Though it might seem trivial, information asymmetry plays a profound role in market dynamics, often causing significant issues. Asymmetric information manifests when one entity in an exchange holds a considerable advantage in information quality or quantity. This information gap disrupts market efficiency, further leading to market failure. The challenges posed by this asymmetry are at the heart of modern economic thought and policy. Therefore, an in-depth comprehension of these dynamics is imperative for effective market management and policy formulation.

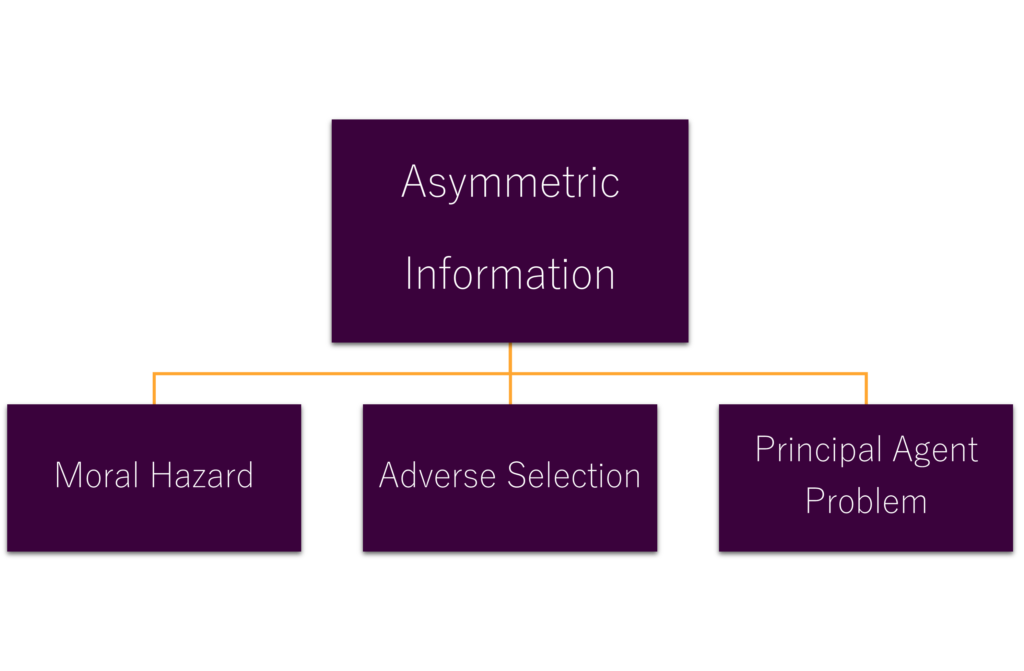

This discourse will explore the meanings and ramifications of information asymmetry. It will highlight how this asymmetry fosters adverse selection, moral hazard, and the principal-agent issue. Strategies like signalling and screening play significant roles in minimizing these adversities.

Econometrics Tutorials with Certificates

Asymmetric Information: Definition and Overview

What is Asymmetric Information?

In the sphere of economics, understanding asymmetric information is pivotal for discerning market dynamics and preempting market failures. It denotes a scenario where one economic actor possesses superior or more information than another in the transaction. This information disparity may skew outcomes and alter the assumed equilibrium in economic interactions.

Divergence in transactional knowledge leads to asymmetric information. Such disparity emerges when one party, be it a seller or borrower, comprehends the product’s quality or creditworthiness better than the counterparty. This knowledge gap can significantly influence trust, pricing, and the overall efficiency of the market.

Importance in Economics

Asymmetric information poses critical challenges in economic interactions, also fostering conditions for adverse selection and moral hazard. In adverse selection, market participation by those with high risks or inferior products skews equilibriums. On the other hand, moral hazard allows for increased risk-taking, facilitated by mitigation from the fallout.

The principal-agent problem, an emblematic illustration of asymmetric information, occurs when the agent’s actions do not align with the principal’s objectives. This misalignment of incentives can lead to inefficiencies and, potentially, market distortions. The interplay between the principle and agent complicates decision-making processes and can further result in outcomes that are prejudiced against one party.

For policymakers, regulators, and market players, confronting asymmetric information is imperative. It is a foundational step towards ensuring the markets operate at their most efficient, devoid of distortions. Hence, by addressing the root causes of asymmetric information, stakeholders can aspire to forge fairer and more transparent economic systems.

Asymmetric Information and Market Failure

At the essence of market failure investigation is the concept of asymmetrical information distribution. This disparity, when present between buyers and sellers regarding pertinent details, often precipitates suboptimal outcomes. As a result, the market may fail in its duty to allocate resources effectively.

The occurrence of adverse selection typifies how asymmetric information can instigate market failure. In this context, riskier individuals or those offering lower-quality goods dominate market participation. Conversely, their high-quality, low-risk counterparts are discouraged from entering the market. Consequently, the prevailing situation favours the availability of low-quality products or services, turning away higher-quality alternatives.

Moral hazard is another ramification of information asymmetry. It comes to fruition when one party, normally the less informed one in a transaction, is motivated to embrace more risk than they would with complete information. Such a scenario often leads to inefficiencies, with entities or individuals opting for actions that do not serve the market’s greater good.

When an ominous adjunction between adverse selection and moral hazard takes hold, a self-correcting market appears out of reach. The net result is inefficiency and market failure cascading through the economic fabric.

| Concept | Description | Impact on Market Failure |

|---|---|---|

| Adverse Selection | Individuals with higher risks or lower-quality products are more likely to participate in a market, while those with lower risks or higher-quality products are deterred from doing so. | Can lead to a market offering only low-quality goods or services, as the higher-quality options are driven out. |

| Moral Hazard | One party in a transaction, typically the party with less information, is incentivized to take on more risk than they would if they had complete information. | Can result in inefficient outcomes, as individuals or organizations may engage in behaviour that is not in the best interest of the overall market. |

Adverse Selection: A Consequence of Asymmetric Information

In the economic domain, adverse selection emerges as a direct result of asymmetric information. It unfolds when one party holds more pertinent information than their counterpart in a transaction. This imbalance empowers the selection of low-quality products or high-risk participants more frequently. Consequently, market inefficiencies take root.

To elucidate, consider the used car market as a paradigm. Here, a seller is privy to their car’s true state, unlike the buyer. Exploiting this informational advantage, the seller might seek a premium, even for an inferior vehicle. The buyer, bereft of this information, struggles to differentiate well-preserved cars from those in disrepair. This confusion often leads to suboptimal purchasing choices.

The ramifications of information asymmetry span various sectors, including insurance and financial markets. Take the insurance arena, for instance, where those at a higher risk of submitting claims are inclined to insure themselves. Meanwhile, individuals posing lower risks might opt out, skewing insurance pools and inflating premiums.

Economists advocate for signalling and screening as strategic interventions to lessen the destructiveness of adversarial selection compounded by informational disparities. These methods intend to close the gap, furnishing both buyers and sellers with crucial knowledge. Such empowerment is pivotal for making enlightened decisions and reestablishing market harmony.

Moral Hazard: Another Impact of Information Asymmetry

Information asymmetry engenders moral hazard—a notable market distortion. Defined by one party’s riskier actions due to consequence-bearing by another, moral hazard typifies settings with principal-agent dilemmas.

Principal-Agent Problem

This quandary unfolds when the objectives of the principal differ from those of the agent, instigating conflict. An illustrative scenario is found in insurance agreements, where the insurer (principal) expects the insured (agent) to mitigate risk. However, the agent may have a higher potential for recklessness or risk-taking because the agent has been insured. This happens because the burden of high risk and costs falls on the principal or insurer.

Mitigating Moral Hazard

Counteracting moral hazard entails strategies like aligning rewards to foster congruent interests and employing vetting mechanisms. Financial incentives geared towards the principal’s aims are also a valid approach. The second revolves around information-gathering to pre-emptively modulate potential risks by the agent, enabling more informed agreements.

In the insurance realm, mechanisms like policy discounts for cautious conduct and pre-contract medical or lifestyle checks serve to alleviate this hazard. These strategies aim to not only mitigate the adverse effects of skewed information but also cultivate market fairness and efficacy.

Signalling and Screening: Strategies to Reduce Asymmetric Information

In markets where one party knows significantly more than the other, certain strategies like signalling and screening can alleviate this asymmetry. These methodologies allow the lesser-informed party to amass additional information. As a result, they contribute to the creation of a more open and efficient marketplace.

Signaling Theory

Signalling theory elucidates how entities can signal detailed information to lessen information gaps. Through these strategic signals, more knowledgeable parties can reveal their true attributes, competencies, or objectives to their less-versed counterparts. As a result, such efforts differentiate them from deceitful or substandard entities, thereby refining market dynamics substantially.

In the context of employment, candidates often utilize educational credentials, professional experiences, or certifications to signal their qualifications and abilities to prospective employers. Similarly, companies convey the quality of their offerings through warranties, reputed brands, or industry acknowledgements.

Screening Mechanisms

Screening empowers the underprivileged party to acquire a nuanced understanding of the more informed entity. This turns the informational disadvantage on its head. Techniques such as background checks, credit assessments, or detailed interviews allow the less-knowledgeable entity to uncover the true nature of the party with superior information.

Within the insurance sector, providers may sift through applicants via detailed medical assessments or comprehensive personal data. This is aimed at evaluating the potential risks associated with offering insurance coverage. Similarly, financial institutions scrutinize loan applicants’ financial histories, incomes, and offered collaterals to ascertain their credit reliability.

Asymmetric Information in Financial Markets

Financial markets are acutely affected by asymmetric information. In these scenarios, one entity has substantially more critical information than the other. This imbalance culminates in what economists term the “lemon problem.” It underscores the difficulty consumers face in discerning superior financial products from inferior ones.

The Lemon Problem

George Akerlof articulated the lemon problem, spotlighting a quandary where buyers cannot precisely gauge a product’s quality pre-purchase. This dilemma is particularly manifest in financial markets. Here, investors might be incapable of meticulously estimating the genuine worth or peril of a financial asset, be it a stock or bond, because of informational deficits.

Asymmetric information’s adverse effects can exclude prime financial products from the marketplace. Unable to identify them over “lemons,” buyers can diminish the market’s product quality. Furthermore, such deterioration can precipitate a market failure.

In environments where pre-purchase product quality verification is arduous, such as used car markets or financial derivatives realms, the lemon problem flourishes. Encounters with asymmetric information foster scenarios of adverse selection. This tilts buyers towards selecting substandard products, deepening the quandary.

Efforts to counteract the lemon problem have seen the deployment of several strategies by financial overseers and stakeholders. These include bolstering disclosure norms, engaging third-party evaluators, and fostering more transparent trading venues. The core purpose of these actions is to assuage information asymmetry, therefore, reestablishing market confidence.

Information Asymmetry in Insurance Markets

In the complex arena of insurance markets, the concept of asymmetrical information is instrumental. This information gap significantly influences relationships between insurers and policyholders. It introduces challenges like adverse selection and moral hazard, compelling insurers to maintain their operational stability and relevance through complex strategies. These include detailed risk assessments and policy pricing.

Adverse selection manifests when those with a greater risk inclination are more predisposed to insure themselves, while lesser risk profiles might refrain. It occurs since policyholders possess more comprehensive knowledge of their risk than the insurers. This disparity often makes it tough for insurers to set accurate policy prices. Consequently, the insured group may be disproportionately filled with higher-risk individuals.

Conversely, moral hazard concerns policyholders participating in more perilous activities once insured. This misalignment can inflate the number of claims and costs for insurers. These higher costs can challenge the market’s profitability and its stability over time.

| Consequence | Description |

|---|---|

| Adverse Selection | Individuals with higher risk profiles are more likely to seek insurance coverage, leading to an imbalance in the insured pool. |

| Moral Hazard | Policyholders may engage in riskier behavior, leading to increased claims and higher costs for insurers. |

Insurers’ response to these adversities involves employing various tactics. They use sophisticated screening methods to glean in-depth information about policyholders’ risks. Additionally, they dangle incentives to sway policyholders towards safer conduct. However, the perpetual asymmetry of available information in these markets constitutes an enduring challenge for all concerned parties.

Role of Incentives in Addressing Asymmetric Information

Asymmetric information, frequently encountered in economic contexts, significantly impacts market efficiency. It can manifest in various forms, notably adverse selection and moral hazard. The strategic deployment of incentives, however, is pivotal in mitigating these challenges and harmonizing the interests of disparate parties.

Thoughtful incentive design empowers both individuals and entities to counter information asymmetry. In the domain of insurance, where policy buyers possess superior information on their risk levels, insurers can adopt signalling and screening methods. These mechanisms compel policyholders to reveal their true risks, leading to more precise policy pricing. Additionally, insurers can offer additional policy benefits for safe conduct and responsible behaviour. Consequently, the issue of adverse selection and moral hazard is curtailed, benefitting all participating entities.

The art of effective incentive design hinges on a meticulous calibration of truthful disclosure with risk-sharing fairness. Consideration of information asymmetry, surveillance capacities, and inadvertent consequences is paramount. Framing incentives that effectively tackle asymmetric information dilemmas demands careful deliberation from policymakers and industry experts.

This action not only enhances market efficiency but also fosters equitable dealings. The centrality of incentives in addressing the enduring issue of asymmetric information is thereby underscored across diverse economic landscapes.

Asymmetric information and Public Policy Implications

The notion of asymmetric information, characterized by unequal information distribution in a transaction, profoundly influences public policy making. Such issues necessitate regulatory attention to ensure market integrity within an asymmetrical informational environment.

To mitigate these challenges, governments frequently deploy information disclosure requirements. These regulations obligate companies and individuals to divulge specific details, promoting market equilibrium and enabling better consumer choices. By enforcing such mandates, policymakers aim to level informational discrepancies, thus fostering fair market interactions.

In financial markets, for instance, stringent rules demand thorough disclosure of financial data, including balance sheets and income statements. This information empowers investors to ascertain the credibility of investment options, alleviating concerns related to the “lemon problem.” Consequently, this transparency rectifies market inefficiencies, enhancing investor trust and market stability.

Moreover, regulatory measures are instrumental in mitigating information asymmetries. Through these, governments can stipulate quality benchmarks for products, guarantee warranties, or impose licensing criteria for certain trades. Such interventions are designed to bridge the information gap between consumers and providers, thereby averting potential market distortions and safeguarding consumer interests.

Yet, the application of regulatory frameworks is fraught with challenges, notably the risk of overregulation. Policymakers face the delicate task of avoiding excessive constraints, which could impede innovation and diminish market dynamism. Crafting effective policies necessitates a nuanced understanding of economic intricacies and the contextual nuances of asymmetric information, underscoring the complexity of regulatory endeavors.

Conclusion

Information imbalances can shape market function deeply. We’ve delved into its definition and the pivotal role it plays in economic theory. Understanding its significance in causing market failures, adverse selection, and moral hazard has offered us a comprehensive view.

Unveiling strategies like signaling and screening, alongside incentive mechanisms, sheds light on effective mitigation techniques. We’ve explored how these strategies can diminish the adverse effects of information asymmetry. Moreover, we’ve scrutinized its impacts on financial markets and the insurance sector, underscoring its pervasive nature.

The imperative for policymakers, businesses, and consumers to grasp asymmetric information cannot be overstated. This understanding lays the foundation for striving towards market efficiency and fairness. Such efforts stand to benefit our society at large. In the ever-evolving economic landscape, the insights from our exploration will remain invaluable, guiding decisions and strategies for a better future.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.