The principal-agent problem sits at the nexus of several modern economic dilemmas. The scenario involves a principal, for example, a shareholder, who entrusts funds or resources to an agent, often a manager. Furthermore, this trust is predicated on the agent making choices in the principal’s best interest. However, if the agent’s motivations diverge from the principal’s, a critical issue arises. The consequent actions might be more favourable to the agent, leading to operational inefficiencies and potential market failure.

The principal-agent dilemma marks a complex affair, drawing significant attention from economists and political analysts alike. Fundamentally, it underscores issues of misaligned incentives, where agents might put their personal gains above the principal’s goals. This disparity can, hence, emerge across various settings. From landlord-tenant relations to ensuring shareholders and corporate executives share aims. A deep comprehension of the problem’s origins and outcomes is essential. Doing so is key to rectifying market inefficiencies and promoting equitable resource distribution among all involved.

Econometrics Tutorials with Certificates

Understanding the Principal-Agent Problem

The principal-agent relationship underpins key economic and organizational dynamics. It characterizes the interaction between a principal, typified by a shareholder or client, and an agent, often a manager or professional. Hence, this delegation of decision-making power by the principal to the agent defines the framework. However, intrinsic to this setup is the potential pitfall of the principal-agent problem. In this scenario, the interests of the agent can divert from those of the principal, inducing agency costs and also leading to outcomes below the optimal.

Key Concepts and Definitions

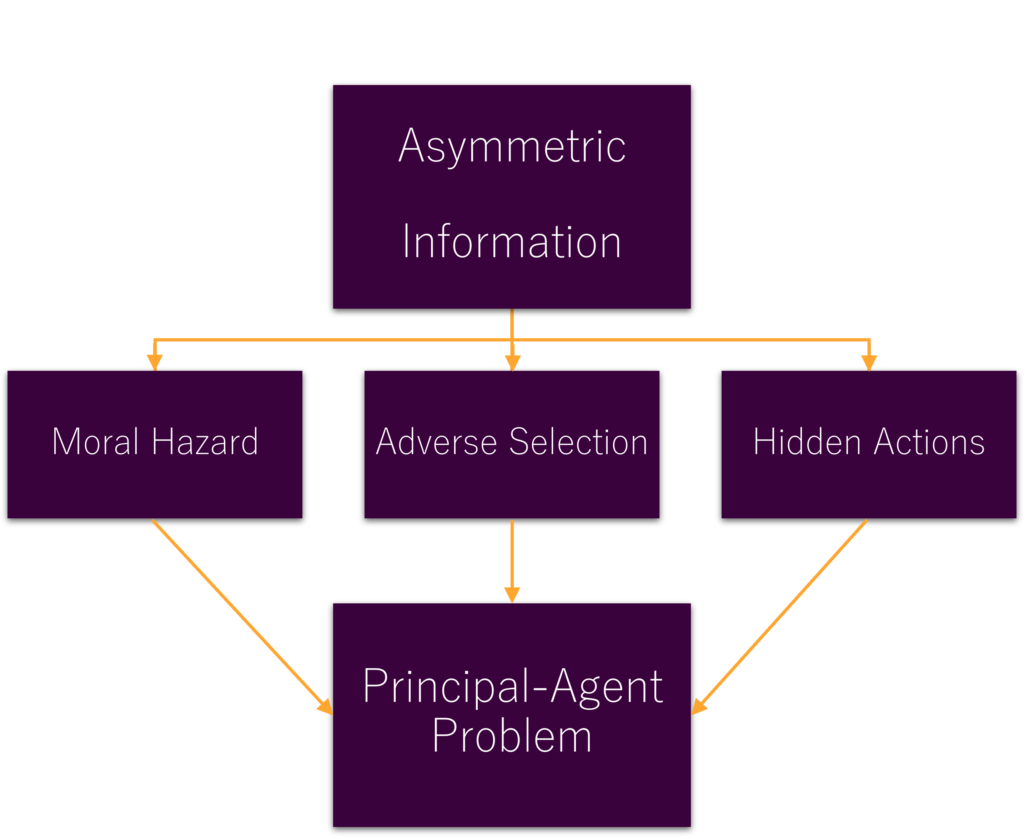

The principal-agent issue’s core lies in the information asymmetry, tilting in favour of the agent over the principal. This asymmetry permits situations of moral hazard, where the agent may take on undue risks or benefit themselves, rather than their principal. Moreover, instances of adverse selection may arise. This occurs when the principal is unable to accurately assess the agent’s competence or intentions, potentially leading to choosing an agent misaligned with their own objectives.

Therefore, the root of the principal-agent challenge is the separation of ownership and control. With the principal ceding decision-making rights to the agent, conflicting interests could manifest as a result. This conflict is due to the likelihood that the agent might prioritize their benefits over the principal’s. The asymmetry of information between the two parties leads to this situation, complicating the monitoring and guiding of the agent’s actions by the principal.

Grasping the foundational and causal aspects of the principal-agent quandary is vital for formulating robust solutions. Moreover, its relevance spans from corporate overseeing to the delineation of public policies.

Agency Costs and Market Failure

The principal-agent problem underpins agency costs, further marked by expenditures the principal absorbs for monitoring and motivating their agent to act in congruence with their best interests. Such costs lead to market inefficiency and misallocation of resources, also deviating from the optimal resource use as perceived by the principal. This disparity in motivational forces and ensuing actions can precipitate market failure, an event where the economic system falls short of efficiently distributing resources to the satisfaction of all involved entities.

Inefficiency and Resource Misallocation

The essence of agency costs lies in the inherent conflicts of interest between the principal and the agent, for instance, the shareholders and corporate management. Such disputes emerge when agents, acting on behalf of a principal, deviate from the ends they should meet, initiating a discord in their objectives.

Efforts to reconcile stakeholder interests include economic incentivization mechanisms like performance-enhancing bonuses and stock options. Nonetheless, these strategies also introduce moral hazard, potentially compelling agents to undertake significant risks to augment their personal gains, possibly at the detriment of the principal’s future interests. For instance, the Enron debacle in 2001 underscored the repercussions of agency hazards, damning shareholders to substantial financial setbacks due to deceitful activities.

These agency costs and their corollary market failures can exacerbate misallocations of resources, impairing the efficacious and productive deployment of assets. Such a scenario fosters economic disregard, inhibits innovation, and generates substandard outcomes for both the principals and their agents.

To surmount these hurdles, implementing substantive solutions like meticulous contract frameworks and thorough assessment of performance coupled with tailored compensation strategies can harmonize the motivations of principals and agents. This endeavour aims to diminish agency costs and encourage the more effective distribution of resources.

Examples of the Principal-Agent Problem

The principal-agent problem is, hence, a fundamental challenge in relationships with disparate interests. As a result, recognizing its forms is essential to mitigate detrimental effects.

Shareholder and Manager Relationship

In the shareholder-manager dynamic, shareholders (principals) and managers (agents) form the central conflict. While shareholders aim for profit maximization from their company ownership, managers prioritize goals like job security, personal benefits, or expanding their domains. This discord leads to agency costs, as shareholders attempt to ensure managerial actions coincide with profit objectives.

Landlord and Tenant Scenario

The landlord-tenant relationship presents another significant instance of the principal-agent challenge. Here, landlords seek property maintenance and minimal utility usage from tenants. Conversely, tenants might focus on their convenience, possibly neglecting property upkeep or overusing utilities. This dynamic introduces information asymmetry and the potential for moral hazard, further adversely affecting the property and the landlord’s financial interests.

These instances also underscore the diverse contexts in which the principal-agent dilemma emerges. Its impact includes inefficiencies, misallocation of resources, and a loss of principal and agent interest alignment. An understanding of these challenges is further imperative in devising strategies to address them.

Causes of the Principal-agent problem

The principal-agent problem epitomizes information asymmetry. Here, the agent, often a manager or employee, commands superior insight regarding their actions and decision-making processes. This knowledge disparity further begets hidden actions. It also fosters scenarios where agents conduct themselves in ways unobservable or unverifiable by the principal.

This obscurity also gives rise to adverse selection. This is when discerning between agents of high and low quality proves problematic for the principal. As a result, it leads to choosing an agent who doesn’t share the principal’s objectives. Such a divergence in interests lies at the heart of the principal-agent dilemma.

In 1976, Michael Jensen and William Meckling, American economists, initially framed the principal-agent problem. Their seminal work accentuated the detrimental effects of information asymmetry and concealed actions. Furthermore, the ramifications stretch across various relational models, spanning from corporate governance to interactions between governments and citizens.

To tackle the complexities stemming from information asymmetry and concealed activities, a cadre of scholars and professionals have devised several countermeasures. These include the strategic formulation of contracts, the meticulous evaluation of performances, and the further structuring of compensations. These methods target the alignment of the principal’s and agent’s interests. By underpinning transparency and incentivizing agents to pursue the principal’s benefits, these practices mitigate the risks associated with the principal-agent issue. They also cultivate more effective and harmonious working dynamics.

| Key Concept | Description |

| Information Asymmetry | The scenario wherein the agent possesses more information about their actions and decision-making than does the principal. |

| Hidden Actions | Refers to the agent’s behaviours or decisions that elude observation or verification by the principal. |

| Adverse Selection | Describes the quandary where the principal cannot differentiate between agents of varying quality. Consequently, an agent is chosen whose aims diverge from the principal’s. |

Moral Hazard and Excessive Risk-Taking

The phenomenon of moral hazard, elucidated by the principal-agent conundrum, is highly concerning. It materializes when the agent takes on excessive risks, unaccountable for the full costs of such ventures. This dynamic is notable within the financial sector, tempting investment bankers to pursue high-risk ventures with potentially substantial returns. However, should these endeavours falter, the losses incurred fall upon the bank or taxpayer.

Rogue traders provide a poignant example within finance, as Nick Leeson’s actions led to Barings Bank’s demise in 1995. His intensive risk-taking underscored the peril of agents acting solely in self-interest, regardless of systemic repercussions. The Barings Bank’s insolvency underscored the dire ramifications of such unchecked pursuits.

The 2008 financial crisis further underscored the pitfalls of moral hazard, exposing the industry’s expectation of governmental bailouts. This anticipation spurred reckless conduct, heavily influencing the ensuing economic downturn. The crisis underscored the necessity of implementing stringent protocols to harmonize agent interests with principal objectives, thereby ensuring accountability for ramifications.

Though most commonly discussed within finance, moral hazard transcends sectorial boundaries, manifesting in realms where principal-agent discrepancies exist. In the insurance domain, property owners, safeguarded by coverage, evade responsibility, leading to premium inflation. A similar dilemma befalls the lending industry, wherein borrowers, facing financial strain, contemplate reneging on untenable loans.

Mitigating excessive risk-taking and moral hazard is pivotal for addressing the principal-agent paradox and averting subsequent market failures and economic catastrophes. To this end, the realignment of incentives, bolstered transparency, and stringent monitoring and accountability infrastructures are indispensable. These measures aid in bridging the divide between agent and principal objectives, diminishing moral hazard’s allure and fostering judicious decision-making.

Resolving the Principal-Agent Problem

The principal-agent problem poses a major hurdle in various business and economic ties. It highlights the potential conflict of interest between the principal, often the owner or employer, and the agent, typically the employee or contractor. Contract design and incentive alignment emerge as pivotal methodologies to reconcile their differing objectives, therefore, ensuring the agent’s actions reflect the principal’s aims.

Contract Design and Incentive Alignment

Addressing the principal-agent challenge demands the skilful structuring of incentives for agents. These incentives may comprise monetary rewards, company perks, equity ownership, status recognition, and more. Such a comprehensive incentive package aims to synchronize the agent’s compensation with the principal’s strategic goals. Hence, the agent is inclined to prioritize the principal’s interests.

Consider a scenario at a small store. The owner might introduce commission bonuses correlated with sales or customer retention. Such incentives further motivate the employees to increase sales and fortify customer ties, hence, advancing the enterprise’s goals.

In a different setting, within a publicly traded firm, the shareholders could incentivize the CEO through stock options or profit-sharing plans. This strategy aims to orient the CEO’s choices towards enhancing the organization’s financial standing. Consequently, the CEO’s efforts are aligned with shareholder interests, promoting the company’s success.

Besides incentive design, contract design stands as an essential component in resolving the principal-agent conundrum. Through meticulous formulation of the agreement’s terms and conditions, the principal can embed mechanisms for monitoring the agent’s performance, defining unambiguous performance benchmarks, and ensuring adherence to accountability standards.

By integrating well-structured incentives with precisely crafted agreements, principals can effectively ameliorate the inherent complexities of the principal-agent problem. This approach cultivates a symbiotic relationship, enhancing the operational synergy between them and their agents.

Performance Evaluation and Compensation

Resolving the principal-agent dilemma requires advanced strategies in performance evaluation and compensation structures. These intricate systems are designed to link the agent’s financial status closely with the principal’s strategic aims. Thus, they motivate the agent to adhere to the principal’s best interests.

Stock Options and Profit-Sharing

Profit-sharing plans and stock options represent sophisticated methods of incentivizing employee performance. Stock options afford the agent the capability to buy the principal’s shares at a set price, thus sharing in the company’s prosperity. Conversely, profit-sharing schemes connect the agent’s earnings directly to the principal’s business success, fostering a shared investment in the firm’s overall achievements.

These sophisticated compensation techniques diminish the risk of the agent focusing solely on personal gain to the detriment of the principal’s goals. The convergence of the agent’s financial motivations with the principal’s ambitions not only ensures the agent is incentivized toward organizational prosperity but also towards aligning their decisions with the firm’s long-term success.

Incentive pay may primarily comprise a base salary and a variable portion, alongside a noteworthy allocation for stock options. This framework is pivotal in aligning the agent’s financial pursuits with the principal’s interests, driving decision-making geared towards the enhancement of the principal’s financial health and value.

Monitoring and Reporting Mechanisms

To overcome the principal-agent challenge and curb the asymmetry of information, principals might deploy comprehensive monitoring and reporting frameworks. These initiatives strive to boost the communication flow and augment the principal’s insight into the agent’s conduct. Their core goal is to ensure that agents discharge their duties effectively and prioritize the principal’s interests.

The method of direct monitoring entails a scenario where the principal directly witnesses the agent’s performance. If the agent’s activities are straightforward to observe, this proves to be an economical choice. Conversely, utilizing indirect monitoring through intermediaries can offer cost-effectiveness, yet it might not be as efficient for more complex agent behaviour.

Outcome monitoring, which centers on the agent’s performance results, proves valuable for scenarios where direct observation of conduct is challenging. When faced with arduous observational circumstances compounded by high costs, peer monitoring stands as a viable option.

Enforcing reporting requirements routinely and engaging external auditors or monitors can further illuminate the principal about the agent’s actions. Thus, establishing unequivocal communication channels between the principal and agent acts as a cornerstone.

Nonetheless, the utility of these surveillance and reporting strategies, aimed at diminishing information asymmetry and curbing agency costs, necessitates careful implementation. Overzealous or overly invasive oversight could inadvertently erode the trust between the principal and the agent. This might trigger counterproductive effects, including demotivation and ethical breaches.

Principal-Agent Problem in Different Contexts

The principal-agent problem extends beyond financial domains into various professional arenas, evident in relationships such as the client-lawyer relationship and the taxpayer-government relationship. These scenarios underscore the hurdles stemming from skewed information availability and the presence of conflicting interests.

Client-Lawyer Relationship

Within the client-lawyer relationship, clients may fear that their legal representatives prioritize personal gains or resort to unwarranted billing practices. Such a scenario is compounded by notable information asymmetry and the precipice of conflicting interests, thereby invoking the principal-agent dilemma. Resolving these issues mandates meticulous ethical considerations and the promotion of transparency throughout the client-professional interaction.

Taxpayer-Government Relationship

The dynamic between taxpayers and the government also falls prey to the principal-agent quandary. Citizens anticipate judicious resource management from the state, yet information asymmetry and the susceptibility of government officials to prioritize their personal or political interests might lead to resource misallocation. This ‘political agency problem’ significantly impacts government credibility and the necessity for greater accountability and transparency.

| Context | Principal | Agent | Key Issues |

| Client-Lawyer Relationship | Clients | Lawyers | Excessive billing practices, prioritizing self-interests over client’s interests, information asymmetry, ethical considerations, transparency |

| Taxpayer-Government Relationship | Taxpayers | Government | Misallocation of resources, pursuit of political or personal interests, information asymmetry, government accountability, transparency |

Exploring the principal-agent problem within these specific frameworks equips us to tackle the inherent challenges of information disparity, re-align incentives, and cultivate a culture of enhanced visibility and responsibility in both professional and governmental spheres.

Ethical Considerations and Transparency

Solving the principal-agent dilemma demands deep ethical analysis and a commitment to clear, honest professional dealings. Those acting as agents must answer for their choices and behaviours. To this end, robust oversight is crucial, ensuring their actions align with the best interests of their principals.

At the heart of establishing trust and reducing conflicts lies transparency. Disclosure involves the purposeful sharing of facts to aid transparency. It strives to offer up all releasable data, whether favourable or not, in a fair and precise way. This fosters better judgment.

Nonetheless, in select scenarios, the divulgence of all facts might not be feasible, due to ethical or regulatory limits. Yet, truthfulness and precision in one’s articulation are indispensable to prevent misguidance. Symmetrical communication, endorsing equal involvement from both sides, nurtures truthful dialogue and genuine interaction.

A commitment to open communication and complete transparency strengthens ties, nurtures crucial partnerships, and aids a democratic environment through open discussion.

| Ethical Considerations | Transparency Measures |

| Conflicts of interest | Disclosure requirements |

| Accountability for actions | Reporting mechanisms |

| Alignment with the principal’s interests | Balanced and accurate communication |

| Fiduciary duties | Two-way communication |

| Ethical guidelines and codes of conduct | Building trust with stakeholders |

Through taking on ethics and embracing transparency, organizations can effectively address the principal-agent conflict. This approach cultivates an environment marked by trust, honesty, and responsibility.

Conclusion

The principal-agent problem lies at the core of economic theory, with profound impacts on market and organizational dynamics. A comprehension of its origins, effects, and resolutions empowers principals to curtail market dysfunction and misuse of resources. The viability of markets and organizations hinges on how effectively this problem is managed.

Strategies to tackle the principal-agent issue revolve around harmonizing agent incentives with principal objectives, bolstering transparency and accountability, and instilling a commitment to ethical choices. Crafting contracts that motivate agents to prioritize principal interests, coupled with ongoing performance evaluation and compensatory structures linked to tangible results, serves to diminish the problem’s inherent agency costs.

Critical for both private and public sectors, resolving the principal-agent challenge is essential for the efficient and fair distribution of resources. Such efforts spotlight the importance of identifying and rectifying the problem’s causative factors. This undertaking not only enhances market productivity and curbs moral hazard but also supports the ongoing viability of organizational and market operations over the long term.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.