The price effect is the combination of both the income and substitution effects. The substitution effect is always positive, however, the income effect can be positive or negative. Therefore, the price effect can be positive or negative depending on the direction and magnitude of both substitution and income effects.

The indifference curves and ordinal utility analysis are used to analyze the price, income and substitution effects. To learn the basics, go to the post on Ordinal Utility analysis.

Econometrics Tutorials with Certificates

Meaning of Price, Income and Substitution effects

Price effect: price effect can be defined as the change in quantity demanded of a commodity as a result of a decrease in its price. This change in quantity demanded takes place through the substitution effect and income effect simultaneously.

Substitution effect: as the price of a commodity falls, it becomes cheaper in comparison to other commodities. Therefore, consumers will buy more of the commodity as it is relatively cheaper compared to other goods that are expensive. This increase in quantity demanded due to a change in relative price is called the substitution effect. The substitution effect is always positive, but, its magnitude depends on the nature and type of commodity.

Income effect: with a fall in the price of a commodity, purchasing power of the consumer increases. He or she can buy the same quantity of commodity with less income spent. In the case of normal goods, the income effect is positive as the quantity demanded of commodity increases with an increase in income. However, the income effect is negative for inferior goods because consumers prefer to buy other goods as their real income rises.

Price effect = substitution effect + income effect

Price effect for different goods

There are three possible combinations of income and substitution effects that lead to different price effects:

Normal goods

The overall price effect is positive for normal goods because both the income and substitution effects are positive.

Price effect = substitution effect + income effect

where the price effect is positive as income and substitution effects are positive

Inferior goods

The substitution effect is positive, but the income effect is negative for inferior goods. However, the overall price effect is still positive for inferior goods. This is because the magnitude of the positive substitution effect is greater than the magnitude of the negative income effect.

Price effect = substitution effect + income effect

where the price effect is positive because

|substitution effect| > |income effect|

Giffen goods

Similar to inferior goods, the substitution effect is positive but the income effect is negative for Giffen goods. However, the overall price effect becomes negative for Giffen goods. This happens because the magnitude of the positive substitution effect is less than the magnitude of the negative income effect.

Price effect = substitution effect + income effect

where the price effect is negative because

|income effect| > |substitution effect|

For normal goods and inferior goods, the price effect is positive. That is, a fall in the price of a commodity leads to an increase in the quantity demanded of that commodity.

However, Giffen goods are a special case where a decrease in the price of a commodity is accompanied by a decrease in its quantity demanded. This is because the negative income effect is huge for these goods, which exceeds the positive substitution effect. The overall price effect ends up being negative and the quantity demanded of the good falls with a fall in its price.

Decomposition of Price effect into Income and Substitution Effects

Price effect is a combination of income and substitution effects taking place simultaneously. But, only the price effect is observed as a change in quantity demanded with a change in price. Income and substitution effects cannot be observed directly because only the overall price effect is observable in the end. Price effect needs to be decomposed into income and substitution effects to study their magnitude and direction.

As the price of a commodity falls, it becomes cheaper in comparison to other commodities leading to a substitution effect. The real income of consumers also increases leading to the income effect. Both of these effects make up the price effect.

To separate the substitution effect from the income effect, the real income of the consumer has to be made constant. In other words, the income effect can be negated by returning the real income of consumers back to the level before the price change. In this way, the change in quantity demanded will reflect only the substitution effect because the income effect will be eliminated.

After obtaining the substitution effect in this way, the difference between the price effect and the substitution effect shows the magnitude of the income effect. Hence, the change in quantity demanded is decomposed into two parts- change in quantity demanded due to substitution effect and change in quantity demanded due to income effect.

There are two ways to make the real income constant:

Hicks’ Method for Income and Substitution effects

According to Hicks, income level must be reduced in such a manner that the consumer returns to the original level of utility. The budget line needs to be shifted leftwards in order to return the consumer to the original indifference curve. The new budget line must be tangent to the original indifference curve. Hence, the income effect is eliminated by reducing the income level through a leftward shift in the budget line. As a result, the visible change in quantity demanded is due to the substitution effect only.

Slutsky’s Method for Income and Substitution effects

Slutsky suggested a different approach where income level must be reduced in such a manner that the consumer is back to purchasing the original quantity of goods when there was no price change. The resultant budget line passes through the original equilibrium point. On this new budget line, the consumer is at equilibrium on an indifference curve that gives higher utility. The quantity demanded of a commodity at this point represents the substitution effect because the income effect has been eliminated.

Let us illustrate both these methods of decomposing price effect in the case of normal, inferior and Giffen goods:

Normal Goods: Income and substitution effects

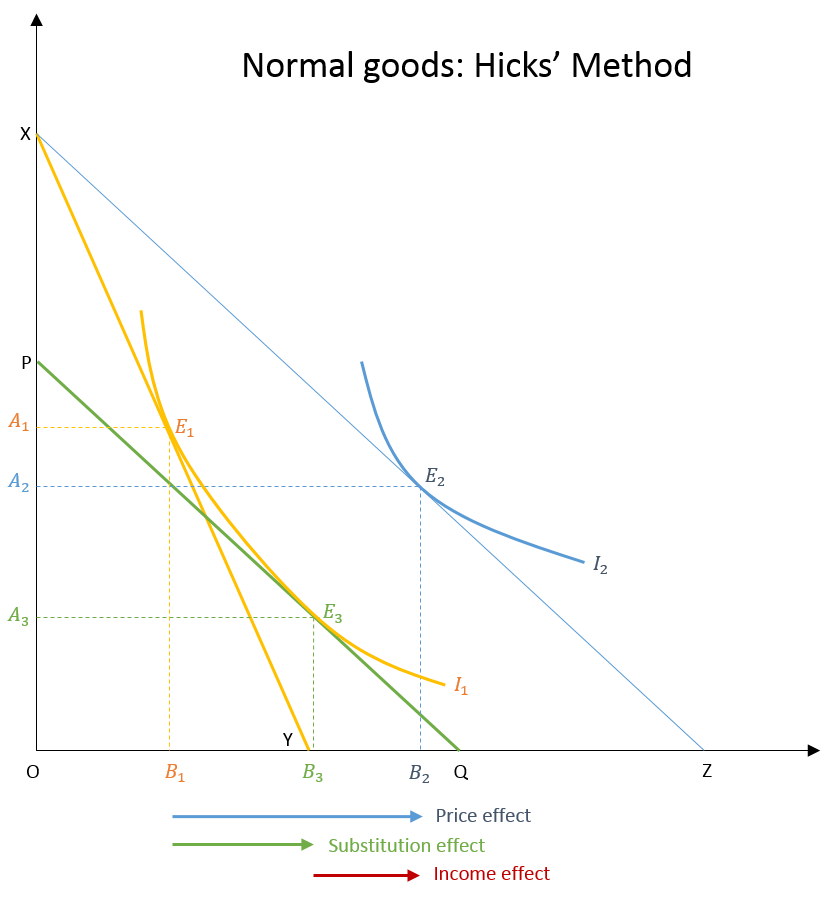

Hicks’ Method

In the case of normal goods, both the income and substitution effects are positive. Therefore, the resultant price effect is also positive.

In the diagram, the consumer is at equilibrium at point E1 initially. We consider the quantity demanded of our normal good on the x-axis (muffins) and the quantity demanded of another normal good on the y-axis. As the price of normal good (muffins, in our example) decreases, the budget line rotates from ‘XY’ to ‘XZ’. The new equilibrium point is at E2, where the new budget line ‘XZ’ is tangent to the indifference curve I2. The change in quantity demanded due to a fall in the price of muffins is the difference between B1 and B2. This represents the price effect.

To decompose this price effect, the increase in real income due to a fall in the price of muffins must be offset by eliminating the income effect.

To reduce the income level, the budget line is shifted parallelly from ‘XZ’ to ‘PQ’. The magnitude of this shift, or the amount of income to be reduced, is such that the consumer is back on the original indifference curve I1. The budget line ‘PQ’ is tangent to I1. Therefore, the consumer is at equilibrium at a new point E3 which is on the original indifference curve, but is associated with a new budget line ‘PQ’. The quantity demanded at this point is B3.

The difference between B1 and B3 is the substitution effect because the income effect has been offset. The change in quantity demanded occurs only due to the substitution effect. The income effect can be obtained by subtracting the substitution effect from the price effect, which will be equal to the difference between B2 and B3.

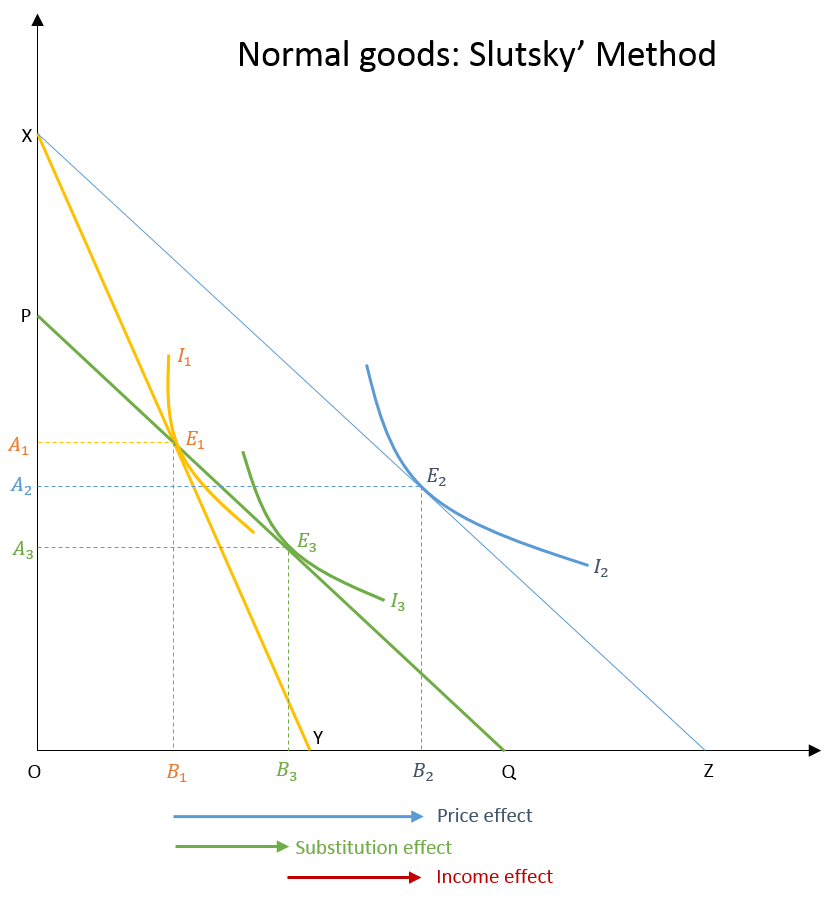

Slutsky’s Method

In this method, the income effect is eliminated by shifting the budget line ‘XY’ to the left in such a way that the consumer returns to the same quantity demanded of the commodity as before the price change. The budget line is shifted to ‘PQ’ and it passes through the original equilibrium point E1. Because the price of the commodity has decreased, the consumer will not be at equilibrium at E1. Instead, the consumer will maximize utility at the point where the budget line ‘PQ’ is tangent to a new indifference curve I3.

At this new equilibrium point E3, the quantity demanded of the commodity is equal to B3. Since the income effect has been offset at this point, the change in quantity demanded is purely due to the substitution effect. The magnitude of the substitution effect is the difference between B1 and B3. Similarly, the income effect is represented by the difference between B2 and B3.

Price effect = Substitution effect + Income effect

(B2 – B1) = (B3 – B1) + (B2 – B3)

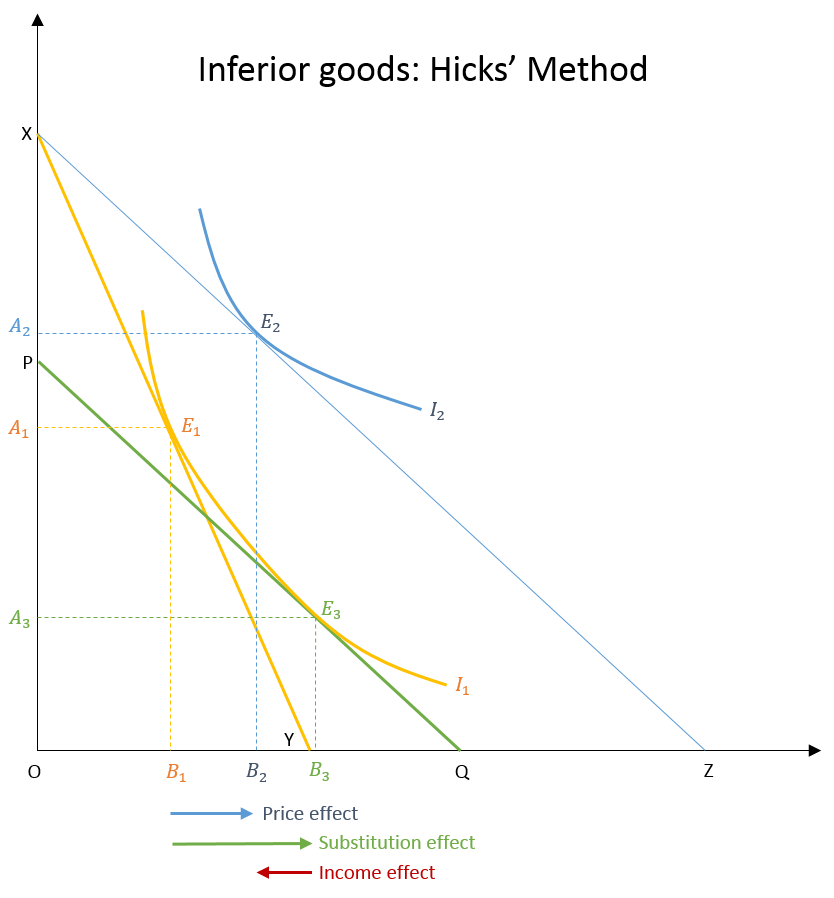

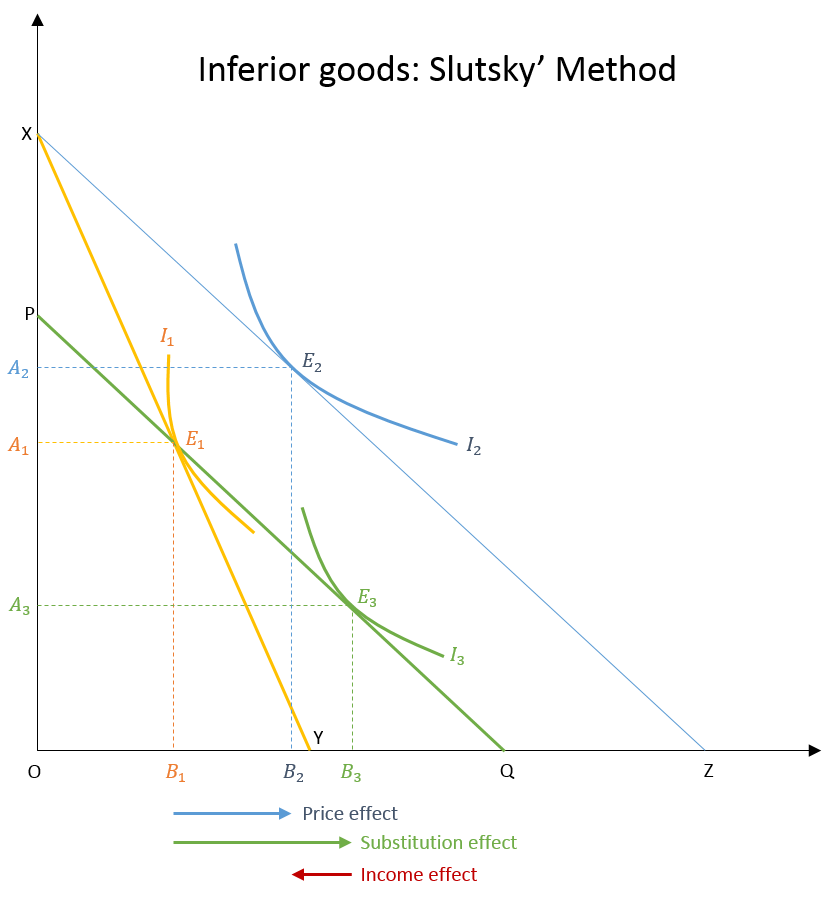

Inferior goods: Income and Substitution effects

The process of isolating substitution and income effect is similar to that of normal goods. Using Hicks’ method, the income effect is removed by returning the consumer to the same level of utility as before the price change. In the case of Slutsky’s method, the consumer is returned to the same quantity of commodity purchased as before the price change.

However, it is clear from the diagrams that the income effect is negative in the case of inferior goods and the substitution effect is positive. The difference between B1 and B3 (substitution effect) is greater than the difference between B3 and B2 (income effect). The end result is a positive price effect which is equal to the difference between B2 and B1.

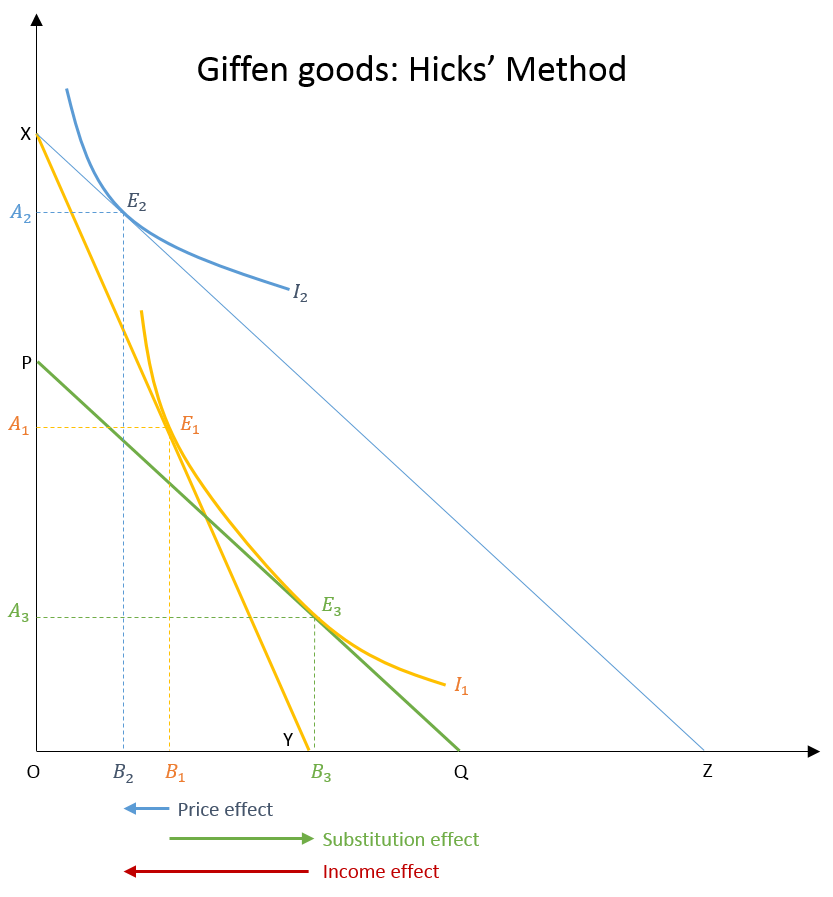

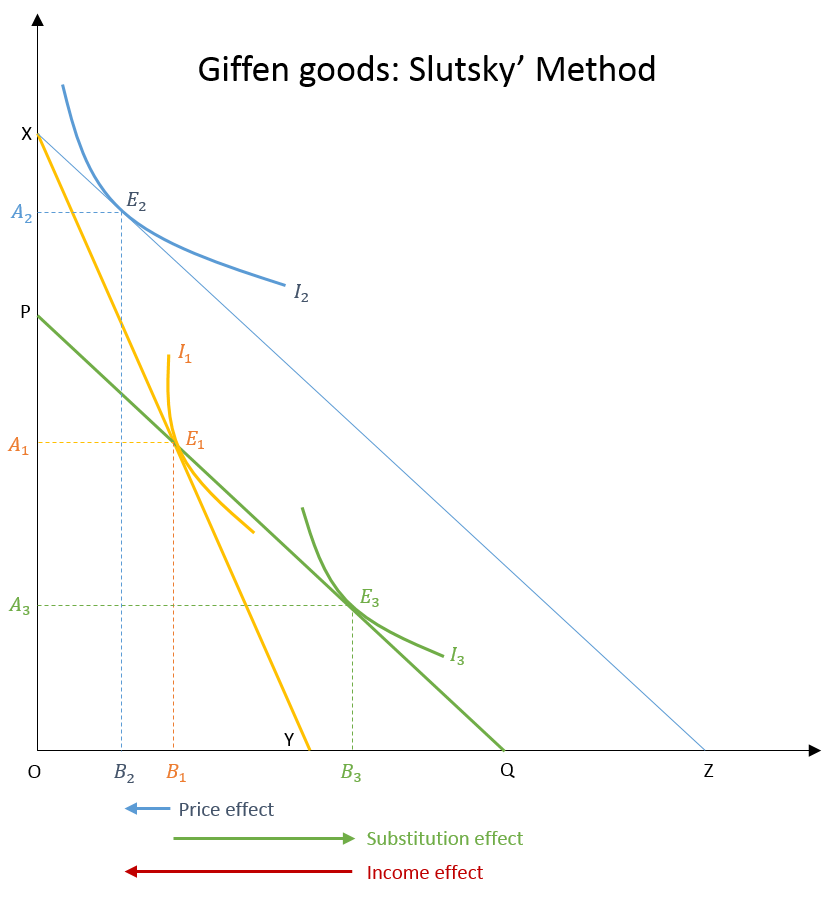

Giffen goods: Income and Substitution effects

The case of Giffen goods is a special one because these goods have a negative price effect. The substitution effect is still positive, however, the income effect is negative and greater than the magnitude of the substitution effect. As a result, the price effect becomes negative.

As seen in the diagram, the negative income effect (difference between B3 and B2) is massive. It is so huge that the substitution effect (difference between B1 and B3) cannot compensate for its magnitude. Hence, the resultant price effect is negative. This implies that with a fall in the price of such goods, the quantity demanded also falls.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.

Great 👍

Thank you!