Cost-push inflation, a phenomenon capable of raising prices by huge amounts, signifies a dramatic shift in economic dynamics. It manifests when the overall price levels elevate due to escalations in labour costs or the prices of essential raw materials. These price fluctuations can cause a reduction in the aggregate supply, the cumulative products and services available, even as the demand persists at its regular pace. Consequently, companies find themselves compelled to transfer these augmented expenses to the consumer, thereby setting off a cycle of inflation catalyzed by rising costs.

Comparatively, demand-pull inflation, spurred by greater consumer requests, stands in sharp distinction to cost-push inflation, which arises from shifts in the supply chain. Mastery of the origins and causes of this oftentimes overlooked yet substantial inflationary trend is indispensable for those tasked with overseeing financial decisions, shaping policy, or managing operational strategies during periods of economic strain.

Econometrics Tutorials with Certificates

What is Cost-Push Inflation?

Defining Cost-Push Inflation

Cost-push inflation emerges from increasing prices caused by elevated costs of wages, raw materials, and essential production inputs. Hence, it materializes as rising production expenses reduce the aggregate supply, with demand for products holding steady. Consequently, manufacturers transfer these escalated costs to consumers through elevated prices.

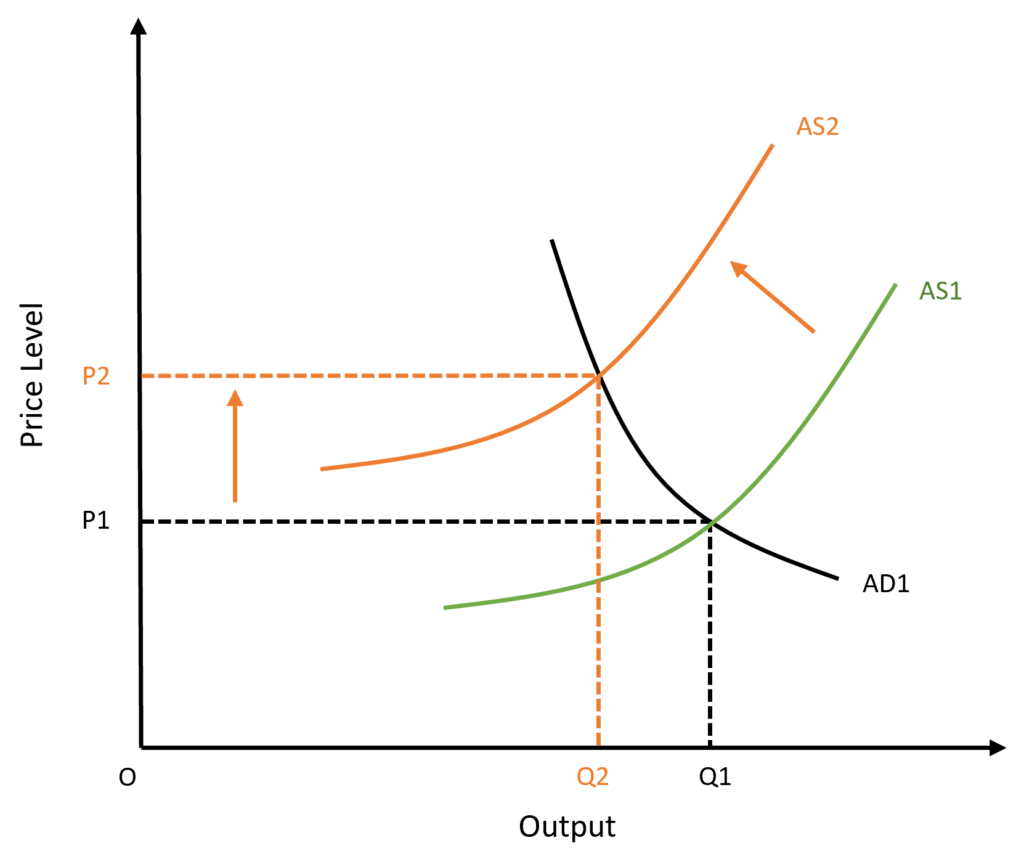

In the diagram, the aggregate supply curve shifts from AS1 to AS2. The reasons behind this shift can be supply shocks, shortage of raw materials, increased production costs, and many others. The Oil supply shock in the 1970s as a result of the OPEC Oil Embargo is a historical example of this phenomenon. Rising production costs put a strain on the output and profit margins of the producers and shift the supply curve to the left.

Due to the shift in supply, the price level increases from P1 to P2, illustrating the phenomenon of cost-push inflation. It is important to note that the aggregate demand or AD1 curve remains stable. If aggregate demand falls and AD1 also shifts to the left, then the price level will not increase. Therefore, the demand has to remain relatively stable for cost-push inflation.

Key Characteristics of Cost-Push Inflation

The principal aspects defining cost-push inflation include:

- It stems from mounting production costs such as labour wages, raw materials, and operational outlays

- This leads to constrained aggregate supply against unchanged demand levels

- Manufacturers adjust pricing to safeguard profit margins and cover elevated operating costs

- It stands in opposition to demand-pull inflation that originates from consumer demand escalation

Difference between Cost-Push and Demand-Pull Inflation

The contrasting element between these inflationary types is the root cause of the price surge:

- Cost-push inflation’s basis lies in mounting production expenditures, demanding price increments

- Whereas, demand-pull inflation emanates from consumer demand surpassing available supply, instigating price elevation

- Supply-side variations typically spark cost-push inflation, while demand-pull inflation initiates from shifts in consumer demands

Causes of Cost-Push Inflation

Cost-push inflation primarily arises from escalations in the costs of production inputs, encompassing raw materials, energy, and supplies. As the expenditure on goods and services production elevates, businesses frequently shift these augmented expenses to their clientele through price hikes.

Increase in Production Costs

Unexpected disturbances in the supply chain, stemming from occurrences like natural calamities or geopolitical upsets, derogate the availability of essential resources while increasing their procurement costs. Consequently, this amplifies the costs of manufacturing and fosters cost-push inflation through the subsequent price escalation by enterprises. The OPEC oil embargo in the 1970s and the post-earthquake supply chain impediments in Japan during 2011 serve as illustrative instances.

Wage Growth and Labor Costs

Rising labour expenditures, for instance, upswings in wages or compulsory benefits, significantly impact cost-push inflation. When employees procure increased remuneration—whether facilitated by group negotiations or legislated minimum salary escalations—firms might heighten their prices to counterbalance these amplified operational costs.

Supply Shocks and Natural Disasters

The primary antecedent of the present global inflation paradigm, which emerged in 2021, possesses its roots in the COVID-19 pandemic. In 2022, the inflationary pressures have been exacerbated by augmented labour requisites for enhanced compensation owing to the escalation in consumer outlays. This duality has precipitated classical cost-push inflation.

Government Regulations and Taxes

Government policies have the potential to significantly influence cost-push inflation via augmented regulations and tax measures. This occurs when governmental bodies introduce new policies or taxation schemes, such as environmental constraints or levies on select products. These fiscal burdens prompt companies to enhance their pricing to manage the surge in their operational outlays.

An illustration of this effect is evident in the 2008 upsurge in food prices due to the subsidization of ethanol production, a policy that sparked global food price increases. Furthermore, the adoption of regulations and levies, including those on tobacco and alcohol, can similarly catalyze inflation.

Exchange Rate Fluctuations, Import prices and Production Costs

Alterations in exchange rates play a crucial role in initiating cost-push inflation. If a nation’s currency loses value, the cost of securing raw materials, components, and finished products from abroad escalates. Consequently, the expenses of production for entities dependent on these overseas resources surge, forcing a price elevation to safeguard profit margins. Ultimately, this surge in import costs is transferred to end consumers, culminating in cost-push inflation.

This phenomenon underscores the crucial part played by imported inflation and exchange rates in moulding inflation patterns through both cost-push and demand-pull mechanisms.

A situation arises where the expenses of procuring foreign-made raw materials, components, and products elevate because of a frail domestic currency. Such a scenario escalates the production costs for entities utilizing these imported materials. To warrant their profit margins, these firms frequently shift the augmented costs to consumers in the guise of augmented prices, thereby instigating cost-push inflation.

How Cost-Push Inflation Works

In the context of cost-push inflation, escalating production costs, such as increased wages or raw material expenditure, instigate a shift in the aggregate supply curve to the left. This rescaling diminishes the overall capacity for producing goods and services at every price tier. Concurrently, an unaltered demand prompts firms to elevate their pricing strategies to counterbalance the augmented expenditure and safeguard profit figures. Consequently, consumers are compelled to pay elevated prices for commodities concomitantly, invoking cost-push inflation.

Conditions Required for Cost-Push Inflation

The emergence of cost-push inflation necessitates the fulfilment of specific prerequisites:

- Elevation in production costs, whether attributable to augmented wages, raw material expenses, or other pertinent input expenditures, must transpire.

- The demand for the items and amenities affected must remain comparatively stable, or inelastic, signifying the consumer willingness to embrace the revised, higher values.

- Entities must possess the capability to transfer the augmented costs onto consumers via price alterations, as opposed to assimilating these elevated outlays.

Examples of Cost-Push Inflation

OPEC Oil Embargo in the 1970s

The OPEC oil embargo in the 1970s stands as a paradigm of cost-push inflation. In 1973, OPEC initiated an oil export embargo. Consequently, oil prices surged from $3 to as high as $12 per barrel. This exponential increase in oil costs led to elevated prices of gasoline and upped the operational expenses for businesses reliant on oil-derived products. The inelasticity of oil demand empowered companies to transfer their augmented expenditure to customers, thus engendering widespread inflationary pressures.

Post-OPEC’s supply restriction, the ubiquitous petrol price hikes ensued. Businesses met with soaring costs for oil-dependent technologies, mirroring the broader trend of cost-push inflation.

Ethanol Production and Food Prices in 2008

The divergence in agricultural focus, courtesy of the US government’s ethanol incentives, incited a corn shortage for human consumption, fostering elevated corn prices. This food market disruption was further compounded by the static need for essential food items. The confluence of these factors significantly escalated food prices worldwide.

In 2008, governmental directives favouring ethanol production triggered a shift in agricultural priorities away from food crops. The exponential appeal of corn for ethanol synthesis led to a dearth of available corn for sustenance, therefore, increasing its market price. With the demand for staple food items inelastic, the adverse effects of this supply-side anomaly reverberated globally, magnifying the cost-push inflation in food prices.

Inflation and Pricing Power

Industries with monopolistic or oligopolistic entities are prone to cost-push inflation. This scenario emerges due to the significant pricing power concentrated in the hands of a few. Such entities can, therefore, raise their prices to counter higher costs, passing them on to consumers. A compelling instance is the OPEC cartel’s capability to induce cost-push inflation by regulating the global oil supply.

Inelastic Demand and Pricing Power

In environments characterized by inelastic consumer demand, like the markets for gasoline, healthcare, and housing, cost-push inflation is more common. Entities in these markets also possess the power to raise their prices. Despite doing so, they witness a minimal reduction in sales volume. Hence, this dynamic equips them to transfer increased production costs effectively to consumers.

Impact on Investments and Savings

Cost-push inflation significantly affects investments and savings. Rising consumer prices depreciate the value of money, hindering effective saving and investing. For instance, if an investment yields 4% but inflation reaches 5%, the net real return is -1%. Subsequently, this diminishes the investment’s actual worth. Therefore, investors must target returns that exceed inflation, ensuring their money maintains or increases its purchasing power over time.

Inflation and Stock Prices

The relationship between cost-push inflation and stock valuations is intricate. As production expenses elevate, companies may find sustaining profit margins challenging, leading to a decline in stock worth. Furthermore, the impacts of inflation vary; low levels might signify economic growth, while excessive rates could be detrimental. In response, investors are urged to adapt their portfolio holdings, focusing on inflation-resilient assets to mitigate the effects of cost-push inflation.

Conclusion

Cost-push inflation fundamentally alters the economic landscape through escalating production costs, including wages, materials, and operational charges. Such inflationary pressures inevitably reduce the capacity for aggregate supply, causing businesses to elevate prices to safeguard their profitability. It diverges significantly from demand-pull inflation, fueled by mounting consumer desires.

The discernment of cost-push inflation’s roots and features is indispensable for both investors and policymakers alike, necessitating the crafting of strategic responses to dampen its deleterious effects on fiscal environments and individual prosperity. Deployment of supply-oriented approaches, alongside contractionary economic measures, and the vigilance over critical benchmarks such as the CPI, offers a cohesive strategy to contend with this economic challenge.

Vigilance regarding the perturbations of cost-push inflation empowers stakeholders to proactively shield their financial assets and reserves, fostering a more resilient monetary stance against the backdrop of augmented production costs and consumer pricing repercussions.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.