respond to any changes in desired capital by increasing investment in the same time period, which may be impossible in reality. In many cases, new investments can take more than one time period to take effect.

Econometrics Tutorials

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.