The New Economic Policy of 1991 introduced a series of reforms in the Indian Economy during Prime Minister P.V. Narasimha Rao’s tenure. Dr. Manmohan Singh is considered the architect of the New Economic Policy because he was the Finance Minister during that period and later also became the Prime Minister of India.

The New Economic Policy further laid the foundation for macroeconomic stability, sustained economic growth and development in India. This new economic policy often refers to Liberalization, Privatization, and Globalization as its pillars. As a result, it represented a massive shift towards a market-oriented economy.

However, the new economic policy faced some challenges, which included concerns about increasing inequality and environmental degradation.

Econometrics Tutorials with Certificates

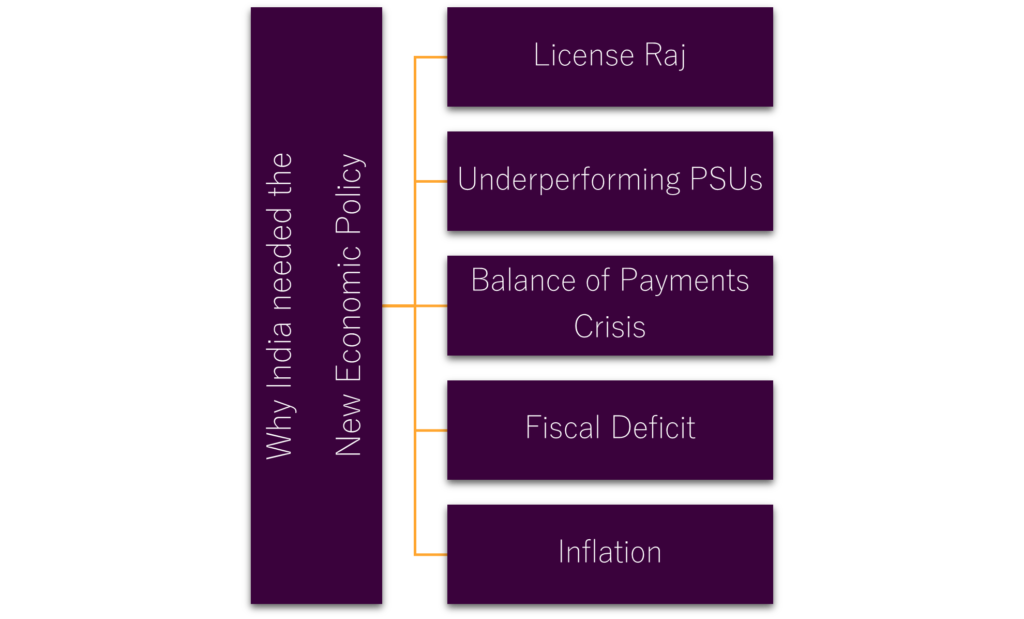

Need for New Economic Policy in 1991

License Raj

“License Raj” refers to government regulations and controls that were part of the Indian Economy from 1947 to 1991. Before the introduction of the New Economic Policy, the Indian Economy had License Raj as one of its main characteristics. The features of License Raj included bureaucratic interference, strict licensing requirements, and regulations that hindered the establishment and further expansion of business or private sector.

Industrial Licensing: The government controlled the issuance of licenses which were mandatory for setting up new industries or expanding existing ones. The government determined who could enter specific industries, and could also dictate the production decisions and allocation of resources. This led to interference by the bureaucratic decision-making process, delays, corruption, and rent-seeking.

Quotas and Permit Raj: Business operations required permits, quotas, and approvals, in addition to meeting licensing requirements for different aspects. This included raw material procurement, production, distribution, and marketing permits which further led to barriers to entry and discouraged innovation.

Price Controls and Regulations: price controls were implemented on a wide variety of goods and services by the government. The objective of these controls was to control inflation and maintain consumer affordability. However, these controls often caused market inefficiencies and introduced other problems like black markets and shortages.

Public Sector Dominance: The License Raj and permits promoted the Public Sector Undertakings (PSUs) in industries such as steel, coal, banking, and telecommunications. They enjoyed monopolies and preferential treatment, which discouraged private enterprises that simply could not compete due to barriers.

Performance of PSUs before the New Economic Policy

Before 1991, public sector undertakings played a significant role in the Indian Economy because they operated in some of the most prominent sectors such as Banking, energy and telecommunications. However, inefficiencies plagued PSUs and they were mostly loss-making enterprises.

Bureaucratic Interference: extensive control and political interference often led to inefficiencies in decision-making, delays, and misallocation of resources. Moreover, every decision had to go through multiple layers of approval and had to clear many administrative hurdles.

Lack of Autonomy and Flexibility: due to bureaucratic control, PSUs had to deal with rigid regulations. This further led to limited autonomy and flexibility in the decision-making process. Government directives and regulations bound PSUs, requiring them to comply with specific rules and regulations. This hindered their ability to respond swiftly to market changes, adopt innovative practices, and optimize operations.

Overstaffing and Labor Unrest: PSUs often suffered from overstaffing. Due to excessive manpower beyond requirements, high wage bills, low productivity, and inefficiencies were common. Moreover, PSUs commonly experienced labour strikes and disputes that further disrupted operations.

Subsidies and Price Controls: PSUs were also looked upon to fulfil social objectives by providing essential goods and services at subsidized rates. Pricing distortions and cost inefficiencies caused financial losses because the PSUs could not recover the full cost of production. Hence, Price controls imposed by the government prevented them from being profitable.

Monopoly or Oligopoly Status: Many PSUs operated in sectors where they enjoyed monopolistic or oligopolistic positions. This resulted in a lack of competition which reduced their incentive to improve efficiency or innovate. Therefore, PSUs often witnessed stagnation due to complacency and lack of competition.

Balance of Payments Crisis

India faced a severe balance of payments crisis before 1991. It was one of the key reasons behind the economic reforms and new economic policy of 1991. India witnessed a shortage of foreign exchange reserves, widening current account deficits, and difficulties with external debt during this period.

Trade deficit: India’s imports consistently exceeded its export earnings, leading to a persistent current account deficit. India was heavily dependent on imports for essential commodities such as crude oil, machinery, technology, and capital goods. On the other hand, problems such as low productivity and inefficiencies constrained export industries.

High Oil Prices: The oil shocks of 1973 and 1979 further exacerbated India’s balance of payments issues. Moreover, The Gulf War of 1991 increased this problem. As an oil-importing country, India faced increased import costs leading to an increasing trade deficit and problems with foreign exchange reserves.

External Debt: India accumulated external debt from multilateral institutions and bilateral loans to finance development projects, meet import requirements, and budget deficits. This became increasingly challenging due to the shortage of foreign exchange reserves.

Fiscal Deficit

India’s fiscal deficit had increased in the years before 1991 due to several factors:

Low Revenue: The Indian government’s revenue was not enough to meet the expenditure requirements. Tax evasion, inefficient tax administration, and a narrow tax base were some of the major factors responsible for low revenue.

Subsidies and Welfare Programs: The expenditure on subsidies, especially on food, fertilizer, and fuel was huge. The government subsidized essential goods and services for the population, which, however, burdened the government finances.

Public sector expenditure: a significant portion of government expenditure was on Public Sector Undertakings. These PSUs needed a lot of finances for their operation. Moreover, many of these PSUs operated inefficiently and incurred losses, exacerbating the fiscal strain further.

Interest payments: payment of interest on the accumulated debt was a major part of the government’s expenditure. It led to an increase in the fiscal deficit. As the fiscal deficit increased, it further became increasingly difficult to pay the interest.

Inflation

India experienced volatile inflation rates in the years before 1991. Even in 1991, inflation was around 13.7%. RBI often adopted expansionary monetary policies to promote economic growth and to finance government deficits. The government often borrowed from the Central Bank due to fiscal deficits which put inflationary pressures on the economy. Global events such as the high prices of oil also contributed to this phenomenon.

Objectives of the New Economic Policy

Liberalization

Liberalization is the process of reducing government control in the economy, therefore, promoting competition, and allowing market forces and private enterprise to operate. In the Economic Reforms and New Economic Policy of 1991, liberalization was a key objective.

- Industrial Deregulation: the industrial licensing system was abolished in most industries. This eliminated bureaucratic hurdles and encouraged entrepreneurship, innovation, and competition.

- Reduced Government Control: By withdrawing from sectors where private enterprises could operate efficiently, the government reduced its direct involvement.

- Trade Liberalization: Imports had quantitative restrictions removed, reduced tariff rates, and phased out non-tariff barriers gradually to promote international trade.

- Foreign Investment: To attract capital and technology from the world, the restrictions on Foreign Investment were eased which led to an increase in FDI.

- Regulatory reforms: regulatory bodies such as SEBI and TRAI were formed to promote transparency, and accountability and protect consumer rights.

- Financial sector reforms: The government deregulated interest rates and removed entry barriers against private and foreign banks to increase competition and improve financial services.

Privatization

Privatization implies transferring ownership and control of public enterprises or assets to the private sector. Its aim is to increase competition, reduce government control, increase efficiency and attract private investment.

- Disinvestment: The government started disinvesting minority shares of certain public enterprises. This involved selling a portion of government-owned shares to private investors while retaining majority ownership and control. In some cases, the government opted for the sale of majority shares where majority ownership and control was given to private investors.

- Public-Private Partnerships (PPPs): public-private partnerships (PPPs) was a mechanism for private sector participation in infrastructure development. These involved joint ventures between the government and private companies to finance, build, and operate infrastructure projects such as roads.

- Asset Sales and Lease Agreements: in some cases, the sale of government assets was carried out or lease agreements with private investors were signed for the management and operation of public assets.

Globalization

Globalization is the process of increased interconnectedness and interdependence among countries and economies around the world.

- Trade Liberalization: The New economic policy reduced tariffs, quotas, and other barriers to promote a free flow of goods and services. India opened up to foreign competition in order to integrate into the global trading system.

- FDI: The government promoted foreign direct investment (FDI) by liberalizing rules and regulations regarding foreign investment. They introduced automatic approvals and simple procedures to provide greater certainty to foreign investors. They also eased restrictions on the entry of foreign companies to attract capital, technology, and expertise from all over the world.

- Financial Integration: The New economic policy aimed to integrate India into the global financial system. This was achieved by liberalizing capital flows and cross-border investments. Restrictions on foreign exchange transactions were relaxed, which led to an increase in remittances and foreign exchange operations.

Fiscal Reforms and Structural Changes in the New Economic Policy

Rationalization of tax policies and rates was implemented to broaden the tax base and revenue collection. Other measures such as the reduction of subsidies and the phasing out of fertilizer and food subsidies were undertaken.

A lot of reforms were introduced in agriculture. The aim was to increase productivity, efficiency, and diversification. Agricultural subsidies were reduced or removed and contract farming was promoted to improve agricultural practices.

Investments in transportation, telecommunications and other important sectors to support economic development were undertaken by the government.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.