The Central Banks implement monetary policy, aiming for maximum employment and economic growth alongside inflation control and stability. This careful equilibrium is vital for the economy’s well-being. To maintain this balance, the central banks deploy a variety of instruments of monetary policy.

Monetary policy constitutes a toolbox for a nation’s central bank to manage the money supply. It involves actions like altering interest rates and reserve requirements. Monetary policy is further broadly categorized as expansionary or contractionary.

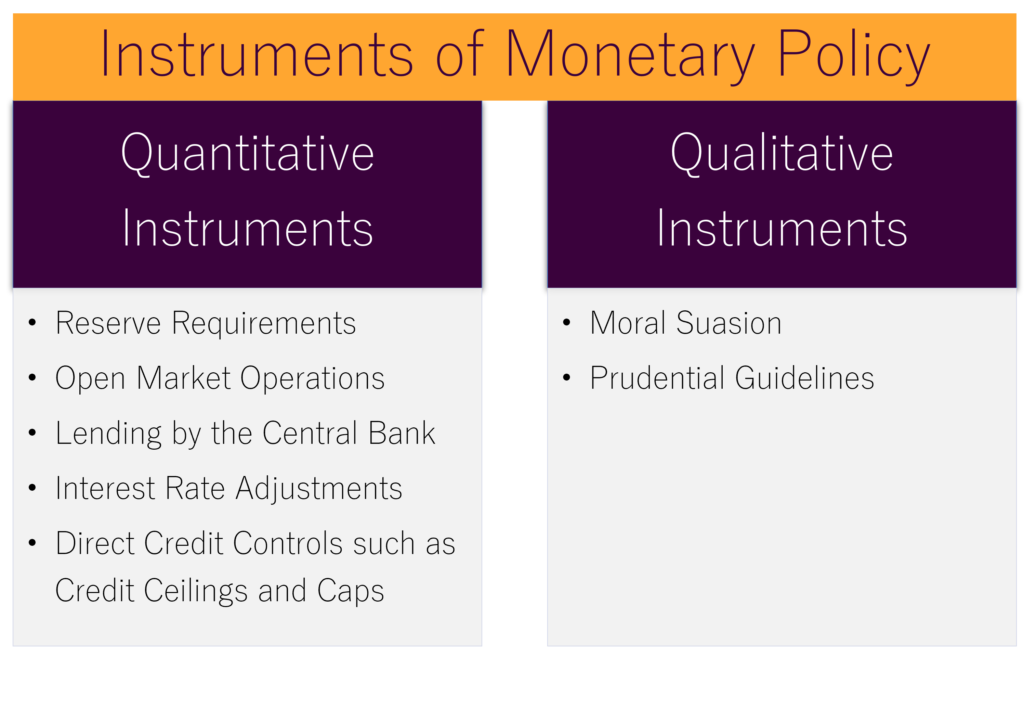

Monetary policy utilizes a spectrum of tools to meet goals such as price stability and full employment. It employs tactics like reserve requirements, open market operations, central bank lending, and interest rate modifications. Additionally, it may use direct credit controls, moral suasion, and prudential guidelines. Furthermore, these tools are typically sorted into quantitative (including reserve requirements and open market operations) and qualitative (like moral suasion and prudential guidelines) categories based on their approach.

The formulation of monetary policy is informed by economic indicators such as GDP, inflation rates, and specifics about various industries and sectors. An example includes the 1980s in the US when faced with double-digit inflation, the Federal Reserve lifted its benchmark interest rate to 20% to tackle inflation.

Econometrics Tutorials with Certificates

What Is Monetary Policy?

Monetary policy refers to a framework of strategic decisions made by a country’s central bank. Its primary aim is to influence the money supply within the economy. This is done to achieve macroeconomic goals, including but not limited to, maximum employment and price stability. Through this process, the central bank also closely regulates the amount of money available in the economic system. It also manages the mechanisms by which new money is introduced.

Understanding Monetary Policy

The control of the money supply and the introduction of new money are key facets of monetary policy. This economic strategy is further influenced by various indicators such as GDP, inflation, and sector-specific growth rates. The central bank executes its policy by making several adjustments. These may include changes in the interest rates offered to commercial banks, the acquisition or sale of government bonds, setting targets for foreign exchange rates, and also tweaking the amount of reserve requirements for banks.

Types of Monetary Policy

Monetary policy strategies are broadly classified into expansionary and contractionary approaches. The former is used to spur economic growth by increasing the money supply while the latter aims to slow down growth and reduce inflation by limiting the money available. A key objective of expansionary policy is to lower unemployment, whereas contractionary policy is implemented to address rising inflation rates.

Goals of Monetary Policy

The overarching objectives of monetary policy include the promotion of economic growth, management of inflation, the mitigation of unemployment, and the influence over exchange rates. To control inflation, central banks implement contractionary monetary policies. Hence, such measures involve decreasing the money supply. Conversely, expansionary monetary policies are used to invigorate a slow economy and foster employment growth. Additionally, central banks utilize monetary policy to uphold steady exchange rates and safeguard the local currency’s value.

Reserve Requirements

Fractional Reserve System

Central banks also wield considerable influence by adjusting the reserve requirements. These requirements mandate the portion or fraction of customer deposits that banks must retain. A reduction in reserve requirements, therefore, facilitates an influx of capital for banks, fueling increased lending activities. Conversely, elevating these thresholds dampens bank lending activities, thus curbing economic growth. The framework of the fractional reserve system delineates the extent of banks’ lending capacity, and therefore, has a pivotal role in regulating the money supply.

Impact on Bank Lending

Furthermore, by manipulating reserve requirements, central banks directly impact the lending capabilities of commercial institutions. Lowering these thresholds further enables a more expansive loan provision, thereby augmenting the overall money supply. Conversely, an increase in such requirements constrains lending, leading to a contraction in the money supply. This mechanism, hence, serves as a crucial lever for central banks in managing economic stability, by dictating the fluidity of credit.

Financial entities are bound by reserve requirements that align with the composition of their deposit obligations, featuring variable reserve requirement ratios.

Open Market Operations

Buying and Selling Securities

Central banks execute open market operations by transacting in government securities with the general public, chiefly Treasury bills. This process is also pivotal in financial management. Selling these securities curtails the available reserves within the banking sphere, whereas their purchase bolsters such reserves. Consequently, these manoeuvres significantly shape the economy’s money supply dynamics.

Central banks, through the vehicle of open market operations, orchestrate the level of reserve balances in the banking system. This is crucial in their efforts to modulate short-term interest rates and influence the broader money supply trends. Manipulating the economy’s liquidity is achieved by buying or selling government bonds, which either infuses or withdraws money from circulation.

Influencing Money Supply: An example

As an example, The Bank of Korea also prominently employs open market operations to navigate the overnight call rate, keeping it aligned with a set ‘Base Rate’ (Source: Bank of Korea). This strategy leverages securities transactions, utilizing them strategically to adjust market liquidity through buying or selling bonds. Notably, the scope of allowable securities for these operations is limited to government bonds, government-guaranteed bonds, and select securities.

Certain market situations prompt a temporary expansion of the Monetary Stabilization Bonds framework, as seen during the Lehman crisis, COVID-19 fallout, and disruptions in the real estate PF-related bond markets. These expansions typically concentrate on RP transactions, underlining their operational priority. In terms of operations, the Bank of Korea has gained a securities lending and borrowing capability since revising the Bank of Korea Act in August 2011, a step that boosts the efficiency of its liquidity management.

Lending by the Central Bank

Central banks are essential in the financial ecosystem, also offering lending to commercial institutions. Their direct involvement further influences the level of bank reserves and the overall monetary base within the economy. By engaging in lending activities with commercial banks, the central bank is capable of augmenting the circulating money and liquidity. This bolsters the economic sustenance and stability significantly.

The Central Banks also assume the responsibility of a “lender of last resort.” It extends loans to viable banks encountering transient issues with liquidity. This role is instrumental in forestalling bank insolvencies and economic turmoils with far-reaching effects. Hence, central bank lending stands as a critical instrument in the repertoire of the central bank for steering the central bank lending, bank reserves, and monetary base alteration towards its policy aims.

| Policy Tool | Description | Impact on Economy |

|---|---|---|

| Central Bank Lending | The central bank issues loans to commercial banks directly, thereby influencing bank reserves and the monetary base. | This action elevates the money and liquidity in the financial realm, backing both economic upswing and equilibrium. |

| Reserve Requirements | The minimal level of bank reserves that commercial banks need to maintain, as a ratio of their deposits, is determined by the central bank. | Modulating these requirements can lead to the expansion or contraction of the money supply. This impacts the availability of credit and economic operations. |

| Open Market Operations | It involves the central bank trading government-backed securities with the public, thereby shifting the monetary base. | A strategy comprising buying increases the money in circulation while selling reduces it, influencing the economic and credit landscapes significantly. |

Central Banks, deploying an array of policy measures, meticulously steer the central bank lending, bank reserves, and monetary base adjustments in pursuit of their economic aims. Hence, they are dedicated to fostering financial steadiness through these undertakings.

Interest Rate Adjustments

Minimum rediscount Rate

Central banks also wield the power to modify the minimum rediscount rate. This rate defines the lowest feasible price at which they extend loans to stable commercial banks. It further serves as a base for the money market’s interest rates. Consequently, it moulds the availability of credit and shapes the avenues for saving and investment within an economy.

Varying the minimum rediscount rate, the central bank can also dictate the economy’s aggregate interest rates. Heightened interest rates escalate the cost of borrowing, diminishing the availability of credit and hindering investment, thus impairing economic advancement. Conversely, lower interest rates mitigate the expense of borrowing, invigorating credit accessibility and incentivizing investment, thus, fostering economic growth.

Influencing Credit and Investment

The central bank exerts substantial influence on the economy’s economic activity and expansion via alterations in the minimum rediscount rate. By adjusting these rates, it can steer the availability of credit, savings, and investment. Such actions further augment or curtail the expense of borrowing and investing for businesses and consumers alike, thereby guiding the economy’s journey towards growth.

Direct Credit Controls

Central banks wield the power to govern credit issuance by commercial banks directly. They do so through tactics like imposing credit ceilings or caps. This approach restrains the volume or proportion of loans destined for distinct economic sectors or endeavours. Thus, central banks influence the use of available financial resources, shaping investment toward their strategic aims.

Credit Ceilings and Caps

Additionally, Direct credit controls empower central banks to channel investment flows into their favoured economic arenas. Through the imposition of lending restrictions on select industries or endeavours, central banks can decisively guide credit and investment directions within the economy.

Directing Investment

The imposition of credit limits enables central banks to steer investment capital towards sectors or activities that mirror their defined policy visions. This methodical strategy also aids in achieving the central bank’s economic objectives, contributing to the realization of broader economic goals.

Moral Suasion

Central banks, through their regulatory dominance, can also exert a significant influence on commercial banks. They encourage compliance with certain financial policies, be it the moderation or expansion of credit, enhancement of savings, or the stimulation of export activities. This strategy, termed “moral suasion,” enables central banks to steer the banking sector’s behaviour without resorting to direct, compulsory measures.

Central Bank Authority

By leveraging moral suasion, central banks empower themselves to steer commercial banks towards favourable practices, irrespective of the individual institutions’ perceptions of risk and reward. Capitalizing on their regulatory arsenal, central banks influence credit strategies, the boost of savings, and the backing of export-led ventures. These directives, therefore, are intended to yield beneficial economic outcomes at large.

Guiding Banking Practices

Moral suasion stands as a pivotal instrument in the arsenal of central banks, particularly pronounced during periods of economic downturns featuring abated interest rates. For illustration, the Federal Reserve historically deployed ‘jawboning’ strategies. Through these actions, it sought to temper inflation via market operations and strategic dialogues that unveiled future intent. Likewise, amid the Greek eurozone crisis, the European Central Bank’s president, Mario Draghi, made a public proclamation that the ECB would enact whatever measures necessary to preserve the euro’s integrity prompting the remarkable resurgence of the currency.

Prudential Guidelines

Central banks have the power to issue written guidelines. These guidelines mandate that commercial banks carefully manage their operations to achieve specific goals. The implementation of these prudential guidelines effectively reduces the autonomy of bank management. It replaces their flexibility with strict rules. This change enables the central bank to exercise more direct control over the decisions and actions within the banking sector.

Regulating Banking Operations

Central banks utilize prudential guidelines to steer commercial banks towards specific economic outcomes by restricting their independence in decision-making. These guidelines form a set of rules and standards for banks to adhere to. They thereby empower the central bank to guide activities within the banking industry. The intention is to align these activities with the central bank’s broader policy goals.

Promoting Desired Outcomes

Prudential guidelines serve as a mechanism for central banks to both control and influence banking operations, thus fostering preferred economic situations. These guidelines essentially offer a structure. This structure allows the central bank to align the actions of commercial banks with its specific policy objectives. In doing so, it works towards benefiting the financial system and the broader economy.

Quantitative vs Qualitative Instruments of Monetary Policy

Quantitative Instruments

Monetary policies feature both quantitative and qualitative mechanisms that steer the money supply and credit climate within an economy. Numerically preset, quantitative tools directly impact economic dynamics through their implementation. Such instruments encompass reserve mandates, open market transactions, and interest rate variabilities.

The stipulation on reserves, governed by the central monetary authority, dictates the percentage of liabilities that financial institutions must set aside as liquid assets. By modifying these limitations, the availability of lending capital can be constricted or expanded, thus inevitably modulating the monetary market.

Furthermore, central banks employ market dealings with public and private sector securities to regulate the volume of reserves within the commercial banking sector and manage short-term loan costs. Through these endeavours, the prevailing money supply and accessibility to credit provisions are modulated.

Adjustments to interest rates, another facet of quantitative policy tools, are crucial. These alterations, affecting the central bank’s primary lending rate, disseminate through the economy, transforming the credit landscape and influencing capital investment, consumption, and overall economic expansion.

Qualitative Instruments

Conversely, qualitative monetary controls emanate from the regulatory authority’s directives, lacking specific numerical objectives. These mechanisms comprise of moral pressure and regulatory criteria, providing frameworks for financial institutions.

Pressure through moral persuasion allows the regulatory authority to guide financial entities towards preferred action, debarring from encouraging adverse practices that elude risk evaluation logic. In contrast, the governance of prudential standards mandates actions in accordance with predetermined protocols, ensuring a more direct influence on economic operations towards achieving set objectives.

In the realm of qualitative tools, the central bank’s influence ranges more broadly, steering not only the immediate money market but also the banking culture in serving wider economic objectives. This suite of tools provides regulators with a robust skillset ensuring adherence to economic equilibrium, employment targets, and continuous financial prosperity.

Conclusion

Monetary policy deploys several tools to attain fundamental economic objectives such as price stability and optimal growth while ensuring full employment. Central banks use various quantitative methods, e.g., controlling reserves and adjusting interest rates, to directly shape the money supply and credit environment. Additionally, they employ qualitative techniques, like moral persuasion and prudent regulations, to influence banking behaviour, aiming to achieve the desired economic outcomes.

The precise selection and skilful application of these instruments lie at the heart of effectively handling macroeconomic challenges and advancing economic equilibrium and well-being on a larger scale. Notably, economic volatility can detrimentally impact living standards, highlighting the essential role of monetary policy in combating inflation and stabilizing the economy.

Successfully employing a broad array of monetary policy tools is indispensable for national growth and financial welfare, allowing central banks to regulate the money supply effectively and mitigate negative effects on vulnerable populations and investors alike. Through strategic implementation of these tools, authorities can lead the economy towards sustainable development, stable prices, and enhanced job creation, creating an environment supportive of economic harmony and advancement.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.