Comparative Advantage theory, attributed to David Ricardo, the English political economist of the early 19th century, provides deep insights into the benefits of specialization and trade among nations.

Comparative advantage underscores an economy’s capability to manufacture specific goods or services at a lower opportunity cost than its counterparts. It posits that through specialization, nations can enhance their overall welfare by trading products they excel at producing for those they are less efficient. Embedded in this theory is the recognition that nations possess diverse cost structures and opportunity costs, hence, by focusing on their comparative strengths, they can achieve maximum productivity. Ricardian analysis illustrated that mutual gains from trade persist, even when one nation has an absolute advantage in all production areas.

The concept of comparative advantage serves as a critical building block of international trade, advocating for nations to concentrate on goods and services in which they have a relative edge, and to partake in commerce that benefits all parties involved. This doctrine remains instrumental, encouraging economic synergy and the optimization of resources through trade, thus fostering global economic growth.

Econometrics Tutorials with Certificates

What is Comparative Advantage?

Comparative advantage refers to an economy’s prowess in manufacturing goods or services with minimal opportunity cost compared to its rivals. This concept underpins the rationale behind the mutual benefits garnered from trade among companies, countries, or individuals. Insights on comparative advantage illuminate the dynamic nature of international commerce and specialization, emphasizing that nations export products even when they have an absolute advantage over other nations.

- Comparative advantage is an economy’s ability to produce a particular good or service at a lower opportunity cost than its trading partners.

- By spotlighting opportunity cost, the theory of comparative advantage showcases the importance of efficient resource utilization. It accentuates the value of analyzing trade-offs in production decisions to maximize gains.

- It’s important to note that absolute advantage represents a country’s unequivocal capability (absolute advantage) to produce a specific good more efficiently than others. However, this is not necessary under the comparative advantage theory.

Understanding Comparative Advantage

At the core of comparative advantage lies a profound understanding of opportunity cost. This describes the benefit foregone when choosing one option over another. In essence, a company/country with comparative advantage sacrifices less by selecting a particular course of action, thus maintaining a superior position.

This paradigm considers the efficiency of resource usage within a given context. It illustrates how despite trade-offs, selecting the most beneficial option is essential. The concept of comparative advantage hails the virtue of choosing what serves best amidst options laden with advantages and disadvantages.

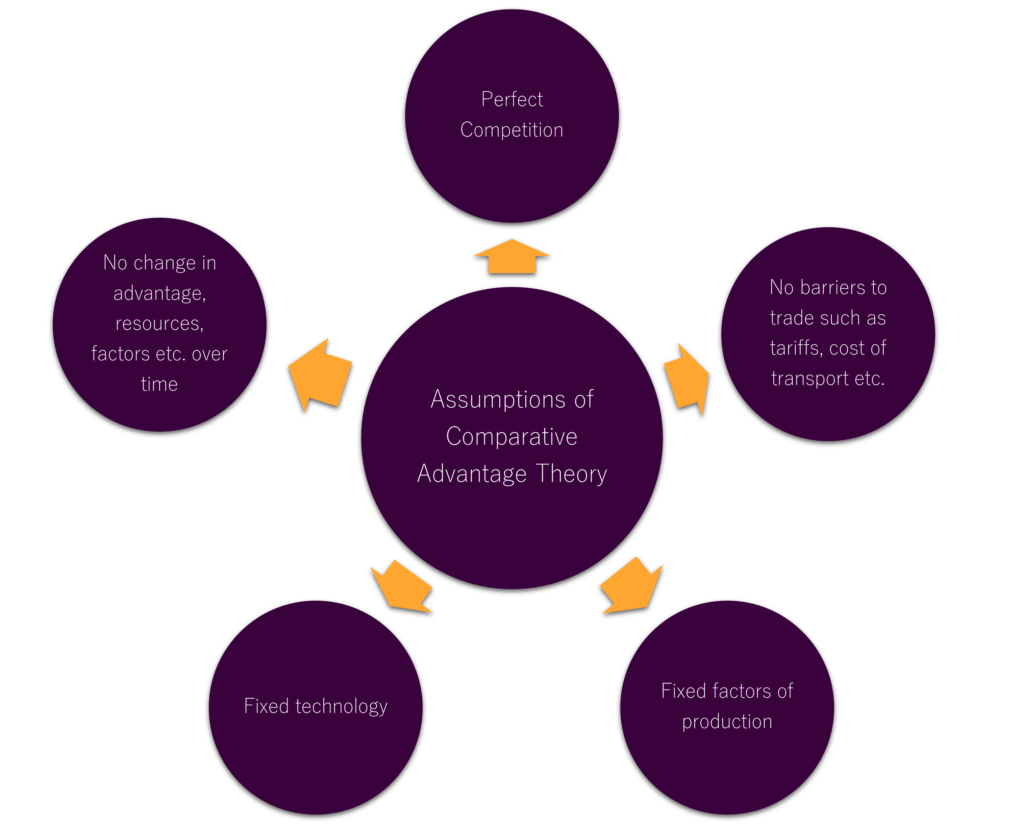

Assumptions of the Comparative Advantage Theory

The comparative advantage theory operates under several assumptions:

- Perfect competition is presumed in the markets of countries.

- The model assumes constant returns to scale, ensuring equilibrium in production efficiency between the nations.

- This theory disregards trade barriers, acknowledging the frictionless movement of goods.

- Factors of production remain fixed within nations.

- Identical production technologies and consumer tastes streamline the analysis to its essence.

Numerical Example of Comparative Advantage

Before Specialization and Trade

Let us consider an example of 2 countries (USA and UK) producing 2 goods (Cloth and Oil) and labour as the only factor of production for simplicity.

| Country | Cloth (Number of hours per unit) | Oil (Number of hours per unit) |

| USA | 100 | 50 |

| UK | 20 | 40 |

| Total Production | 2 | 2 |

In the table, we can see that the UK has an absolute advantage in the production of Cloth as well as Oil. This is because the UK can produce 1 unit of cloth in 20 hours as compared to 100 hours in the USA. Similarly, the UK can produce 1 unit of Oil in 40 hours as compared to 50 hours in the USA. The Theory of absolute advantage would say that a mutually beneficial trade is not possible in this scenario because the UK is more efficient in the production of both goods. However, comparative advantage says otherwise.

Opportunity Costs

| Country | Cloth (Opportunity Cost) | Oil (Opportunity Cost) |

| USA | 2 | 1/2 |

| UK | 1/2 | 2 |

For the USA, the opportunity cost of producing 1 unit of Cloth is 2 because the USA could have produced 2 units of Oil with 100 labour hours. That is, the USA foregoes 2 units of Oil by producing 1 Cloth. Similarly, it foregoes half a unit of Cloth by producing 1 unit of Oil with 50 labour hours, which is its opportunity cost of producing Oil.

Conversely, the UK foregoes half a unit of Oil by producing 1 unit of Cloth in 20 labour hours. This is the opportunity cost of producing Cloth with the given 20 labour hours. Moreover, the opportunity cost of Oil is 2 for the UK because it gives up 2 units of Cloth by producing Oil in 40 labour hours.

After Specialization

According to the Comparative Advantage theory, both the USA and the UK can still benefit from specialization and trade. This can happen if they specialize in a good with lower opportunity cost as compared to the other country. That is, the USA should specialize in Oil because its opportunity cost of producing Oil is lower than the UK. On the other hand, the UK should specialize in Cloth because its opportunity cost of producing Cloth is lower than that of the USA.

| Country | Cloth (Available labour hours) | Oil (Available labour hours) |

| USA | 0 | 50+100 |

| UK | 20+40 | 0 |

| Total Production | 3 | 3 |

When specializing in Cloth, the UK will now have 60 labour hours available for producing Cloth. This is because it will not produce Oil domestically which frees up an extra 40 hours of labour. In total 60 labour hours, the UK can produce 3 units of Cloth.

The USA now has 150 labour hours after specializing in Oil because it will not produce Cloth domestically, thus, giving it an extra 100 hours of labour. As a result, the USA can produce 3 units of Oil in a total of 150 labour hours.

Therefore, after specialization, the overall production has risen from 2+2 units to 3+3 units of Cloth and Oil. This happens because the countries are specializing in goods in which they have a lower opportunity cost as compared to the other countries. Even though the UK had an absolute advantage in both Cloth and Oil, the countries can still benefit from specialization as the overall production of goods has increased.

Gains from Trade

Furthermore, both countries can end up in a beneficial situation by trading with each other. For example, the UK can exchange 1 unit of Cloth for 1 unit of Oil from the USA. In that case, the UK will end up with 1 Oil same as before, but, it will now have 2 units of Cloth for domestic consumption.

Similarly, the USA will end up with the same amount of Cloth at 1 unit. However, it will now have more Oil for domestic consumption. That is, the USA will be left with 2 units of Oil after trade as compared to 1 unit before specialization and trade.

Hence, specialization and trade can be beneficial if countries have a comparative advantage. This applies even when one country has an absolute advantage in all goods.

Comparative Advantage vs Absolute Advantage

Comparative advantage differs from the absolute advantage in a nuanced manner. Absolute advantage characterizes the capacity to outpace others in the quantity or quality of goods and services. In contrast, comparative advantage denotes the efficiency in producing goods and services with a lower opportunity cost, not necessarily unmatched volume or quality.

Differentiating the Two Concepts

Consider an attorney juxtaposed against their secretary. The attorney surpasses the secretary in generating legal services, displaying expertise alongside advanced typing and organization skills. In this scenario, the attorney shines with an absolute advantage in both professional domains, legal services, and office tasks. According to the theory of Absolute Advantage, mutually beneficial trade cannot occur in this scenario.

However, it is in the arena of comparative advantage that the dynamics of trade reveal their intricate dance. Suppose the attorney yields $175 for legal services but only $25 for an hour spent on secretarial tasks. On the other hand, the secretary’s hourly output is $20 for office duties and $15 for legal services. Here, the pivotal nature of opportunity cost emerges.

For the attorney, allocating an hour to secretarial duties, intending to make $25, eradicates a potential $175 legal service revenue. This stark opportunity cost differential makes the attorney’s involvement in administrative tasks non-viable. The attorney should direct the efforts towards law practice, subcontracting secretarial work. Conversely, the secretary, facing the alternative of $20 hourly administrative work, finds the opportunity to assist the attorney in a typing and organizing capacity substantially more rewarding, given their lower inherent opportunity cost of $15.

Criticisms of Comparative Advantage

The theory of comparative advantage, paramount in explicating international trade benefits, has not been immune to critique over time. Similar to absolute advantage, it assumes fixed factors of production and static technology. Moreover, it does not consider transport costs and other barriers to trade such as tariffs or protectionist policies.

Among these critiques, the concept of rent-seeking behaviour stands out for its impact. Rent-seeking involves efforts by particular groups or individuals to influence governmental actions for the sole benefit of their interest, disregarding the overarching values of free trade and comparative advantage.

Rent-Seeking Behavior

For a tangible illustration, consider shoe producers of a country. They might grasp the theoretical underpinnings of free trade but face the undeniable threat posed by cheaper foreign shoes. Their hesitation to embrace alternative sectors, even those that might boost worker productivity, stems from their preference to maintain profitability and job security. This inclination drives them for exclusive privileges, such as special tax dispensations, to fortify their sector against international competition. This lobbying, characterized by rent-seeking, distorts the comparative advantage theory’s prognostications, impeding countries from fully reaping free trade’s benefits.

Rent-seeking critics further contend that such actions can bear adverse effects on a nation’s resources by prioritizing interest protection over enhancing productivity and efficiency. In doing so, the long-term economic benefits envisioned by the comparative advantage principle are significantly compromised.

Understanding Opportunity Cost

Grasping the significance of comparative advantage demands a fundamental exploration of opportunity cost. This essential concept defines the benefits sacrificed when opting for one alternative over another. To illustrate, consider a situation where a worker can dedicate an hour to making either 1 cloth or 2 oil. In this scenario, deliberation on the opportunity cost arises: What benefit is forfeited by electing to produce cloth or oil, respectively? Choosing to craft a cloth implicates a sacrifice of 2 potential units of oil. Conversely, selecting oil imposes a cost of yielding 1/2 of a cloth. Grasping the essence of opportunity cost underpins the comparative advantage principle.

Delving into microeconomic realms, the process of making decisions where resources are limited is crucial. Optimal selection hinges on the ability to compare available options. Here, opportunity cost unveils the essence of the most valuable foregone choice. Notably, understanding comparative advantage aids in the effective allocation of constrained resources.

The phenomenon of trade is intricately linked with the concept of specializing based on comparative advantage. Through such specialization, economic transactions are fostered. Consequently, leveraging comparative advantage optimally determines the resource allocation approach as we discussed in the numerical example earlier.

Conclusion

The theory of comparative advantage underpins international trade, unravelling why nations gain by specializing in goods where they hold an edge. It underscores that by honing their strengths and engaging in commerce, economies bolster their efficiency and output. This triggers trade benefits. Despite its bounds, this concept stands as a cornerstone for comprehending the merits of unfettered commerce and the key role of opportunity cost in economic actions.

Even if a nation dominates in the production of certain items, trading can still offer advantages as we discussed in the example. Despite the UK’s ability to produce cloth and oil more efficiently than the USA, they can still benefit from specialization and trade. This instance showcases how countries, through specializing and trading in their forte, elevate their value creation and enjoy collective advantages.

In the contemporary global scenario, the concept of comparative advantage holds critical importance. China, for example, has a comparative advantage in inexpensive labour, presenting a competitive edge over the U.S., which thrives in sophisticated capital-intensive labour. Acknowledging and leveraging these complementary capacities through commerce and specialization fosters heightened productivity and wealth across all participants.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.