Consumption expenditure plays an important role in determining the gross national product (GNP). Consumption generally contributes the biggest portion of GNP, becoming a decisive factor responsible for the national income of any economy. The consumption function was first introduced by Keynes in 1936. His ideas associated with consumption behaviour later became known as the Absolute Income Hypothesis.

It explains the relationship between income and consumption, where real consumption is a positive function of real income. That is, an increase in income leads to an increase in consumption expenditure. However, this increase is less than proportionate, meaning that the percentage increase in consumption is less than the increase in income.

Econometrics Tutorials with Certificates

marginal propensity to consume (MPC) and average propensity to consume (APC)

The slope of the consumption function refers to the marginal propensity to consume.

According to the consumption function, MPC is less than 1 because the increase in income is greater than the resultant increase in consumption. The slope of the curve is positive depicting a positive relationship. However, the increase in consumption is less than proportionate. This implies that with an increase in income, consumers spend less percentage of income or save more percentage of income.

The average propensity to consume is the ratio of consumption to income. That is, it is the proportion of income spent (consumed) at a given level of income.

APC = C / Y

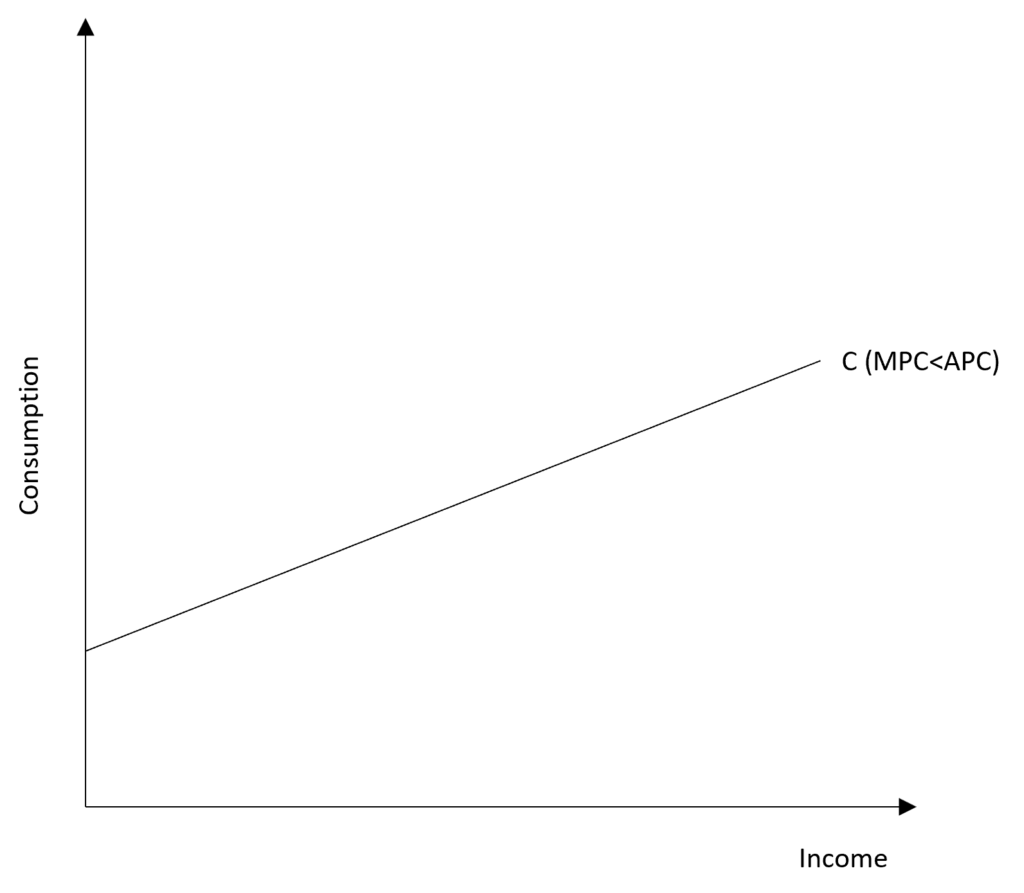

relationship between MPC and APC

From the curve, it is evident that APC falls with a rise in income because less and less income is spent on consumption. The marginal propensity to consume (MPC) is less than the average propensity to consume (APC). This happens because when APC falls with a rise in income, the ratio of increase in consumption to increase in income will be less than C / Y or APC.

MPC < APC

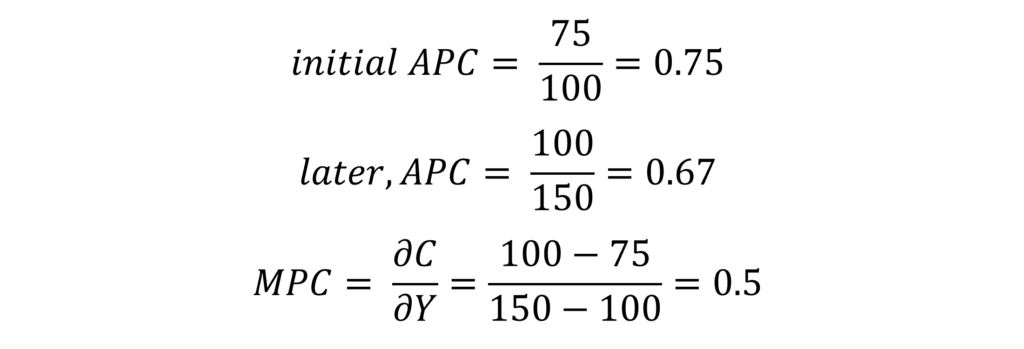

Suppose, income is $100 and consumption is $75 initially, which rise to $150 and $100 respectively. Then,

As long as APC falls with an increase in income, MPC will always be less than APC. Since the absolute income hypothesis postulates that APC decreases with an increase in income, MPC will be less than APC.

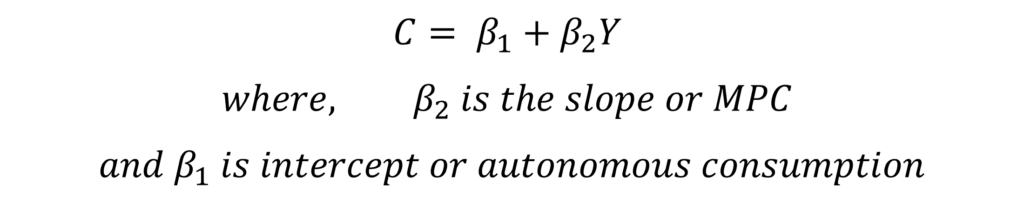

absolute income hypothesis: consumption function

The consumption function associated with the absolute income hypothesis can be expressed as:

Autonomous consumption is the minimum consumption expenditure even when the real income is zero, i.e. consumers must spend a certain minimum amount. For instance, consumers need to purchase some necessities for survival despite zero income. This kind of consumption may be carried out from previous savings or borrowings.

As income rises, consumption increases as well. The increase in consumption is shown by the slope coefficient (MPC).

Empirical Evidence

Long run consumption

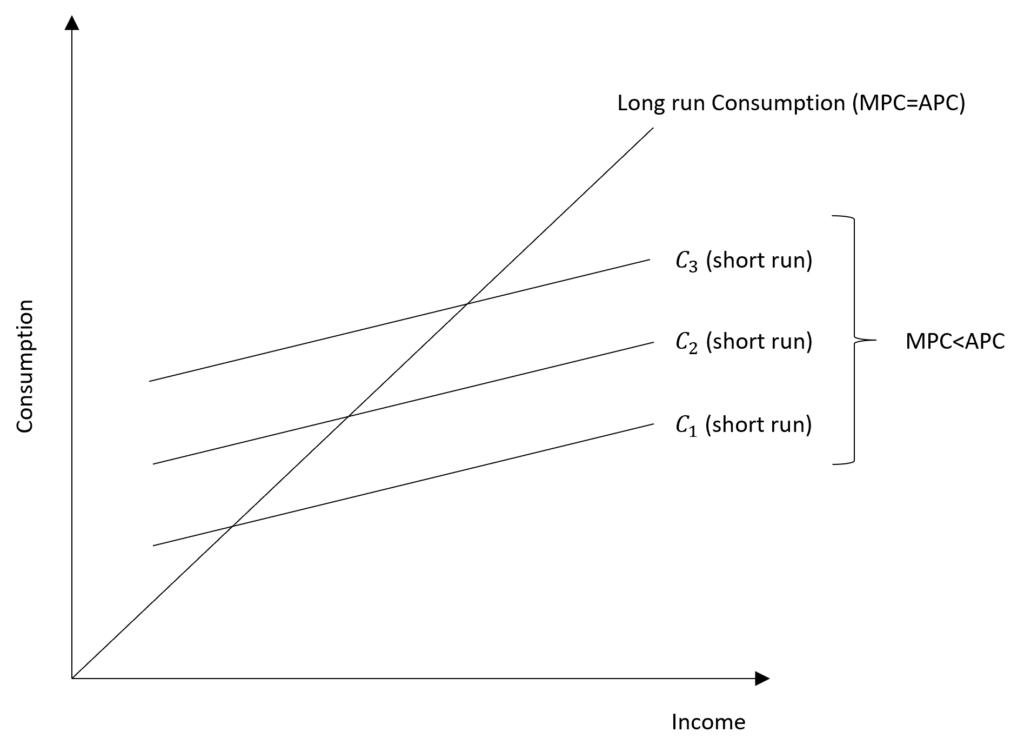

A study conducted by Simon Kuznets in 1946 showed a different type of consumption expenditure. In the long run, it was observed that on average, APC did not decline with an increase in income. Therefore, APC and MPC were equal even as income grew along the trend. Hence, the consumption function trend was a straight line passing through origin with MPC equal to APC. The Absolute Income Hypothesis could not explain this behaviour.

Role of business cycles or cyclical fluctuations

Kuznets also observed that APC was below the trend during periods of a boom in the economy and above the trend during periods of slump. In the short run, therefore, consumption behaved similarly to the propositions of the absolute income hypothesis. This is because APC declined with an increase in income as it was observed to be below trend during the boom (high income) periods in a business cycle. As a result, MPC < APC during the short run due to cyclical fluctuations in income.

Cross-sectional studies

In addition to business cycles, MPC was observed to be less than APC in cross-sectional studies. Hence, APC was observed to decline with an increase in income across different sections of consumers. This implies that consumers with higher incomes tend to spend a relatively smaller proportion of their income.

Based on the above observations, the consumption function put forward by the absolute income hypothesis can be considered a short-run consumption function. This is understandable because the cross-sectional and short-run behaviour of the consumption function was observed to be the same as proposed by the absolute income hypothesis.

criticism of the Absolute Income Hypothesis

- It fails to explain the long-run behaviour of consumption observed by Kuznets, where MPC=APC.

- The theory did not explicitly account for the role of cyclical fluctuations or business cycles, where MPC<APC over a short period only.

Stagnation Thesis and Role of Wealth

Based on the absolute income hypothesis, economists believed that economies will stagnate after World War 2. As income rises, consumption will increase but the ratio of consumption expenditure to income (C / Y) will go on decreasing. Real output in an economy is a combination of consumption, investment and government expenditure:

As “C / Y” falls with a rise in income, either “I / Y” or “G / Y” must increase to maintain the full employment level in the economy. There is no way to determine whether “I / Y” will increase or decrease, therefore, “G / Y” must increase. Hence, government spending must increase at a faster rate than income, otherwise, the economy will stagnate.

After World War 2, government spending would fall and economies would plunge into recession or depression. But, the opposite happened and consumption increased leading to inflation instead of stagnation. This happened because consumer expenditure was controlled through rationing during the war. The extra income during that period was converted into assets or wealth. When the war ended, it led to a jump in consumer expenditure due to the increased assets and wealth. This proved that income is not the only determinant of consumption, but, wealth also plays an important role in consumption expenditure.

Other theories such as the Permanent Income Hypothesis, Relative Income Hypothesis and Life-cycle Hypothesis attempted to overcome the shortcomings of this theory and explain the empirical results.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.