Fiscal policy involves the strategic manipulation of governmental expenditures and tax structures to alter economic trajectories. In essence, governments use several instruments of fiscal policy to achieve varied goals and objectives including macroeconomic stability and full employment.

Primarily shaped by the ideas of John Maynard Keynes during the early 20th century, fiscal policy aims to counteract market failures. Keynes advocated for governmental intervention to correct economic imbalances. In the U.S., President Franklin D. Roosevelt famously utilized this strategy during the Great Depression. His New Deal policies heavily focused on public works projects and the inception of social welfare programs.

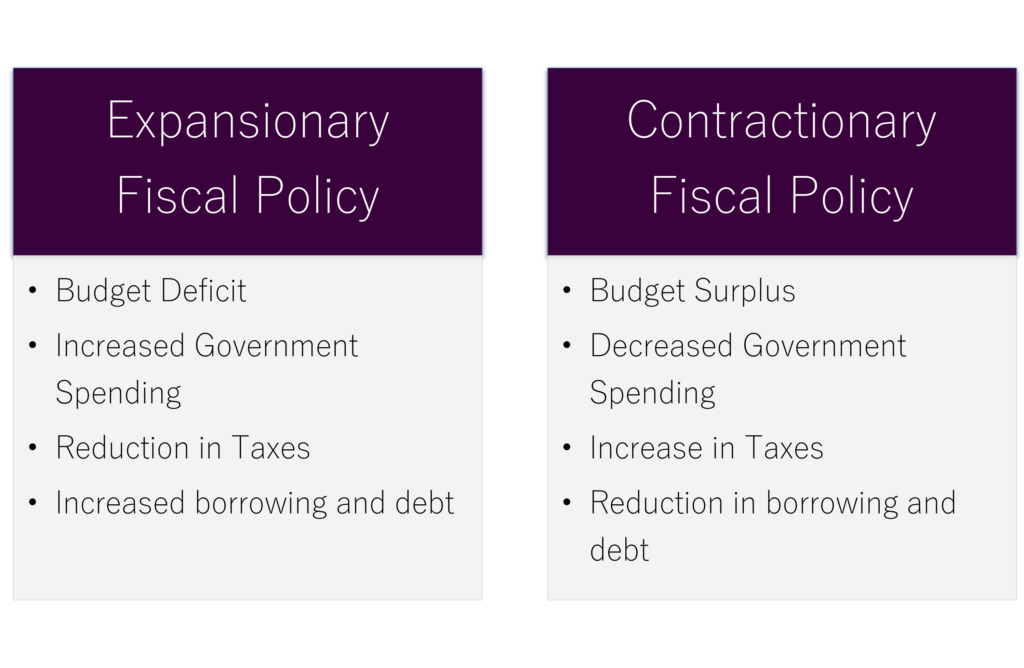

In present times, the nations deploy tax adjustments and expenditure shifts as principal fiscal instruments. These measures, known as expansionary and contractionary fiscal policy, are employed in varying economic scenarios. For instance, during economic downtrends, tax cuts and increased government outlays are utilized to spur demand. Conversely, in periods of inflation, tax hikes and austerity measures are enacted to curtail spending. The dynamics of these policies directly influence employment rates, inflation levels, and overall economic progression.

In India, for example, the fiscal policy strategy revolves around Public Debt, Government Expenditures, and Revenues. Since 2003, the matter has been under the stewardship of the Indian Ministry of Finance. Its core goals are to attain stable prices, maximal employment, and sustainable economic expansion.

Econometrics Tutorials with Certificates

What Is Fiscal Policy?

Fiscal policy delineates the strategic use of governmental expenditures and taxation to mould economic dynamics, notably macroeconomic phenomena such as aggregate demand, employment, inflation, and growth. In a recessionary phase, tax reductions or increased government spending are potential tactics to invigorate demand and boost economic endeavours.

Conversely, in scenarios of excessive inflation, policies might incline towards tax hikes or spending curtailments to temper economic activity. This approach stands in opposition to monetary policy, vested within the discretion of central bankers as opposed to elected representatives.

Definition and Key Takeaways

In its essence, fiscal policy echoes the principles of John Maynard Keynes, a luminary economist from Britain (1883-1946). Keynes postulated that recessions emanated from a lack of consumer and business expenditures within the total demand. His proposition advocated for governmental intervention, tweaking fiscal strategies to balance the ebbs and flows of private sector engagement, thus smoothing the economic rhythm.

His intellectual framework emerged as a response to the seemingly uncorrected trajectory of the Great Depression, challenging established economic thought. These insights fostered significant policy action in the U.S., notably the New Deal era marked by substantial investments in public infrastructure and social welfare initiatives.

Understanding Fiscal Policy

Within the Keynesian theory, aggregate demand propels economic performance and expansion. It comprises consumer expenditure, corporate investments, government disbursements, and the international trade balance. Keynes argued that the private sector’s inherent volatility and susceptibility to psychological elements hinder persistent economic advancement, potentially leading to downturns. He contended that governmental fiscal manoeuvres could scientifically address these fluctuations, aiming for a steadier economic course.

Adjustments in the fiscal landscape are indispensable; augmented government spending or reduced taxes when consumption wanes, to bolster aggregate demand, exemplifies one strategy. Conversely, if exuberant private spending surfaces leading to inflation, a strategy of tax increase or reduced government outlays to moderate demand might be adopted.

Corrective Government Fiscal Action

For deficit in spending, remedial action includes fiscal augmentation or tax abatement to boost overall demand. Inversely, in case of exorbitant private euphoria leading to inflationary pressures, policies pivot towards fiscal moderation to rein in demand. The overarching strategy is to judiciously manage fiscal variations, ensuring budget deficits during downturns and surpluses in economic peaks.

Instruments of Fiscal Policy

The governments generally adjust tax rates and government spending as their primary fiscal policy tools to steer the economy. To boost economic activity, it diminishes taxes and pumps up spending. This approach often involves the government taking on debt through issuing government bonds. Conversely, in an effort to curb an overactive economy, the government might hike taxes and reduce its expenditures. Fiscal policy tools serve as mechanisms for governments to manage the economy. They do this mainly by tweaking taxation and spending levels.

| Fiscal Policy Tools | Description |

|---|---|

| Government Spending | It encompasses subsidies, transfer payments, public projects, and state workers’ salaries. Rampant government spending directly boosts economic pursuits. |

| Taxation | Changing tax rates has pronounced effects on both consumer and business outlays. Lessening taxes increases disposable income while heightening them serves to moderate an excessively active economy. |

| Public Borrowing | Through bonds and similar financial tools, the government can cover spending deficits and enact policies of expansion. |

Budget and its Role in Fiscal Policy

Fiscal policy entails the management of a government’s financial affairs, focusing on income and spending. In the United States, for example, this involves the interplay of public debt, government expenditures, and revenues.

Revenue is derived from national taxes, interest, and investments. Government expenditure is characterized by two distinct categories: revenue expenditures and capital outlays. The former addresses routine operational functions, while the latter sustains long-term investments in infrastructure and assets.

| Fiscal Policy Instrument | Description |

|---|---|

| Public Debt | It’s how the government finances deficits, resorting to instruments like bonds and savings schemes. |

| Government Expenditures | This category spans subsidies, welfare, public constructions, and administrative salaries. It’s crucial for societal and economic support. |

| Government Revenues | Comprises taxes, interest, and various fees collected by the government. These form the financial backbone of public services and investment. |

The U.S. faced a $1.38 trillion federal budget deficit in 2022. This deficit emerged despite total revenues of $4.9 trillion against expenditures of $6.27 trillion. The impact of fiscal decisions, including taxation and spending adjustments, reverberates across budget variances, public revenue distribution, and spending priorities.

Government Spending

Government spending represents a pivotal facet of fiscal policy, encompassing subsidies, transfer payments like welfare systems, execution of public works, and remuneration for public servants. By modulating its expenditure, a government wields the power to significantly impact economic activities.

This influence is prominent when increased spending catalyzes demand, thereby bolstering production and job opportunities. This fiscal strategy, known as expansionary fiscal policy, orchestrates an increase in economic output by boosting overall demand through elevated government expenditures. Such a method is frequently employed during economic downturns to revitalize financial health. Conversely, contractionary fiscal policy involves reducing government expenditure to reign in demand. Therefore, this approach is often utilized to curb inflationary pressures in the economy.

In 2022, the budgetary allocation of the US federal government has been set at an impressive $6.27 trillion. The efficacy of fiscal policy hinges on maintaining a precarious equilibrium between government disbursements and the imposition of taxes to stave off inflation or economic lethargy. Policymakers grapple with ascertaining the optimal level of government intervention necessary for upholding economic prosperity, reflecting the intricacies inherent in fiscal governance.

Taxation

The government wields significant influence over economic activity through its tax policies. Decreasing taxes can enhance disposable income for both individuals and companies. This surplus income fuels spending and investment, hence propelling economic expansion. Notably, taxation plays a paramount role in altering disposable income, outlays on consumption, and capital investments. A tax decrease empowers individuals by augmenting their disposable income, thus encouraging both spending and investment decisions.

However, the impact on investment from reduced corporate and personal tax rates is not conclusive. In contrast, a tax increase might temper an overheated economy by limiting disposable income. Taxation stands as a linchpin of fiscal policies used by governments for economic regulation. Alterations in tax rates and strategies can wield substantial influence on demand, employment, inflation, and other macro-level economic factors.

Hence, an expansionary fiscal policy entails a reduction in taxes to boost disposable income and demand in the economy. On the other hand, contractionary fiscal policy employs increased taxation in order to curtail prevailing high demand in the economy.

Public Debt and Borrowing

Public borrowing is the mechanism through which governments fund expenses surpassing their tax revenue amounts. The United States’ national debt stood at $34.64 trillion on June 3, 2024, reflecting a national debt-to-GDP ratio of 121.62% by the fourth quarter of 2023.

Countries obtain funds, either domestically or internationally, utilizing financial instruments like bonds and similar tools. It serves as a fundamental approach to supporting public services, building infrastructure, financing welfare initiatives, and steering the nation’s financial strategies. Deficit spending, characterized by the outflow of government funds exceeding their income, is a consequential part of an expansionary fiscal policy supported by public borrowing.

Federal expenditures in the United States accounted for 22.8% of its GDP in 2023. Notably, the largest allocations were for Social Security (22%), Health (14%), Net Interest (13%), and National Defense and Medicare (both 12%). In that year, America’s defence outlays exceeded the combined military spending of the subsequent top worldwide contributors. Furthermore, projections indicate a threefold rise in government interest expenses by 2032, topping $1.2 trillion per year. The Congressional Budget Office (CBO) forecasts that over the coming decade, interest payments on the federal debt may amount to $12.4 trillion, translating to daily expenditures of $2.4 billion for the U.S.

While borrowing and debt can be a powerful tool for financing government initiatives, it is essential to consider the ramifications of excessive debt.

Instruments of Fiscal Policy under expansionary and Contractionary Policies

Expansionary Fiscal Policy

Expansionary fiscal policy is enacted by the government to bolster economic growth through increased spending or tax reductions. Such measures are prevalent during times of economic downturn or in the face of sluggish growth. Their primary aim is to invigorate job creation, spur investments, and escalate consumer spending.

The strategy hinges on the notion that a diminution in taxes or a surge in government expenditures injects more capital into the marketplace, thus stimulating demand. The ensuing outcome is a virtuous cycle wherein companies expand their workforce, wages see an upswing, and consumers find themselves with augmented purchasing power.

Contractionary Fiscal Policy

In stark contrast, contractionary fiscal policy is employed when the economy shows signs of overheating, often manifested through inflationary trends. Its implementation involves a step-up in tax rates or a slash in governmental spending. The resultant effect, a hope, is to steer the economy towards stability and away from inflation. By curtailing the disposable income of both individuals and enterprises, the policy aims to mitigate demand and pressure on prices.

Unlike its expansionary counterpart, this strategy is seldom adopted due to its negative ramifications on growth and employment. Nevertheless, its selective employment is deemed crucial, helping to avert economic bubbles and maintain financial equilibrium.

Neutral Fiscal Policy

Neutral fiscal policy denotes a governmental budget designed to neither impede nor stimulate growth. It achieves this equipoise through a meticulous balancing of government expenditure and tax levies, ensuring a budget that is well-rounded. The intent is to preserve the economic harmony without perturbing the existing balance.

This policy is typically pursued when the economy is at equilibrium, devoid of severe inflation or recession threats. It stands as a testament to the government’s commitment to maintaining a steady-state economy, facilitating sustainable growth under stable conditions.

Fiscal Policy vs Monetary Policy

The government’s fiscal policy seeks to direct economic activity by adjusting taxes and spending measures. In contrast, the Central Banks usually handle monetary policy. This involves regulating the economy’s liquidity by manipulating the money supply. The core objectives of monetary policy include fostering full employment, stabilizing prices, and maintaining manageable long-term interest rates.

Coordinating fiscal and monetary policy is common for achieving broader economic goals. Fiscal policy mainly influences demand, while monetary policy shapes the availability of funds and interest rates. The government implements fiscal policy, whereas the Central Banks execute monetary measures. Fiscal policy, through its impact on variables such as GDP, employment, and inflation, often indirectly influences monetary policy’s effectiveness.

By adjusting interest rates, monetary policy motivates borrowing and spending. Fiscal policy regulates overall expenditure via governmental financial actions. Both fiscal and monetary policies are essential for economic management, and their effects ripple through the economy, touching individual and family finances directly and indirectly.

Conclusion

Fiscal policy plays a critical role in the government’s management of the macroeconomy at a strategic level. Through altering tax rates and the allocation of government spending, policymakers flex their influence over aggregate demand, employment, inflation dynamics, and the trajectory of economic growth.

It adheres closely to Keynesian economics dictums, which underscore the government’s pivotal duty in stabilizing the economic fluctuations endemic in the business cycle. This strategy hinges chiefly on four main tools: the budget, government spending, tax policies, and public borrowing. The usage of these fiscal instruments varies according to the economic status quo and the desired policy outcomes.

Fiscal policy stands apart from monetary policy, a sphere governed by central banks, yet often these avenues are aligned to foster macroeconomic equilibrium and sustainable economic progress. Additionally, it can serve as a mechanism to spur or discourage specific behaviours through the manipulation of taxes, the issuance of subsidies, and the facilitation of essential healthcare services. Notwithstanding, the efficacy of these measures pivots on the efficacy of governance structures, the adept crafting of fiscal policies, and the market’s reaction to pricing mechanisms.

In essence, fiscal policy is a potent weapon in the governance arsenal for steering the macroeconomy, impacting various economic indicators like employment levels, inflation rates, and overall demand. Guided by the complexities of economic scenarios, strategic fiscal policy calibration can significantly advance critical economic aims, fostering a landscape of enduring stability and economic well-being.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.