A recent study examined 17 countries across 180 years, unveiling an intriguing fact: 65 out of 73 deflation episodes did not trigger an economic decline. This discovery, hence, challenges long-standing assumptions that deflation inevitably causes economic distress. It offers a new perspective on deflation, a phenomenon often misunderstood and complex in its implications.

Deflation is marked by a general decrease in the price of goods and services, usually coinciding with a reduction in money and credit availability. The common phenomenon during deflation is the increase in purchasing power of currency over time. This occurs as the costs of capital, labour, and goods decline, despite their relative prices holding steady. For economists, deflation has been a persistent concern as it significantly affects various economic sectors, especially finance-related matters.

Econometrics Tutorials with Certificates

What Is Deflation?

Deflation emerges as a universal plunge in the costs of commodities and amenities, bolstering the currency’s purchasing strength. Typically, it converges with the cutback of monetary flow and credit availability. But, it can alternatively be triggered by enhanced production and technological advancements. This shift also reduces the nominal expenditures on capital, labour, goods, and services, potentially lowering their absolute prices. The repercussions, particularly in the financial domain, preoccupy economists. These falling price patterns elevate the real worth of debts, aggravating the predicament of those owing money as they might end up repaying in deflated currencies.

Deflation Changes Debt and Equity Financing

The advent of deflation substantially lessens the viability of leveraging debts for governments, enterprises, and individuals, notwithstanding depreciated market prices. Contrastingly, it augments the influence of equity financing rooted in savings. Investors, consequently, find businesses with substantial cash reservoirs or minimal debts more alluring amidst deflation. Concurrently, high indebtedness coupled with scarce asset accumulation diminishes attractiveness. Additionally, such economic climates encourage the escalation of real interest rates.

Hence, the effects of deflation on the viability of debt financing are counterproductive for entities and individuals. In sharp contrast, the prowess of equity funding anchored in saving surges. Businesses with significant liquid assets or those free of substantial debt find favour among investors during deflation. Simultaneously, the allure of heavily indebted entities with minimal reserves diminishes.

Causes of Deflation

Deflation may arise from several sources. These include a shrinking money supply, lowered consumer buying, and a rise in business efficiency. Notably, a loss of financial liquidity, due to policies from central banks, is a key player in monetary deflation.

Such an occurrence stems from a reduction in the amount of money available or its substitutes. Should the supply of money drop without a proportionate dip in economic activity, the general cost of goods also declines.

Decrease in the Money Supply

The reduction in money available is a potent cause of deflation. This situation arises when central banks opt for tighter monetary regulation. This choice constricts the flow of both credit and cash within the market.

An example of this scenario played out during the early 1930s in the USA. Such a period was marked by severe fiscal and monetary tightening coupled with heightened joblessness and increased loan defaults.

Decline in Consumer Demand

A drop in overall consumer spending may, too, instigate a deflationary trend. This downward economic spiral can result from cuts in public spending, collapses in the stock market, or an overall drive to save more. Additionally, when the monetary policy shifts towards a more restrictive stance, seen through higher lending rates, the drop in spending becomes evident.

Such a dip in consumption forces businesses to adjust their pricing strategies. Therefore, they may enact price cuts to ramp up volume sales, fostering a cycle of deflation.

Increase in Business Productivity

Technological breakthroughs leading to better business output could, paradoxically, also trigger falling prices. The more companies streamline their operations, the more they can lower their production costs and increase output. Take, for instance, the trajectory of data storage costs. The price of a gigabyte of data dropped from $437,500 in 1980 to merely three cents in 2014, all thanks to technological innovations.

Historically, deflation has been observed in situations where the supply of goods increased due to higher productivity without any increase in the money supply.

Measuring Deflation

Deflation stands in stark contrast to inflation, characterized by a pervasive decrease in the cost of goods and services within an economy. The Consumer Price Index (CPI), a comprehensive metric, steps in as the cornerstone of inflation as well as deflation rate assessments. It meticulously logs the selling prices of diverse items across the economy, enabling economists to pin down deflation’s movements accurately.

Consumer Price Index (CPI)

The multifaceted Consumer Price Index (CPI) spans various consumer outlays such as food, housing, clothing, and healthcare. It also includes transportation, recreation, educational expenses, and costs for communication services, among others. By scrutinizing these fluctuating prices, the CPI becomes a crucial yardstick for gauging the economy’s inflation or deflation tendencies.

Components of CPI

Eight fundamental categories constitute the CPI, encompassing food and beverages, solely rents in housing, and attire. It further includes healthcare services, transportation fares along with fuel expenditures, recreational activities, education, and communication costs. Additionally, certain other general commodities and services fall within this index’s purview, with notable exceptions of income taxes, Social Security dues, as well as investments like stocks, bonds, real estate, and life insurance.

Deflation and Economic Contraction

Deflation intertwines with economic contractions, further culminating in escalated unemployment, insurmountable debt obligations, and bleak forecasts for enterprises. In its severest manifestations, a deflationary spiral can precipitate a recession, and in extreme cases, a depression. As a result, the phenomenon is widely acknowledged as a detrimental force, besetting a host of deleterious effects on the economy at large.

The ensuing drop in prices, symptomatic of deflation, can also instigate a reciprocating decline: marginalized economic output, an uptick in joblessness, commercial insolvencies, and personal fiscal ruin.

The precipitants of deflation also entail curbed governmental expenditures, the faltering of stock markets, an overt preference for saving among consumers, and the rigorous enforcement of monetary policies. Such circumstances directly erode the aggregate demand, fostering a reduction in prices across different industries. Furthermore, deflation adversely affects the appeal of leveraging debts.

In the throes of deflation, debtors face an ominous plight, with their liabilities retaining unchanging magnitudes amidst falling prices, thus foreboding significant hurdles for both private and sovereign debt-burdened economies alike. The resolution to deflation frequently emerges in the form of expansive fiscal and monetary measures by authorities and central banks, encompassing the relaxing of bank reserve stipulations, direct treasury acquisitions, interest rate cuts, escalated public expenditures, and tax abatements. These interventions, therefore, aspire to invigorate economic hemodynamics, mitigating the shroud of deflationary pressures.

Deflation’s Impact on Borrowers and Debtors

Debtors face serious challenges under deflation. The actual worth of their debts rises, even though the prices of goods and services are decreasing. This predicament affects individuals and whole economies, particularly those with substantial national debts. Repaying loans becomes more arduous in deflation. The money they owe grows over time.

Deflation is disadvantageous for entities utilizing debt finance, including governments, businesses, and consumers. It elevates their debt burdens. The ramifications of deflation on those in debt can be profound. They struggle more to pay off their loans and debts. This, in turn, can affect the entire economy, potentially causing a recession due to diminished spending by consumers and businesses.

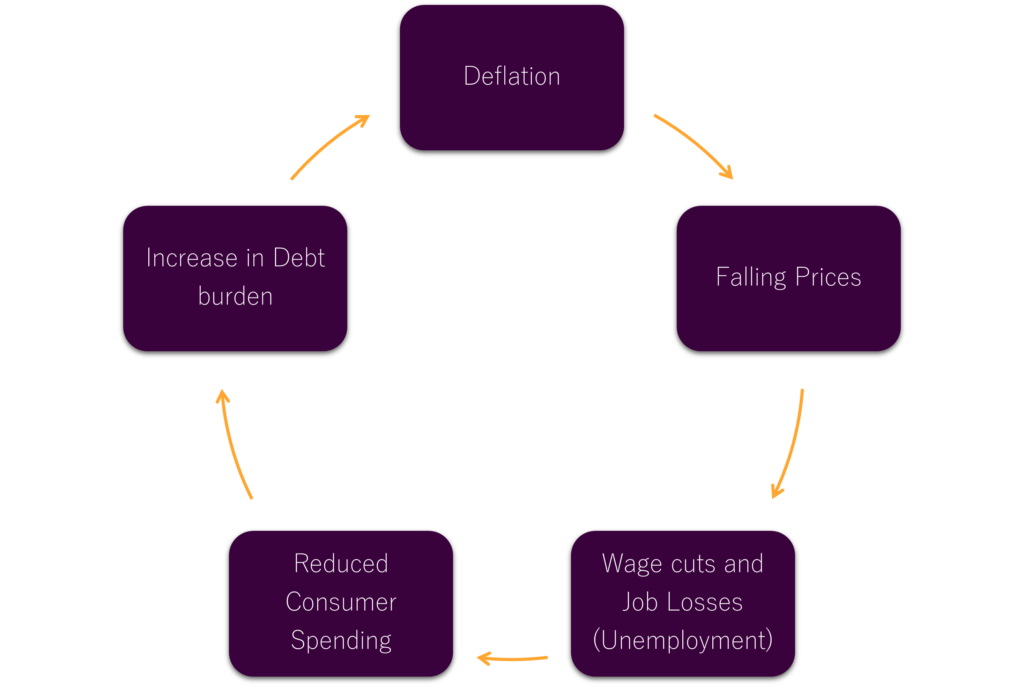

Deflationary Spiral

Within a deflationary spiral, diminishing price levels incite a detrimental chain reaction. This further leads to escalated unemployment, reduced compensation, waning consumer demand, and a downward spiral of prices. Consequently, the economic condition worsens as firms diminish wages and job offerings to preserve profit margins.

Wage Cuts and Job Losses

The environment of deflation necessitates that enterprises curtail their expenses. Often, this also translates to a diminishment in wages and the termination of jobs. As the number of unemployed individuals increases, consumer expenditures diminish. This further compounds the deflationary pressures.

Reduced Consumer Spending

Amid a deflationary spiral, consumer outlays witness a decrease. Individuals may defer their purchase decisions, hoping to benefit from future price reductions. Consequently, this behaviour weakens the economy. Hence, the associated drop in consumer needs initiates a cycle of diminished production, plummeting prices, and a contraction in economic endeavours.

Debt Burden Increases

A milieu of deflation augments the actual worth of debt, making it arduous for debtors to settle their obligations. This process can catalyze another cycle marked by curtailed expenditure, reduced incomes, and a growth in debt burdens. In effect, this sequence further compounds the economic slump.

Historical Examples of Deflation

The Great Depression

The United States has confronted deflation intermittently throughout its extensive economic history. The most noteworthy occurrence emerged during the Great Depression spanning the early 1930s. It was marked by a nearly 7% annual price decrease from 1930 to 1933. This severe deflationary phase was predominantly fostered by the financial industry’s collapse. This collapse was underpinned by widespread bank failures, stimulating a sharp reduction in the available money supply.

The Great Depression stands as a pivotal chapter in U.S. economic annals. It was characterized by profound economic downturn, soaring unemployment figures, and a conspicuous plunge in prices. The dynamic of deflation significantly exacerbated the economic adversities endured by consumers, businesses, and governmental entities alike.

Japan’s Lost Decade

In synchronous with historical instances, Japan grappled with a protracted bout of deflation in the 1990s. This duration colloquially labelled Japan’s “Lost Decade,” was emblematic of sluggish economic expansion, and elevated joblessness. The pervasive deflationary pressures posed formidable challenges for Japan’s economic framework.

Consequently, it underscored the critical risks entailed by extended periods of diminishing prices.

Changing Views on Deflation

Atkeson and Kehoe Study

The aftermath of the Great Depression marked a consensus among most economists that deflation was inherently harmful. This belief was based on the mirroring of monetary deflation with high joblessness and mounting bankruptcies. However, in 2004, a seminal study by economists Andrew Atkeson and Patrick Kehoe refuted this rationale. They discovered that out of 73 episodes of deflation, an overwhelming 65 did not precipitate an economic downturn. Furthermore, 21 out of 29 depressions did not feature deflation, thereby contesting former understandings of deflationary experiences. The analysis spanned 180 years of economic history across 17 nations.

Deflation’s Potential Benefits

Recently, the economic community has begun reevaluating traditional views on deflation. A plethora of perspectives now surround the issue, discussing the potential benefits of deflation, particularly focusing on the Pigou effect. According to this effect, a decrease in prices can spur employment because of the increase in wealth, thereby stabilizing the economy.

Adding to this, technological advancements have seen drastic reductions in prices, highlighting the advantages of deflation. Such technological progress allows for the widespread lowering of prices, benefiting consumers. Though deflation can render debt financing less attractive, it simultaneously propels the economic power of equity financing that is based on savings.

Deflation and Monetary Policy

Central to averting deflation, governments and central banks deploy multiple strategies, mainly by enacting expansionary policies. These may feature relaxing bank reserve requirements, purchasing government debt, and diminishing benchmark interest rates.

Role of Central Banks

Central banks assume a pivotal role in addressing deflationary risk. Notably, the Bank of Japan commenced a quantitative easing initiative in March 2001. This program focused on current account balances and escalated purchases of domestic bonds, aimed to mitigate deflation’s impact. Despite these efforts, Japan’s deflation has persevered, showcasing the intricate nature of deflation combat.

Expansionary Policies

In the assault against deflation, governments may also employ fiscal countermeasures. Expansionary fiscal policies, encompassing augmented public expenditure and tax abatements, endeavour to invigorate consumer and corporate spending. This serves as a buffer against deflationary undercurrents.

The efficacy of these strategies in deflationary scenarios hinges on the core causes and unique economic settings of the affected territory. Synchronizing the efforts of monetary and fiscal actors is imperative for a truly impactful and holistic response to deflation challenges.

Inflation vs deflation

Deflation and inflation represent divergent economic conditions. Inflation denotes a general uptick in goods and services prices, quantified through the consumer price index (CPI). Conversely, deflation marks a decrease in these prices, with an inflation rate dropping below zero per cent.

Central banks strive to govern the dynamic of inflation and deflation via monetary policy measures, ideally targeting a mild inflation range of 2% to 3% each year for the sake of economic equilibrium.

Extended periods of deflation may impede economic advancement and bolster joblessness, much akin to the situation witnessed during Japan’s protracted “Lost Decade.” Moreover, deflation has the potential to instigate a damaging downward economic spiral amidst severe downturns such as recessions or depressions, as diminishing economic activities coupled with reduced demand aggravate the situation.

| Inflation | Deflation | |

|---|---|---|

| Definition | General increase in the price level of goods and services | General decline in the price level of goods and services |

| Measurement | Consumer Price Index (CPI) | Consumer Price Index (CPI) |

| Monetary Policy | Central banks raise interest rates to control inflation | Central banks lower interest rates but with limited effectiveness |

| Economic Impact | Can lead to higher costs of living and reduced purchasing power | Can stunt economic growth and increase unemployment |

| Beneficiaries | Debtors, governments with large debts, physical asset owners | Consumers with high income, fixed-income investors, exporters |

Conclusion

Deflation, an intricate economic concept, impacts not just individuals and businesses but the wider economy. While it can seem beneficial due to increased purchasing power, continual deflation causes severe issues. These include economic slowdown, high unemployment, and financial turmoil for those in debt.

Governments and central banks employ various strategies to counter deflation. However, the success of these measures hinges on the specific causes and economic context. Deflation during the late 19th century was often fueled by technological progress and enhanced efficiency. Nonetheless, the researchers caution that unanticipated deflation triggers detrimental effects.

In our ever-changing economic environment, it’s crucial for policymakers, companies, and the general public to grasp the intricate nature of deflation. By familiarizing ourselves with its origins, effects, and potential solutions, we can contribute to a stable economic climate that benefits everyone involved.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.