Ragnar Nurkse introduced the concept of the vicious circle of poverty. Many other economists have further developed it. It attempts to shed light on the reasons behind the underdevelopment of certain poor economies and their failure to come out of this situation. Moreover, this concept also shares some ideas with the low-level equilibrium trap.

Underdeveloped countries suffer from low income, low productivity and underutilization of resources. This has further far-reaching detrimental effects across all sectors of the economy. These effects and vicious circles can be further depicted through supply, demand, and resource mismanagement in underdeveloped economies.

Econometrics Tutorials with Certificates

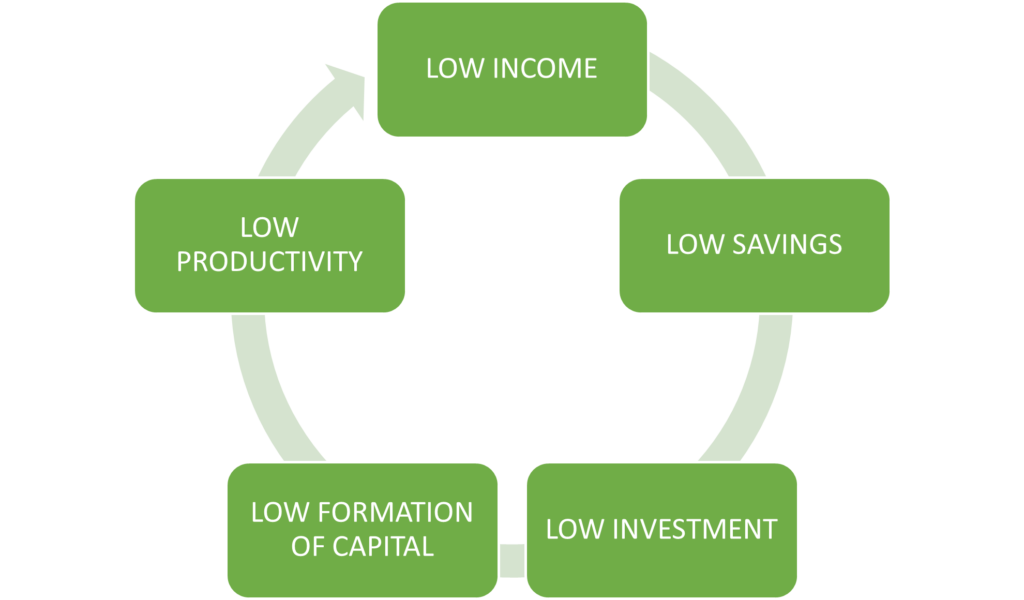

Vicious circle of poverty: Supply-side

Firstly, underdeveloped or poor economies are characterized by a low level of income per capita. As a result of the lack of income, the amount of savings remains low. Therefore, the rate of investment and formation of new capital is minimal with the low income and savings of the population. Hence, the economy fails to raise productivity across all sectors due to low investment and inadequate capital formation. The vicious circle is complete with recurring low-income levels caused by low productivity.

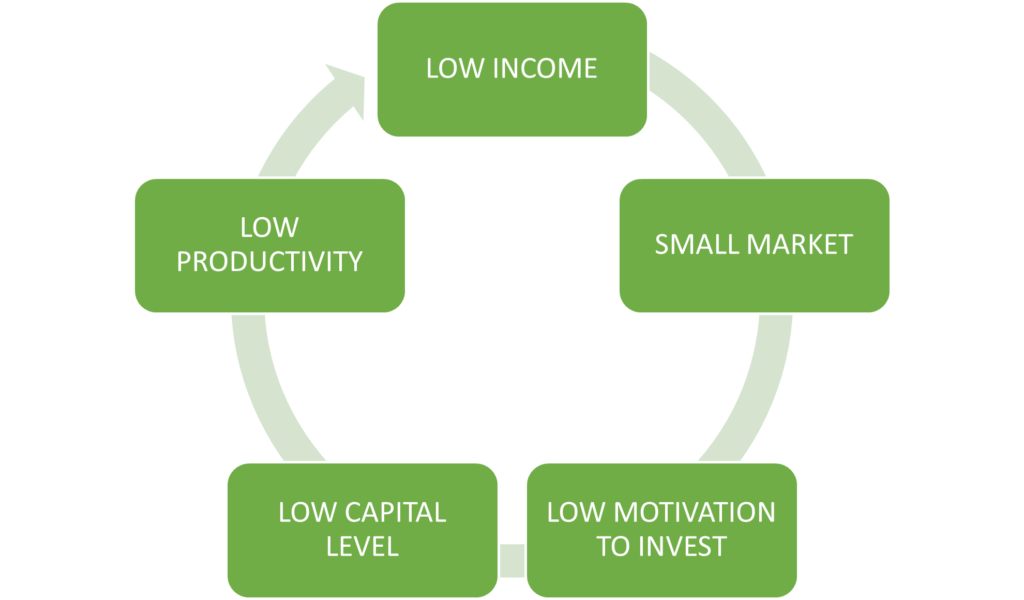

Vicious circle of poverty: Demand side

Secondly, on the demand side, the low-income level of the economy means a restricted purchasing power of the population. Their demand for commodities or services remains low, thereby, preventing any growth of the market. Since the market remains small and demand low, the inducement to invest suffers because the opportunity for gains is meagre in a small market. Low investments further lead to a low level of capital formation. Hence, productivity suffers and the vicious circle is complete with low-income levels due to low productivity.

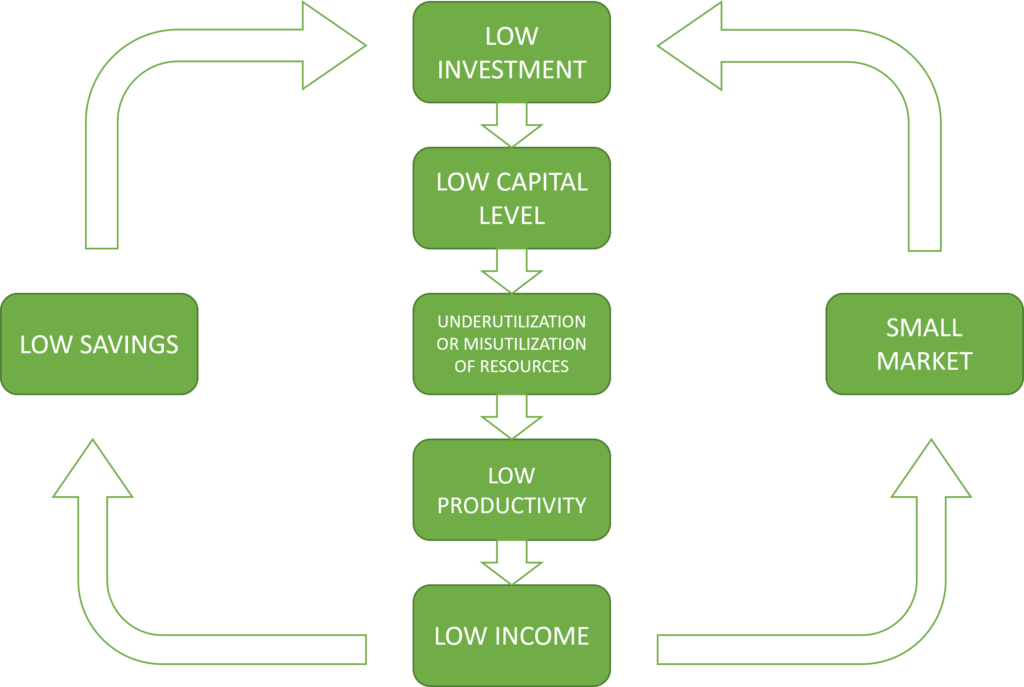

resource utilization

Another way to view the vicious circle of poverty is through the mismanagement of resources. Since the resources in poor economies are underutilized or unutilized, the productivity of these resources is low. Low productivity further leads to a low level of income. As seen on the supply and demand side of the vicious circle, low-income results in low savings, small purchasing power of the population and a small extent of the market. Finally, all of these contribute to a lack of investment and capital formation in the economy. Due to inadequate capital, resources remain unutilized or underutilized which completes the vicious circle of poverty.

consumption patterns causing the vicious circle of poverty and their solutions

Subsistence Sector

In poor underdeveloped economies, a large proportion of the population is engaged in the agriculture sector which is characterized by low levels of income. Among these, a large portion of this agricultural population is dependent on subsistence agriculture with underdeveloped equipment and primitive techniques. Moreover, they are mostly uneducated and unskilled, preventing them from migrating to urban centres for high-paying employment. As a solution, a focus on education and skill development to increase employability along with the expansion of the industrial and services sector to increase employment opportunities is needed.

Rich or High-income Groups

The consumption of high-income groups is focused on durable goods or even luxuries. These goods are not domestically produced in underdeveloped economies due to the small extent of the market. Moreover, these goods require production on a large scale and highly skilled labour. Both of these are generally missing in poor economies. Additionally, these high-income groups often engage in conspicuous consumption for demonstrating their social status and prestige. Therefore, a huge portion of their income is spent on the purchase of foreign goods.

Due to the small domestic market, demand for investment is low and most of the investment from these high-income groups ends up in foreign markets. Therefore, it is the responsibility of the government to create investment opportunities in the domestic market and also to create favourable policies for domestic investment. Hence, Infrastructure development and public sector investments are needed to expand and create an atmosphere of confidence in the domestic industry.

Econometrics Tutorials with Certificates

This website contains affiliate links. When you make a purchase through these links, we may earn a commission at no additional cost to you.