In India, since 2003, the Fiscal Responsibility and Budget Management (FRBM Act) has served as a cornerstone for introducing financial accountability and supervising the nation’s public expenditure. However, the authoritative trajectory has not been devoid of complexities, with the government facing difficulties in adhering to its formidable objectives throughout various periods.

The fundamental aim behind the inception of the FRBM Act was to eradicate India’s revenue shortage and curtail the fiscal deficiency to a viable 3% of the Gross Domestic Product (GDP) by the conclusion of March 2008. Nonetheless, the global financial meltdown of 2007 led to a shift in these deadlines and eventually, their nullification in 2009. The fiscal deficit target for the coming three years was missing in the Union Budget 2021-22, as the government opted to modify the Act to facilitate a larger fiscal deficit of 6.8% of the GDP. Notwithstanding these exigencies, an interim goal has been declared by the government to pare down the fiscal deficit to 4.5% of the GDP by the financial year 2025-26.

The FRBM Act has embarked on a comprehensive journey, characterized by achievements as well as deficits. In light of contending with the economic ramifications of the COVID-19 pandemic, this pivotal statute is poised to significantly influence fiscal responsibility, strategies and obligation management for the foreseeable future.

Econometrics Tutorials with Certificates

Introduction to the FRBM Act

In the year 2000, the Atal Bihari Vajpayee Government of India unveiled the Fiscal Responsibility and Budget Management (FRBM) Bill. It aimed to provide a legal framework for the country’s fiscal discipline efforts. This marked a significant step towards solidifying economic practices within the nation. The official enactment of the FRBM Act swiftly followed in 2003, ushering in specific guidelines for fiscal responsibility.

Background and Rationale

The FRBM Act emerged with clear goals. It sought to establish open and accountable fiscal systems. In doing so, it aimed to ensure a fair and sustainable sharing of the nation’s financial burdens over the years. The Act also aspired to pave the way for enduring fiscal stability within India. Additionally, it aimed to grant the Reserve Bank of India the flexibility needed to effectively combat inflation.

Objectives of the FRBM Act

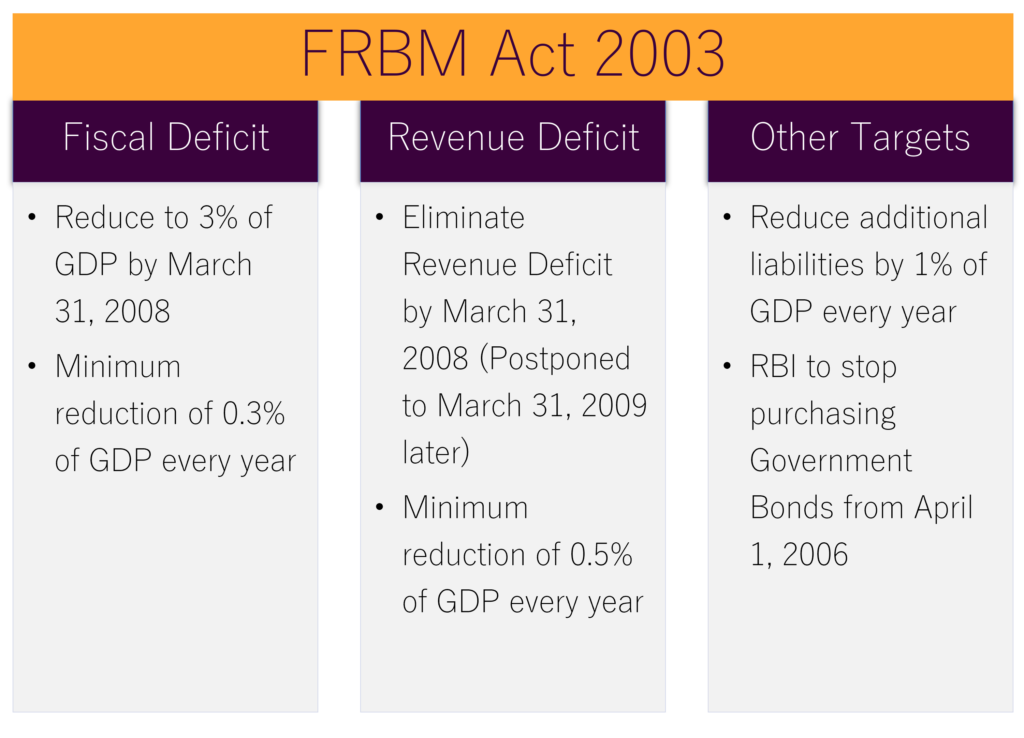

Key objective of the FRBM Act was to limit the fiscal deficit to 3% of India’s GDP by March 2008. It envisioned the complete eradication of the revenue deficit by the same year. Furthermore, this legislative framework aimed to decrease the nation’s annual fiscal deficit.

The Act also outlined specific criteria for the medium-term fiscal policy statement. This included benchmarks for revenue deficit, fiscal deficit, tax revenue, and overall liabilities as a share of the GDP.

Key Provisions of the FRBM Act

Fiscal Management Principles of the FRBM Act

The FRBM Act mandated that the government must yearly present critical fiscal documents alongside the Union Budget. This includes the Medium-term Fiscal Policy Statement, Fiscal Policy Strategy Statement, and Macroeconomic Framework Statement.

Moreover, the Act outlined restraints on government borrowing from the Reserve Bank of India. It further aimed to enhance fiscal transparency in the formulation of government financial plans.

Borrowing Limits and Restrictions

The primary goal of the FRBM Act was to usher in transparent fiscal management systems. This was to ensure a fair distribution and sustainable management of the nation’s debts, striving for fiscal resilience over the long term.

Transparency and Reporting Requirements

It was also required to outline projections for specific fiscal metrics. These include revenue deficit, fiscal deficit, tax revenue, and outstanding liabilities, all in relation to the country’s GDP within the medium-term fiscal policy statement. Additionally, it aimed to allow the Reserve Bank of India the flexibility needed to address inflation within the country effectively.

FRBM Act: Fiscal Targets and Indicators

Following the implementation of the FRBM Act, the central government concurred on several fiscal benchmarks and measures. The agenda aimed at wiping out the revenue deficit by March 2009 (originally set for March 2008). It targeted a fiscal deficit limit of 3% of GDP by March 2008. Additionally, the Act called for a yearly decrease of 1% of GDP in added liabilities, which encompassed external debt.

Revenue Deficit Elimination

The FRBM Act necessitated that the fiscal parameters, including the revenue deficit as a GDP proportion, be outlined in the medium-term fiscal policy statement. The initial mission was to erase the revenue deficit by March 31, 2009, with no less than 0.5% of GDP trimmed each year. Nevertheless, owing to the 2007 global finance calamity, the FRBM Act’s timeframes were pushed back and later dropped in 2009.

Fiscal Deficit Reduction

The FRBM Act set a goal to curtail the fiscal deficit to 3% of GDP by March 31, 2008. It required a 0.3% of GDP annual diminish to hit this fiscal deficit mark. Further revisions to the legislation prolonged the deadline for the 3% fiscal deficit objective to March 31, 2015, and subsequently to March 31, 2018.

Additional Liabilities and Debt Management

The FRBM Act directed the central government to constrain the issuance of guarantees to a maximum of 0.5% of GDP from the fiscal year 2004-05 forward. It was designed to usher in clear fiscal management protocols and a fairer burden-sharing of debts over time. Furthermore, it compelled the government to draft steps that enhance fiscal openness and curb the practice of keeping financial documents under wraps.

Implementation Challenges and Revisions

Despite the commendable aspirations of the FRBM Act, established to hold the Center’s annual fiscal deficit ratio (FDR) at 3% of the gross domestic product (GDP), and its mandate for states to enact parallel FRBM Acts to restrict their fiscal deficits to 3% of their GDP, the Government of India has found itself grappling to attain these established goals. The eruption of the 2007 global financial crisis played a huge role in this. It precipitated the deferral and later the abandonment of the Act’s enforcement deadlines in 2009.

Recent times have witnessed the government introducing adjustments to the FRBM Act. This is to allow for augmented fiscal deficits, as evident in the most recent Union Budget 2021. This budget targeted a fiscal deficit of 6.8% of GDP for the fiscal year 2021-22, a notable decrease from the 9.5% observed in the preceding year. Aiming to reduce its fiscal deficit to 4.5% by 2025-26, the government followed a roadmap leading to this directive.

Impact of Global Financial Crisis

The reverberations of the 2007 global financial crisis significantly impeded the FRBM Act’s execution. Originally earmarked for 2007-08, the timeframe to achieve the 3% target has undergone several extensions since. This legislative implementation was halted four times after its 2003 inception as economic conditions thwarted the government’s efforts to adhere to the fiscal constraints stipulated by the Act.

Amendments and Relaxations on the FRBM Act

In the recent past, the Indian government has instated numerous amendments and relaxations in the FRBM Act. These amendments chiefly allow for an enlarged fiscal deficit. The Act’s Exemptions/Escape Clause affords a 0.5 percentage point leeway in exceptional circumstances such as war or massive natural disasters. Moreover, amendments to the FRBM Act were introduced after the Global Financial Crisis and in response to domestic economic deceleration, effectively postponing fiscal targets.

Critiques surrounding the FRBM Act portray it as deficient in elements that would incentivize the attainment of its fiscal targets. The act has come under scrutiny for including vaguely defined fiscal deficit escape clauses and inadequately addressing the repercussions of missed fiscal targets, hence limiting accountability.

The FRBM Act and Monetary Policy

The FRBM Act aimed to empower the Reserve Bank of India (RBI) in its quest to manage inflation. By strictly forbidding the Central Government from borrowing from the RBI, with rare exceptions, it offered the RBI much-needed freedom to execute monetary policy with efficiency. Furthermore, the FRBM Act strived to harmonize fiscal and monetary strategies, crucial for the nation’s overall economic health.

Enabling Effective Monetary Policy

The FRBM Act played a vital role in ensuring the RBI had the autonomy and tools required to combat inflation. Its limitations on government borrowing from the RBI supported the alignment of fiscal and monetary actions. It is essential for maintaining price stability and nurturing economic advancement.

Coordinating Fiscal and Monetary Policies

Its core intention was to facilitate a closer synergy between the fiscal stances of the government and the monetary actions of the RBI. This alignment, set by the FRBM Act, aimed at bolstering macroeconomic stability and overall economic governance. Additionally, it endowed the RBI with manoeuvrability to address inflation in India effectively.

FRBM Act: Evaluation and Criticism

The Fiscal Responsibility and Budget Management (FRBM) Act sought to instil fiscal discipline but has sparked considerable discourse regarding its efficacy. It laid down a target for the Centre’s fiscal deficit ratio at 3% of GDP, necessitating the adoption of similar standards by states for their domestic products. Nonetheless, the Act has grappled with achieving its intended outcomes, necessitating frequent amendments and adjustments over time.

Successes and Shortcomings of the FRBM Act

The FRBM Act garners accolades for its promotion of greater fiscal clarity and oversight. It bars direct government loans from the Reserve Bank of India, safeguarding the independence of monetary policy, and prohibits the RBI from purchasing primary Central Government securities since 2006, thereby forestalling the monetization of deficits. Yet, the Act encounters rebuke for its inclusion of loosely defined fiscal deficit exemption clauses and its deficiency in enforcing accountability for unmet benchmarks.

As of 2021-22, the goal for the fiscal deficit is narrowly set at 6.8% of GDP, down from 9.5% the previous fiscal year and 4.6% prior. The government eyes shrinking this deficit to 4.5% of GDP by the fiscal year 2025-26. Nevertheless, these objectives have undergone several alterations, underscoring the persistent trials in adhering to the FRBM Act.

Debate on Social Expenditure Impact

A central issue surrounding the FRBM Act is its effect on social spending. It has drawn criticism for potentially mandating reductions in vital social outlays, yet proponents argue its role in aiding overall economic stability through controlled inflation. The Act’s challenges in meeting stated aims have precipitated numerous modifications, also necessitating the relaxation of its constraints over time.

In the domain of social welfare, allocations for women’s welfare decreased by 26% in 2021-22, contrasting with a notable increase of 52.7% and 50% for SC and ST welfare, respectively, within the same period. Moreover, there was a marked 32.7% rise in funds earmarked for the North Eastern region in 2021-22. These disparities spotlight the ongoing dialogue surrounding the FRBM Act’s influence on governmental priorities and financial allocations.

Committees and Recommendations

N.K. Singh Committee on FRBM Act

In 2016, a significant governmental initiative emerged, constituting the N.K. Singh Committee. The committee’s sole purpose was to meticulously assess the efficacy of the FRBM Act and, if deemed essential, formulate recommendations for its improvement.

Subsequently, the committee’s narrative entailed a stipulated fiscal deficit reduction, setting targets at 2.8% for the fiscal year 2020-21 and a further reduction to 2.5% by 2023. These fiscal endeavors were to be bolstered by the establishment of an autonomous Fiscal Council. This council envisaged as an independent advisory body, would be tasked with providing sagacious counsel on fiscal policy matters.

The committee’s far-reaching directives plunged further into the fiscal landscape, proposing a cap on the national Debt to GDP ratio. A nuanced dichotomy was outlined for the central and state governmental bodies. It directed a threshold of 40% for the central government, while advocating a more lenient ceiling of 20% for the various states, all to be actualized by the year 2023. In recognition of the unpredictable exigencies that governments often confront, an allowance was granted for deviations from the aforementioned fiscal targets. Under designated circumstances such as exigencies in national security, war, natural disasters, economic reforms, or a substantial dip in economic growth, a window was provided, permitting fiscal variances up to 0.5% of the GDP.

However, in acknowledgement of the tumultuous volatilities that often besiege governmental agendas, the committee allows for considerable latitude. They permit divergence from preset fiscal benchmarks upon the solemn advice of the Fiscal Council. This allowance caters to crises of national proportions, such as those concerning security, war, natural calamities, far-reaching economic reforms, or precipitous economic downturns, ensuring a pragmatic flexibility within the ambit of fiscal governance.

FRBM Act in Recent Years

In the Union Budget 2021-22, specific targets for the upcoming three years were noticeably absent. This exclusion from the budget signifies a significant departure from traditional practices. The prior fiscal deficit, as a portion of the GDP, was targeted at 6.8% for the fiscal year 2021-22. This figure indicates a sharp decrease from the 9.5% recorded in the previous year and a subsequent fall from the 4.6% in 2019-20. These changes highlight a massive modification in fiscal strategy driven by external events. During the Budget address for 2021, the Finance Minister declared the ambitious goal of shrinking the fiscal deficit to a mere 4.5% of the GDP by the fiscal year 2025-26.

Targets and Projections

The FRBM Act’s recent years underscore ongoing challenges faced by the government in adhering to fiscal deficit objectives. Originally aiming for a deficit of 3.4% of GDP in 2019-20, the Act necessitated further reduction to 3% by the conclusion of March 31, 2021. However, the unforeseen economic impacts of the COVID-19 pandemic necessitated a strategic reevaluation. Consequently, the fiscal deficit target for the fiscal year 2021-22 was set at 6.8% of the GDP. The FRBM Act’s stipulations have thus been significantly adjusted in response to these extraordinary circumstances.

The government, in accordance with the FRBM Act projections, has articulated its objective to curtail the fiscal deficit to 4.5% of the GDP by the fiscal year 2025-26. This undertaking signals a calculated effort to lower deficit levels from recent highs, all while ensuring continued economic support through a delicate balance of fiscal consolidation and stimulus measures.

Union Budget Implications

The Union Budget FRBM Act nexus is clearly visible in the government’s fiscal management strategy. For the fiscal year 2021-22, the proposed total expenditure was vast, totalling Rs 34,83,236 crore. The magnanimity of the spending plan indicates the government’s stalwart commitment to propelling economic rebound through strategic investments and high budgetary allocations. However, this adherence to expansive spending has concurrently raised the fiscal deficit target, thereby necessitating amendments to the existing FRBM Act.

The Budget announcement for the year 2021 showcases a notable reallocation of funds. Specifically, significant increments were marked in the allocations for essential projects. For instance, the Jal Jeevan Mission witnessed a monumental 123% boost in funding, underscoring the government’s dedication to key initiatives.

Additionally, emphasis on the welfare of Scheduled Castes (SCs) and Scheduled Tribes (STs) was palpable, with an exceptional 52.7% and 50% rise in budget allocations, respectively, affirming the government’s commitment to inclusivity and equitable growth. A substantial increase of 32.7% in funding for the North Eastern region mirrors similar values of development across the nation. Concurrently, a juxtaposed 26% reduction in the allocation for the welfare of women, compared to the 2020-21 revised estimates, underlines potential areas of concern warrant further assessment.

Conclusion

The Fiscal Responsibility and Budget Management Act, of 2003, aimed to establish a culture of financial restraint while mitigating fiscal deficits and enhancing fiscal caution within India. It has seen various amendments and practical challenges since its inception. Despite these, it serves as a key directive for the oversight of the nation’s financial operations, ensuring macroeconomic equilibrium. With the COVID-19 crisis posing significant fiscal hurdles, the FRBM Act’s guiding role in setting fiscal and debt policies for the future is indispensable.

The FRBM Act, upon enactment, delineated objectives for fiscal deficit margins, revenue shortfalls, and overall debt, striving for improved fiscal practices and budget handling. Tackling these stipulations has proven arduous for the government, necessitating alterations and relaxations of the Act’s mandates. Nonetheless, the legislation stands as an essential mechanism for maintaining fiscal rectitude and fostering enduring economic equilibrium in the Indian context.

As the government endeavours to amend the FRBM Act, taking into account escalated fiscal pressures due to the pandemic, it’s paramount to preserve the Act’s central tenets of fiscal integrity and budget regulations. The Act’s influence on aligning fiscal and monetary strategies, coupled with its effects on social spending, will remain under thorough review and discourse moving forward. Despite the ongoing discussions, the FRBM Act holds a critical place in India’s fiscal policy architecture, influencing the nation’s economic course in the era post the pandemic.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.